CHINA’S HI-TECH AMBITIONS TO SUPPLANT THE WORLD’S TOP MANUFACTURING COUNTRIES, BY EXTRACTION OF RARE STRATEGIC METALS FROM TIBET

Blog #1 of 2

LHAGANG LITHIUM AND RARE EARTH DEPOSITS

Fresh evidence has emerged confirming how and why Tibetans in remote areas, far from metropoles of power, experience the state as predatory.

The Tibetans of the rugged landscape of Lhagang (Tagong in Chinese) have long lived well amid the sheltering and often sacred pilgrimage mountains, with plentiful rivers, highlands for pasturing the animals and ridgetops for growing crops. Lhagang, in Kham, easternmost Tibet, is not far from old trade routes taking sturdy Tibetan mountain ponies down to the Chinese lowlands for Chinese armies, their pack yaks laden with bricks of tea and fine silks for Tibetan consumption.

Lhagang has long been famous for its horses, and its grassland is now marketed as a tourism destination for those seeking a taste of the wild west within the mandatory stability of China’s deep inland. For Chinese lowlanders seeking relief from the muggy heat of the Sichuan basin, Lhagang/Tagong is only 150 kms into Tibet, just north of the major highway G318 that connects Sichuan to Kham and all the way to Lhasa.

The people, Lhagangpa, were resilient, self-sufficient, in no need of being governed by some distant power, whether Lhasa or Beijing. The powers of the modern state, to discipline, reward, extract, engineer, forbid, enclose, exclose or impose its will, for reasons of state, were at most modest. The local principality did extract taxes, but its needs were modest, its elite small, its interventions minimal.

When the Lhagangpa discovered in the 1950s that they were Chinese citizens, ruled from Beijing and the stiflingly hot capital of provincial Sichuan, way down the mountainsides in Chengdu, it was an unwelcome surprise, but once the fighting ceased, not always onerous. The People’s Liberation Army never went away, but dug in, on the best land, its permanent presence a reminder that it is futile to rebel. The route to Lhagang branches from the highway through Dartsedo (Kangding in Chinese), Nyagchu and Lithang, all towns with a history of resistance and of garrisoned PLA as a permanent presence.

After the official campaign to denounce the lamas and landlords, to compulsory class warfare had come and gone, by the 1980s there was little sign of the distant state. The Lhagangpa could get on with their lives, with herding their animals, ploughing the fields and growing barley, remembering once more that life is about much more than production. Pilgrimages to holy mountains resumed, bringing from afar the devout to cleanse their minds of accumulated quarrels and the tyranny of habit. Monasteries destroyed in the official campaign to smash everything old could be rebuilt. The state, with its revolutionary violence, had intruded into everyone’s life, but it turned out to be spasm, 25 years of chaos and shouting slogans.

The state had no interest in their traditional mode of production, in investing in livestock industries, dairies or improving barley varieties for the growing Chinese taste for manufactured beer. The Lhagangpa were back on their own, even the old tea-horse trade route, remade into a highway, was still a slow switchback up and down the precipitous terrain, prone to blockage by landslides, snowfall and storm.

THE SOVEREIGN STATE COMES BACK IN

The state had not done with them. Engineers surveyed the Nyagchu, the river that bisects the whole of Kandze prefecture, from northwest to southeast, defining the entire prefecture as its catchment, other than ranges in the west that drain into the Dri Chu, or upper Yangtze, which is not only the western border of Kandze but the interprovincial border demarcating Sichuan from Tibet Autonomous Region. No less than 11 hydro dam sites have been proposed on the Nyagchu above Nyagchu town, most of them on a scale that would overpower local communities, and produce electricity for export to distant urban markets.

Geologists roamed everywhere, drilling and measuring, but to the Lhagangpa, their secretive work tapping at rocks, in a language no-one knew, remained a mystery. At Jiajika, amid the snows, lithium was found, in ores of spodumene and pegmatite, an oddity even to the exploration teams. Lithium is one of the commonest elements, and in the 1980s its uses were limited, and basic, in making industrial grease, glass and other………. The romance of the tea-horse road trade caravans did not extend to lithium.

