Blog two in a series on Tibet in 2021 2/8

DARKNESS TO LIGHT

In official thinking, civilisation, development and modernity all go in a straight line that travels from rural to urban, from darkness to light, from poverty to wealth, from illiteracy to reading Chinese, from proletarian precarity to factory work in the rapidly industrialising interior of China. That is the civilising mission. The Han are exemplary, everyone should model themselves on the Han.

Right now, on this trajectory of inevitable and necessary progress, the nomads displaced from their lane tenure security are stalled, able neither to go back nor forward. Their land tenure has been cancelled, they live in small concrete apartments on urban edges, forbidden to raise any animals, and with no access to urban jobs, almost all of which require literacy in Chinese. They are reduced to dependence on state handouts of rations to survive on.

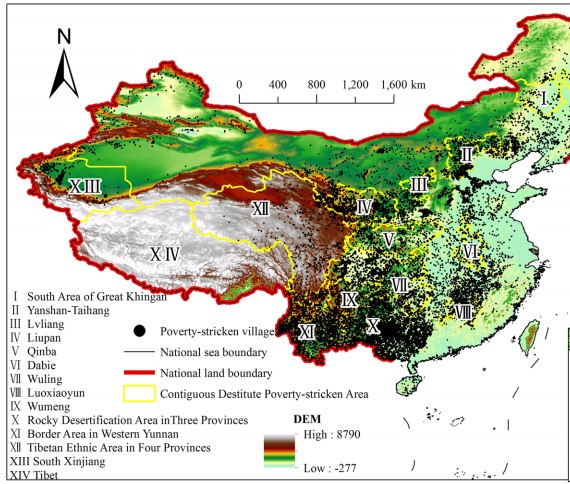

Some folks need to be saved from themselves, and from the inherent destitution of homelands seen from afar as utterly lacking in factor endowments enabling greater productivity. It’s all rational. It’s the benevolence of the party-state. The Tibetans are the wretched of the earth, because of who they are and where they are. If China’s civilisjng mission enters a new phase of accelerating the pace of assimilation, complete with compulsory re-education/vocational education camps, the justification will be the forward momentum of development and modernity, making Tibetans job ready. It’s for their own good.

PLAUSIBLE YET NOT PROBABLE?

Plausible as this is, it may not happen. Tibet is not Xinjiang. In Xinjiang, China was able to mobilise millions of Han settlers who have made Xinjiang home over two generations, and now feel it is theirs. There are few nonTibetans with roots in Tibet, except in Xining and surrounding agricultural districts, available to be sent into Tibetan families to teach them how to become high quality, civilised Han. That’s a major difference.

Nor in Tibet is terrorism available as a hegemonic discourse that silences all else.

In fact urban Han are discovering rural Tibet, not only for its spectacular landscapes but also for its kind, generous, trustworthy rural people. Urban Chinese unable to fly overseas because of pandemic lockdowns have been hiring SUVs to self-drive around Tibet. Han online now connect viscerally with Tibetans, whether it’s the overnight sensation of a handsome young Khampa, Tenzin instantly becoming Ding Zhen; or the tragedy of a cheerful young Tibetan woman showing her daily rural routines to millions, until her murder by an enraged husband. Both Lhamo and Tenzin bridged all distance, eliciting instant connection, strong emotional responses among millions of Han. Desire and horror transcend all racist stereotypes that stigmatise Tibetans.

Then there are the educated urban Han who discover the transformative insights of Tibetan Buddhism, usually in remote rural locations where undistracted, intensive practice of mind training is taught.[1]

These add up to lived experience of Tibetans as neither backward nor uncivilised, in no need of coercive, patriarchal, racist assimilation into Han norms.

If the party-state really is gearing up to compel Tibetans to declaim official slogans en masse, or remain incarcerated, such a campaign could falter and fizzle. That seems to be the big question hanging over 2021.

COPPER

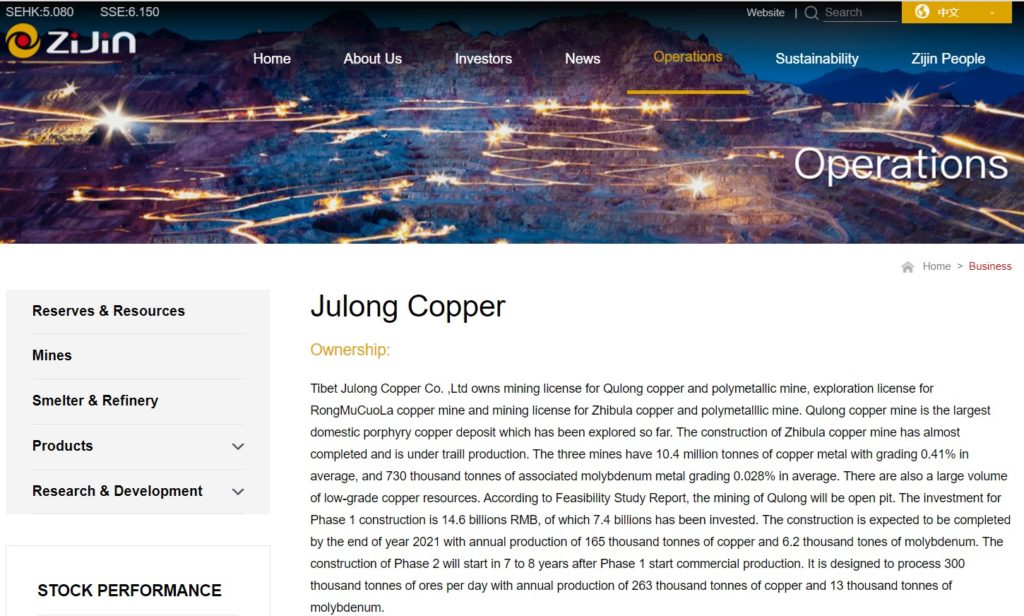

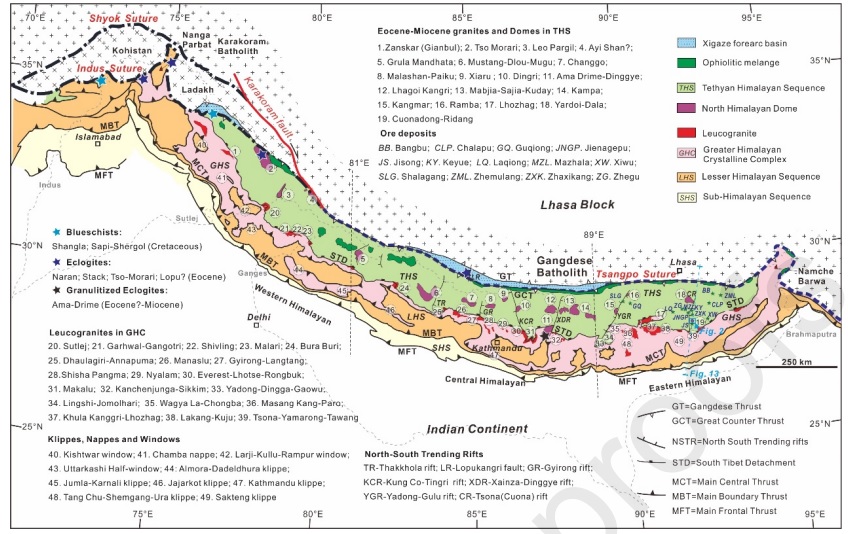

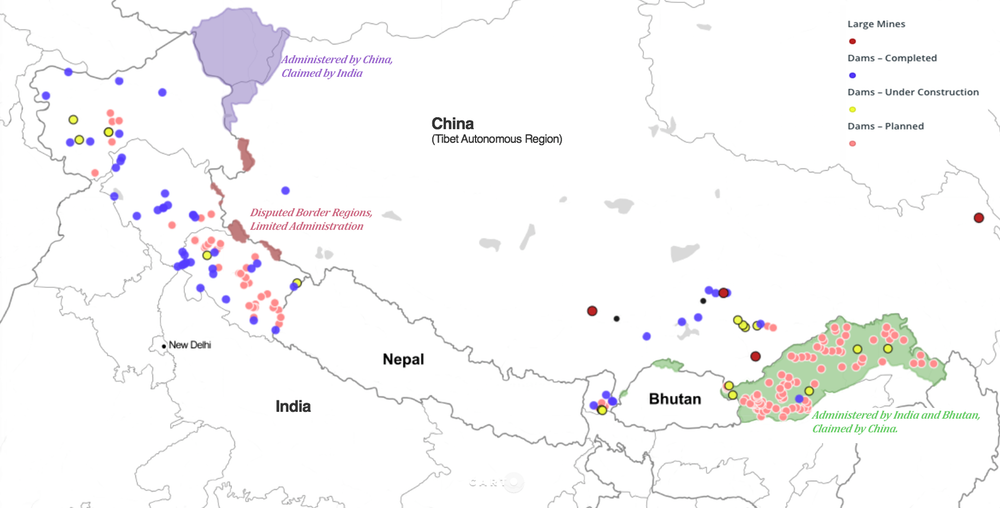

Right across Tibet, from the far west all the way to Kham, Chinese geologists have identified and quantified copper deposits, usually with a bonus of gold and silver on top, plus other minerals in demand such as molybdenum, lead and zinc.[2]

As renewable energy grows, copper demand grows, and exploitation of Tibetan copper deposits will intensify. Wiring an electric car requires much more copper than a petrol or diesel. Transmitting electricity over great distances, from Tibet to east China factories, for example, requires lots of copper. Gathering electricity generated by solar and wind farms scattered about the landscape takes a lot of copper.

Rising demand for copper (and lithium, also abundant in Tibet) means not only more intensive copper mining, but also further globalisation of Tibet, tying Tibet to the volatile boom and bust cycles that chronically afflict the mining industry. This could have serious consequences in Tibet.

Mining, crushing and concentrating the ores mined are all ramping up in Tibet, likewise the more profitable step of refining the concentrates in a smelter which, at great heat, melts and separates the metals to be separately poured off.

But that is not the only way to make money from copper. Traders play a big role in the price swings, betting on what future prices will be. Smart traders make money when they correctly anticipate copper prices will go up; and make money when they correctly forecast prices will drop, selling now and buying back later at a lower price. This exaggerates the swings. China used to complain about arbitrageurs speculating on the prices of basic commodities; now it has joined them. “Shanghai is launching a challenge to London’s dominance in metals trading by issuing a new futures contract for copper that analysts say has the potential to become a global benchmark. The Shanghai International Energy Exchange (INE) will start trading monthly copper futures denominated in renminbi, in contracts based on the metal to be delivered into warehouses in China.”