The geologists carefully noted the deposit and its concentration of this lightest of metals. Maybe one day it might serve the needs of a new power in manufacturing, with the potential to become the world’s factory. But lithium is found plentifully elsewhere in Tibet, in the salt lake beds of Qinghai province, on flat land much more accessible to China’s industries, with rail access built by the 1980s, as the military industrialisation penetrated far inland to develop nuclear submarines and missiles well away from the American imperialists and Soviet revisionists. In the Tsaidam basin of Qinghai, lithium was one of the salts of the briny salt lakes, admixed with potassium salt (potash) needed for making fertiliser, common salt, needed for making plastics and petrochemicals, and magnesium salts. Extraction required only a bulldozer to scrape and scoop the salt into a truck. Better still, potash and sodium salt (common salt) were already being removed, millions of tonnes a year, with lithium an unwanted by product of the dirty process of separating the salts.

the world’s factory. But lithium is found plentifully elsewhere in Tibet, in the salt lake beds of Qinghai province, on flat land much more accessible to China’s industries, with rail access built by the 1980s, as the military industrialisation penetrated far inland to develop nuclear submarines and missiles well away from the American imperialists and Soviet revisionists. In the Tsaidam basin of Qinghai, lithium was one of the salts of the briny salt lakes, admixed with potassium salt (potash) needed for making fertiliser, common salt, needed for making plastics and petrochemicals, and magnesium salts. Extraction required only a bulldozer to scrape and scoop the salt into a truck. Better still, potash and sodium salt (common salt) were already being removed, millions of tonnes a year, with lithium an unwanted by product of the dirty process of separating the salts.

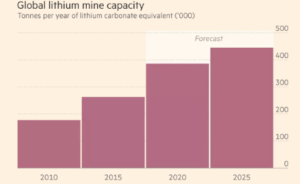

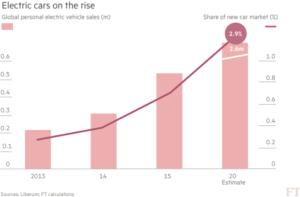

While the bulk lithium producers of Qinghai continue to extract the metal salts of Tibetan lakes in tens of millions of tonnes a year, they struggle to isolate and purify the elements sufficiently for the big new market for lithium, for the batteries powering everything from electric cars to smart phones, drones (military and civilian), even the buses that shuffle you across airport tarmacs and batteries that store solar and wind energy for peak periods of the day. Uses for lithium are exploding, despite the reputation of lithium batteries, poorly made in China, for overheating, burning and even literally exploding. While lithium-powered electric cars are yet to attract mass markets, despite big subsidies from the Chinese government, other uses are fast accelerating.

That is why the rock mineralisations of lithium in Lhagang are back on the extraction agenda. The lithium is spread over a huge area, of hundreds of sq. kms, in dikes of once-molten rock that cooled so slowly that enormous crystals were formed in the pegmatite rock, among the largest crystals to be found anywhere. Geologists believe the presence of lithium was essential to slowing the cooling, allowing time for the crystals to form. The mineralised area is so large it extends to Nyagchu, 70 kms SW, home of Tenzin Delek Rinpoche, a lama who spoke up for the environment, was prosecuted and convicted by depicting him as a violent terrorist. He later died in gaol.

GAME-CHANGER: DISCOVERY OF STRATEGIC MINERALS FOR CHINA’S HI-TECH AMBITIONS

The Lhagang/Nyagchu pegmatite field is rich not only in lithium but in rare earths such as niobium, beryllium and tantalum.

Tantalum is widely used in jet engine turbine blades, electronics and ballistics. Tantalum is found in cell phones, DVD players, laptops, hard drives, and the PlayStation3 — essentially almost any piece of home or industrial electronic equipment. Tantalum is the material of choice for several advanced anti-tank weapon systems. The warheads are packaged along with sophisticated parachutes, sensors, and electronics to create a smart weapon: a munition that can be deployed, directed, and detonated against targets that are beyond the sight of the soldier.

Tantalum, though rare, has innumerable hi-tech uses, and fresh applications, led by military-industrial research, continue to expand. Concern over tantalum and its current sourcing from mines in central Africa, in conflict zones where conflicts are fuelled by profits from tantalum extraction (commonly called coltan), has now reached a point where the European Union has strict regulations to limit tantalum from Congo entering the European market.

Tantalum mining in Tibet is also a source of conflict, as is evident from the many petitions written by Tibetans in Lhagang/Tagong/Jiajika, in Kham Kandze, begging for mining to stop. Tibetans living in the EU can make the case, on behalf of the Lhagangpa, for all tantalum extraction, from all conflict zones, in Africa and in Tibet, to be covered by the EU regulations.

Niobium likewise has many uses, especially in hardening speciality steels, a market China is keen to dominate as its long standing overcapacity in steel production, and the reluctance of central leaders to force too many inefficient steelmakers to close, results in a state-sponsored push, with access to state-driven cheap finance credit, for China’s metals manufacturers to boldly seize global control. China Molybdenum, largely owned by the government of Luoyang city, a mining town, has been especially bold, locking up control of most of the global niobium supply in 2016 by buying the Brazilian mine from Anglo-American. This is a classic counter-cyclical strategy, taking maximum advantage of the downturn in commodity prices in recent years, which left many mining companies worldwide overstretched and debt-laden, needing to offload prime assets to stay afloat. China now has achieved its strategic objective of worldwide dominance of niobium, a metal that is key to innumerable future applications. [1] In this way China selects strategic minerals amenable to domination and arranges the necessary finance at concessional rates for its favoured corporate crony to buy up big.

Beryllium has many civilian uses, but also many military applications, in missiles and plutonium bombs. China is one of only three countries that produces it. Though rare, it is toxic to human health. Beryllium is considered a health and safety issue for workers. Exposure to beryllium in the workplace can lead to a sensitization immune response and can over time develop chronic beryllium disease (CBD). Beryllium is chemically similar to magnesium and therefore can displace it from enzymes, which causes them to malfunction. Because beryllium is a highly charged and small ion, it can easily get into many tissues and cells, where it specifically targets cell nuclei, inhibiting many enzymes, including those used for synthesizing DNA. Its toxicity is exacerbated by the fact that the body has no means to control beryllium levels, and once inside the body the beryllium cannot be removed. Chronic berylliosis is a pulmonary and systemic granulomatous disease caused by inhalation of dust or fumes contaminated with beryllium; either large amounts over a short time or small amounts over a long time can lead to this ailment. Symptoms of the disease can take up to five years to develop; about a third of patients with it die and the survivors are left disabled.

The Toxicology Data Network (Toxnet) operated by the US government National Institutes of Health says bluntly: “There is sufficient evidence in humans for the carcinogenicity of beryllium and beryllium compounds. Beryllium and beryllium compounds cause cancer of the lung. There is sufficient evidence in experimental animals for the carcinogenicity of beryllium and beryllium compounds. Beryllium and beryllium compounds are carcinogenic to humans.”

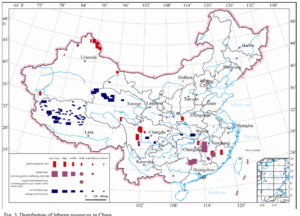

In recent years China has produced 20 to 30 tonnes of niobium a year, and 70 to 90 tonnes of tantalum, seemingly small amounts, but rare earths are indeed rare, and industrial uses, although frequent, require only tiny amounts.[2] More uses for these special metals are invented each year, notably in industries China is determined to dominate globally.

Lithium is also a strategic mineral, beyond its humble civilian uses. Right now, there is great concern that North Korea is using lithium in its nuclear weapons program.

Even civilian uses for lithium, in batteries big and small, have a military dimension. As solar and wind power grow, a major constraint on their reliability is that wind blows intermittently and unpredictability; likewise sunshine at most shines only by day, and is obscured by cloud. One increasingly common strategy for dealing with this is to use lithium batteries –on a huge scale- to store the electricity generated when winds blow and sun shines, then release it at times of the day when electricity demand is highest. It is not only civilian consumers who need reliable electricity, so too do the security forces, and in remote frontier areas where electricity supply is least reliable.

US Navy Commander Wilson VornDick argues that: “President Xi Jinping conceives of energy construction as an integral part of the national security plan to include expansion and construction of more renewable energy resources. China is securitizing renewable energy, as part of a broader energy strategy (能源戰略). The strongest and most effective wind currents for capturing energy are located primarily in the west, in Xinjiang and Xizang (Tibet). A 2007 treatise by two members of a PLA unit stationed in Tibet describes the varieties of renewables that can create “independent power generation” (独立发电系统) . Many units are stationed in remote areas. Units in Tibet often operate far from home bases. The primacy of informationization is key—the PLA no longer requires just sustenance to survive, but also electrical energy to execute its digitized operations. Beyond powering basic life support functions like heating, cooling, or lighting, the PLA of the 21st century will require sustainable, independent, and secure power sources to run its servers, computers, and combat systems in order to fulfill informationization.

Chromium, extracted for several decades from mines near Tsethang in south central Tibet can be considered a strategic mineral too, as well as a major pollutant, especially in its unregulated use in making leather.

If the US and China engage in a trade war, these minerals will be further restricted, stockpiled competitively, and move further into the strategic category.