A few years ago, China bought out the biggest metals speculation hub, the London Metals Exchange, and is now backing it up with massive stashes of actual copper, for those moments when a bet goes wrong, and a trader has to deliver actual copper at the agreed price. The actual tonnage of copper stored in bonded warehouses in Shanghai varies between a low of 200,000 tons to a high of almost 700,000 tons. These are further reasons for accelerating the extraction of copper deposits in Tibet. The copper deposits of Tibet are now “a play” in trader jargon. Whether copper mining in Tibet booms or busts, Shanghai copper futures traders will make money.

Right now, as demand surges, price surges and lots of hot money pours in. However, there is a big mismatch between the speed of all that hot money sloshing round the world, and the time it takes to get a copper mine into production, usually a decade’s work. That is why mining is boom and bust. In a bust, the mining company can abandon the mine and the tailings dams, claiming bankruptcy. Nothing Tibetan communities can do about it, because from the outset they are disempowered.

That’s a danger for Tibet. In boom times, mining companies are keen to get going, willing to cut corners, bribe officials and ignore environmental assessments, in order to get into production. In bust times, some go broke, and walk away from waste dumps and tailings holding dams storing millions of tons of pulverised rock containing toxic heavy metals, leaving others to do the long term work of preventing leakage into rivers.

Most copper deposits in Tibet are close to the Yarlung Tsangpo river and its tributaries, including big dams upriver from Lhasa on the Kyichu. The Yarlung Tsangpo is the collision of two continents, where part of India was pulled deep into the Earth underneath Eurasia, generating heat and pressure over long periods, melting metals, pushing them up to form ore deposits. Even the copper deposits in Kham, east of Chamdo, are high above rivers and the danger there of dam collapse releasing into the river heavy metals Tibetans knew all along had to be left alone, deep in the earth.[3]

Those deposits have been assessed by Chinese geologists for decades, followed by economic geologists generating spectacular profit potential numbers. The mines they have planned, ready for investment, typically envisage operating for 25 or 30 years of extraction, before the deposit is exhausted and they walk away, leaving behind a mountain of toxic tailings.

The biggest mines currently are Gyama and Chulong, both on the Kyichu above Lhasa, and Shetongmon, to the west of Shigatse. But if the copper price is right, there could be dozens of mines, each with its own electricity supply, crushers, concentrators and probably smelters, all stages requiring lots of energy.

At the end of 2020 copper is at the highest price in seven years, similar to the boom years between 2006 and 2012, which were only briefly interrupted by the global financial crash of 2008. The smart money is betting it will stay high or go higher. One of the sharpest traders, Trafigura, “is forecasting a near 800,000 tonne increase in Chinese copper demand in 2021 alone as Beijing invests heavily in its grid and renewable power.” If demand exceeds supply by only a small amount, prices rise dramatically; that is how capitalism works.

The new owner of the Chulong deposit at Songtsen Gampo’s birthplace plan to blow up, dig out, crush and concentrate 30 million tons of rock a year, until 2037. Nearly all of that rock, crushed to powder, will forever remain on that high mountain ridge, since the amount of copper, molybdenum, gold and silver in any ton of rock adds up to less than one per cent. That’s a massive legacy to leave with Tibetans, after the mine is exhausted, as planned, by 2037.

The world’s biggest mining companies, acting together, have responded to recent disastrous failures of mine waste tailings dams, by coming up with agreed standards and principles for future mining practice. The Global Industry Standard On Tailings Management published in August 2020 by the International Council on Mining and Metals (ICMM), and the UN Environment Programme, states its first principle: “Respect the rights of project-affected people and meaningfully engage them at all phases of the tailings facility lifecycle, including closure.”

China’s miners in Tibet fail this first principle. No Chinese miner has joined ICMM. Nobody asks Tibetans for permission to mine. Still less are communities involved in the planning and management of millions of tons of mine waste, stored above ground for thousands of years after the mine has closed.