Other rare minerals, with new civilian and military uses, have been discovered in unexpected places elsewhere in Tibet, including a coalfield in northern Tibet, surprisingly rich in rubidium, yttrium, caesium and gallium.[3]

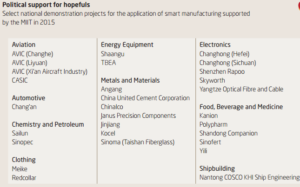

CHINA’S NEW MASTER PLAN: MADE IN CHINA 2025

China has far to go if it seeks to become a major, or eventually, a dominant player in producing these key metals –lithium, tantalum, niobium and beryllium- or if it plans to dominate global manufacturing of products that rely on these metals. If China is to fulfil its Made in China 2025 plan for upmarket dominance of elaborately transformed high-end products, the Tibetan veins of these four metals may be the key.

Right now China can source supply worldwide and does so, notably by importing lithium in huge amounts from salt lake beds high in the Andes. That has worked well, enabling Chinese minerals producers and processors to pick and choose the cheapest suppliers globally, and increasingly, to own the mines, around the world.

But now demand is growing fast, both for civilian and military uses of all these unusual metals; and the world is becoming more nationalist, protective, less globalist, more inclined to classify these as strategic minerals which government will stockpile, or even seek to monopolise.

China enjoyed a few years in the early 21st century when it dominated rare earth supply, and used its dominance to reduce exports, especially to countries it had political quarrels with, such as Japan. China’s dominance in rare earths was initiated at a time when there were plenty of alternative sources worldwide, but price competition from Chinese producers, unencumbered by environmental constraints, high wages or any need to pay royalties to host indigenous communities, drove mines worldwide out of the market, closing production everywhere but in China. Once a near-monopoly was established, China used it not only to punish the Japanese, but to incentivise companies worldwide that need rare earths to relocate their operations to China, and share their technologies. In this way, China leapfrogged into becoming a major power in rare earths, before, inevitably, some of the mines around the world that had closed were restarted, to create competition once more. China’s window lasted only a few years, but it used that window, while it lasted, to great advantage.

This is the strategy of making national champions, and it requires close coordination between the party-state and the mining/processing corporations. Many of China’s miners, processors, smelters and commodity trading companies are state-owned, with some shares traded openly on stock exchanges. Whether state-owned or not, they benefit from highly preferential policies of central leaders, who have picked specific corporations as winners to be made into national champions. The state directs the banks it owns to lend to selected mining companies at low rates, even when the loans are risky and banks, if given the choice, would prefer not to lend, or to factor in the risk by charging higher rates. There are many other subsidies and special deals for favoured corporations, giving them unfair advantage over competitors, even an ability to pay high prices for foreign acquisitions deemed essential to strategic dominance.

TIBET AS PART OF THE NEW MASTER STRATEGY

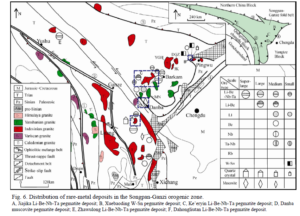

Thus the scatter of veins and dikes of lithium, tantalum, niobium and beryllium across much of Kandze prefecture in Sichuan may emerge as key to China’s ambitions. China’s geologists now speak of the Jiajika deposit, as it is called in Chinese, with great enthusiasm: “Being one of the major producers for rare metals in China the Jiajika Li-polymetal deposit in Sichuan is the most important hardrock-type lithium deposit with more than 500 veins of pegmatite concentrated there.Being one of the most important hardrock-type lithium polymetallic deposits both in China and abroad, the Jiajika-style Li-polymetallic deposit has great prospecting potential.” That is the judgement of a team from top institutions assessing economic deposits, including the Beijing based China University of Geosciences and Key Laboratory of Metallogeny and Mineral Assessment,Institute of Mineral Resources, Chinese Academy of Geological Sciences, in 2015.[4]

“When compared with similar deposits worldwide, the Jiajika deposit on average is larger, has higher grades, and is a shallow, multi-commodity deposit that is easy to exploit.”[5]

They estimate the total amount of lithium in Jiajika at 920,000 tonnes, which makes it competitive with the biggest deposits worldwide. Yet the lithium content of the pegmatite rock is only 1.2 per cent, necessitating a huge mining operation to not only extract vast amounts of waste rock, but also to process it on site, as it is uneconomic to haul away, for distant treatment, huge tonnages of rock which will inevitably be 98% waste material that has to be stored forever in safety. The rare earths are highly concentrated by global standards, but are still extremely rare. In the mineral-rich veins of Lhagang and Nyagchu (Jiajika), beryllium content is 0.043%, niobium 0.013% and tantalum 0.009%.