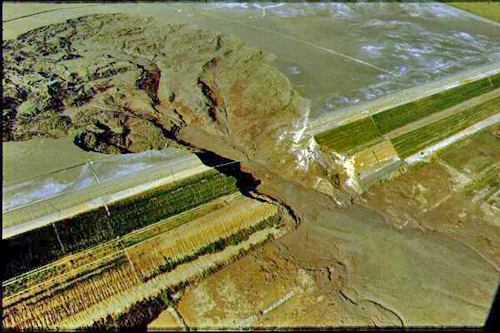

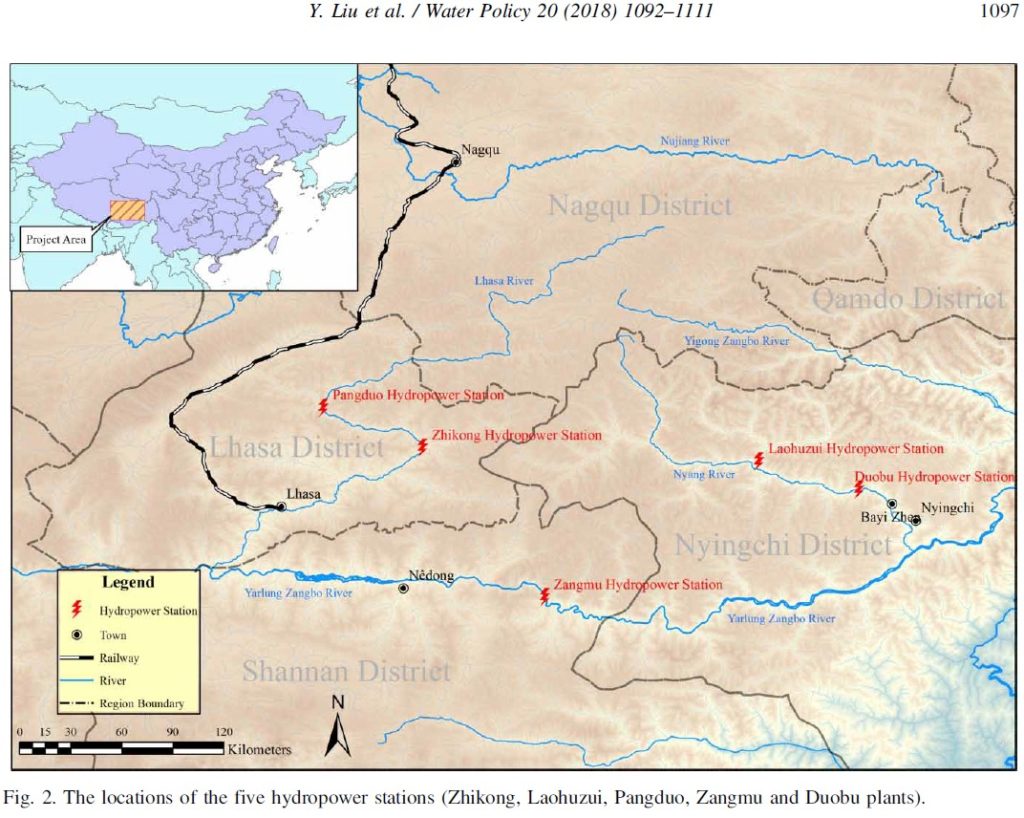

Where will the electricity for all that rock crushing, concentrate cooking and smelting come from? The existing Zhikong 直孔水电站 and Lhundrup Pondo (Pangduo 旁多水电站)hydro dams on the Kyichu Lhasa River could be supplemented by cascade dams nearby. The recently announced new dam on the Nyang Chu above Nyingtri is only 200 kms from the Chulong and Gyama copper mines. Either way, it means more damming of substantial Tibetan rivers that feed in to the Yarlung Tsangpo. Each location is risky in such geologically active districts. The 2018 massive landslides that temporarily halted both the Yangtze[4] and Yarlung Tsangpo[5] are a reminder that Tibet is a young, rising, unstable land, made much more unstable by glacier melt now so fast that massive portions of glacier can slide into rivers, bringing with them so much rock that the greatest of rivers can be stopped altogether, until the accumulating waters powerfully break through. Hydrodammers beware.

GLOBALISED TIBET

The globalisation of Tibet is now happening at an accelerating pace. The fate of Tibetan rivers, mountains, historic sites and local communities now depends on global copper price fluctuations. Hydroelectricity from dams on Tibetan rives is now used to churn out blockchain, and to make polysilicon of sufficient purity to be used in the highest of hitech, in printed circuits. Tibet has gone global. No-one has asked the Tibetans.

Using hydropower from Tibet to make polysilicon is integral to China’s urgent program to decouple from reliance on US imports for hitech, and the pioneer of making Tibet a frontline has been felicitated recently, a new hero: “Xie Xiaoping, a professor-level senior engineer, chairman of the Yellow River Hydropower Development Co., Ltd., and secretary of the party committee, Xie Xiaoping, as a leader in China’s photovoltaic industry, built the world’s largest water and solar complementary power station; led the construction of the world’s largest outdoor demonstration base with the most complete experimental equipment and the most advanced experimental methods; has promoted the healthy and sustainable development of the global photovoltaic power generation industry; leading the birth of the only domestic enterprise that produces and sells electronic grade polysilicon, breaking China Electronics Grade polysilicon complete dependence on imports.”

This grandiose claim makes Xie Xiaoping a hero in Qinghai. But why is hitech done in Tibet? Is it something to do with a Tibetan source of silicon? Or is it the Yellow River Hydropower Development Co. dams and hydropower that go to waste because lowland China provinces refuse to connect to it, leading to huge wastage of electricity? Or is it because purifying silicon for use in solar panels and computer chips is where the money is?

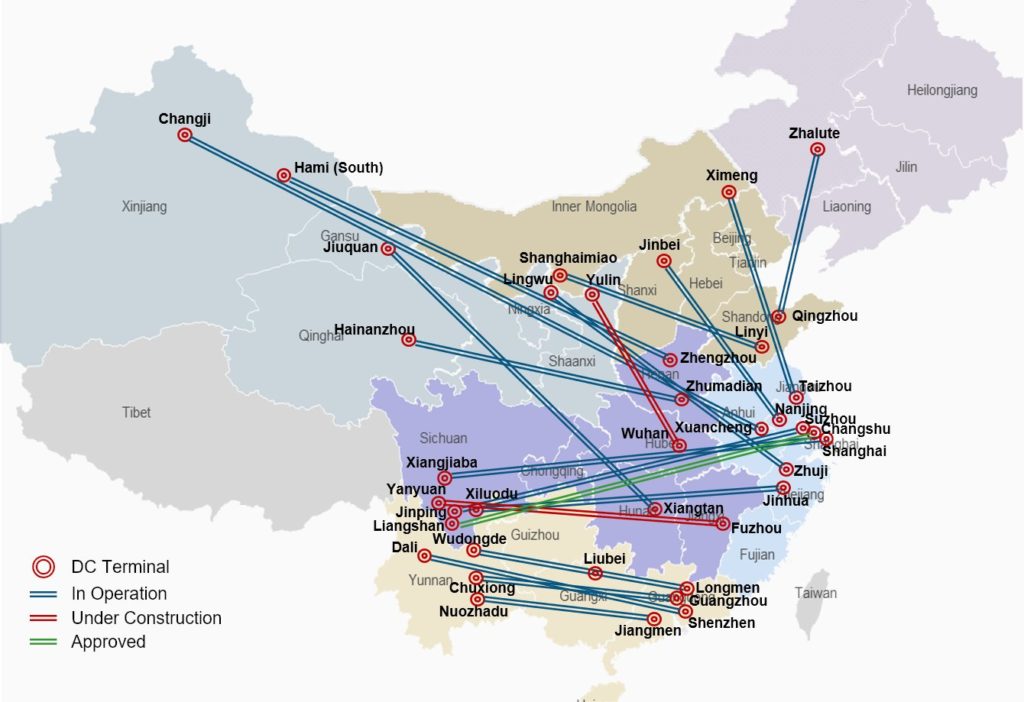

Silicon is the commonest of elements, available wherever there is sand. No need to go to Tibet. The Yellow River hydrodam cascade does produce excess electricity, but not for much longer, as a new ultra-high voltage power grid is due for completion, transmitting electricity from Tibet to central China 1300 kms to the east. The most compelling reason for Xie Xiaoping’s state owned enterprise is the money to be made from the frantic bubble economy as China races to make its own computer chips, since the US is no longer willing to export them.

Investigative reporting by China Economic Weekly reveals the frauds embedded in the race to become China’s Silicon Valley: “the current chaos in the chip industry includes some “three-nos” companies with no experience, no technology, and no talents, engaged in the integrated circuit industry, some places have insufficient knowledge of the law of integrated circuit development, blindly launching projects. Many local governments eager to “overtake” have bet on the chip industry, set up industrial investment funds and numerous subsidies and rewards, and built a large-scale chip industry park to create a “chip city”. So companies from all walks of life flocked. Since 2019, nearly 20,000 companies have switched to “integrated circuits, chips, and semiconductors”. Even in Tibet, some companies have added “integrated circuits, chips, and semiconductors” to their business scope. In further detail, many of these “changed” chip companies belong to the technology industry, and some of them come from various industries such as construction or construction engineering, human resource services, biomedicine, clothing, and cement.”

Production of extremely pure silicon is energy-intensive, often located near hydro dams, in Tibet both close to the Yellow River dam cascade and also in Amdo Ngawa in Sichuan, near dams on tributaries of the Yangtze. As with blockchain manufacture, these are at present highly seasonal industries, barely functioning in the dry months, operating at full speed in the wet months when much hydropower goes to waste, not connected to the national grid.

[1] JIN Hao, In Search of Shangri-La: The Utopian Representation of Tibet in An Yiru’s The Sun and the Moon, Utopian Studies , Vol. 31, No. 1 (2020), pp. 1-24

[2] Zengqian Hou et al., The Miocene Gangdese porphyry copper belt generated during post-collisional extension in the Tibetan Orogen, Ore Geology Reviews, 36 (2009) 25–51

[3] Jia Chang, et al.,Geological and Chronological Constraints on the Long-Lived Eocene Yulong Porphyry Cu-Mo Deposit, Eastern Tibet: Implications for the Lifespan of Giant Porphyry Cu Deposits, Economic Geology, 2017, 1719-1746

[4] Limin Zhang, Te Xiao, Erosion-based analysis of breaching of Baige landslide dams on the Jinsha River, China, in 2018, Landslides, 2019, 1965-1979

Yu-xiang Hu, Zhi-you Yu, Jia-wen Zhou, Numerical simulation of landslide-generated waves during the 11 October 2018 Baige landslide at the Jinsha River, Landthat slides 2020, 2317-

Hai-bo Li I Shun-chao, Mass movement and formation process analysis of the two sequential landslide dam events in Jinsha River, Southwest China, Landslides, 2019,

[5] Chen Chen, Limin Zhang, Barrier lake bursting and flood routing in the Yarlung Tsangpo Grand Canyon in October 2018, Journal of Hydrology 583 (2020) 124603