Only when demand is great is it profitable to invest heavily in the mining, crushing,  processing and extraction of these unusual metals; and that time is fast approaching. Because the deposit is scattered over a big area, it lends itself to not one but many mines, probably with several owners, as there are many players keen for a stake. The largest vein is one km long and up to 100 m wide, but most are much smaller.

processing and extraction of these unusual metals; and that time is fast approaching. Because the deposit is scattered over a big area, it lends itself to not one but many mines, probably with several owners, as there are many players keen for a stake. The largest vein is one km long and up to 100 m wide, but most are much smaller.

The geologists are confident that the tectonic plate collision that brought these concentrations of metals so close to the surface extends over a much wider area, and other such deposits will be found, and quantified.

All aspects of this find will cause massive impacts on local Tibetan communities. Some veins begin only 25 m below the surface, some are 300m. The dispersed veins, the amount of profit to be made, the vast amounts of overlying rock to be removed, the buried veins, the low concentrations of valuable metals and high proportion of waste to be stored onsite, all make for maximum social and environmental impact.

The scattered lithium veins of the Jiajika lithium/rare earth deposit crop up in an area of 8o sq. kms, but a much bigger area, of 500 sq. kms is understood by geologists to be rich in further finds of lithium. Geologists enthuse about what they define as a “superlarge” deposit that is easy to extract: “The Western Sichuan lithium metallogenic belt is located in the Songpan–Ganze orogenic belt, which contains significant granitic pegmatite rare-metal resources. Most discovered deposits (spots) are located in the eastern margin of the Songpan–Ganze orogenic belt, which includes the Pingwu, Barkan, Danba, Yajiang, and Jiulong areas. Eleven lithium deposits were recorded in a 1990 reserves table, including one superlarge deposit (Jiajika deposit), one large deposit (Ke’eryin deposit), and four medium-sized deposits. Western Sichuan contains the highest reserves of Li2O in China. These lithium resources coexist with or are associated with many useful elements such as Be (beryllium), Nb,(niobium) and Ta(tantalum). The deposits are shallowly-buried, can be easily mined, and have a low detached ratio, resulting in low extraction costs. The Jiajika pegmatite deposit is located at the southern part of the Songpan–Ganzê orogenic belt. In the Jiajika pegmatite field, pegmatite dikes surround the granite body in both horizontal and vertical directions. The total area of the metamorphic zones is about 500 km2. In the Jiajika deposit, a total of 498 pegmatite dikes with a size of more than 20 m2 are distributed in an area of about 80 km2.”[6]

[1] James Wilson, China Molybdenum on the hunt for prime western mines, Financial Times, May 4, 2016

[2] 2013 Minerals Yearbook: China, US Geological Service, https://minerals.usgs.gov/minerals/pubs/country/asia.html#ch

[3] SUN Yuzhuang, ZHAO Cunliang, LI Yanheng and WANG Jinxi; Anomalous Concentrations of Rare Metal Elements, Rare-scattered (Dispersed) Elements and Rare Earth Elements in the Coal from Iqe Coalfield, Qinghai Province, China; ACTA GEOLOGICA SINICA (English Edition) Vol. 89 No. 1 pp.229–241 Feb. 2015

[4]刘丽君,付小方,王登红,郝雪峰,袁蔺平,潘蒙, 甲基卡式稀有金属矿床的地质特征与成矿规律*

LIU LiJun, FU XiaoFang, WANG DengHong, HAO XueFeng, YUAN LinPing and PAN Meng; Geological characteristics and metallogeny of Jiajika-style rare metal deposits; Mineral Deposits, December 2015, vol 34 #6, 1187-1198

[5] LI Jiankang, WANG Denghong and CHEN Yuchuan; The Ore-forming Mechanism of the Jiajika Pegmatite-Type Rare Metal Deposit in Western Sichuan Province: Evidence from Isotope Dating, ACTA GEOLOGICA SINICA (English Edition) 87 No.1 pp. 91-101 Feb. 2013

[6] LI Jiankang, ZOU Tianren, LIU Xifang, WANG Denghong and DING Xin, The Metallogenetic Regularities of Lithium Deposits in China, ACTA GEOLOGICA SINICA (English Edition) Vol. 89 No. 2 pp.652–670, Apr. 2015