Advocacy opportunities

Occasionally, readers of the Rukor.org blog wonder what can be done in a practical way to right the wrongs China’s “development” agenda imposes on Tibet.

One example is our recent blog series on trout manufacture in Amdo Chabcha, in 200 cages set into the nine reservoirs China has built on the Ma Chu/Yellow River. Readers were concerned at the cruelty of cultivating and then killing fish by the millions in a major Tibetan river, an industry abhorrent to Tibetans who generally take seriously the teaching that all sentient beings have in past lives been your mother. Tibetans do not extract the plentiful native fish in Tibetan rivers and lakes. Our discovery shocked Tibetan readers, who wonder if anything can be done, before planned upscaling gets so big the industry becomes unstoppable.

http://115.236.76.50/qhkjb/html/2020-06/03/content_3_1.htm

So we are revisiting China’s deep inland trout-cum-salmon fish commodity chain, specifically to analyse what might be done.

Below are further details, with the focus on the foreign investors who make this new industry possible.

Beyond the trout-cum-salmon blog are case studies of other current foreign investors in Tibet. All are written so as to be of practical help for anyone considering taking action, beyond reading about it. The emphasis is on the practicalities of advocacy, on both the opportunities to speak up for Tibet, and the constraints.

The five case studies of foreign investment in Tibet are:

- Fish farming trout aquaculture

- Lithium extraction and battery manufacture for electric vehicles

- Luxury hotels

- Copper mining upriver from Lhasa

- Power grids designed to transmit electricity generated in Tibet over vast distances

CASE STUDY ONE: FACTORY FARMED TROUT (OR FUGITIVE SALMON)?

STRENGTHS: A KEY FOREIGN INVESTOR

Since the private companies operating the fish farms in Amdo Chabcha boast they have licences to export trout to Europe, Russia and elsewhere, and since this is a highly globalised industry, Tibetans in worldwide exile may find it possible to gain traction. Not only is output global, even more so the inputs of supply of fertilised eggs, and manufactured fish feed, and fish processing equipment are provided by nonChinese companies, so Tibetans in exile may find nearby those companies that need reminding of corporate responsibility and not take their social licence for granted.

The story of how, where and why China has turned to Tibet for mass production of rainbow trout, sold in wealthy Chinese cities as “salmon” is told in depth at https://rukor.org/tibets-globalised-fish-industry/ and is not repeated here.

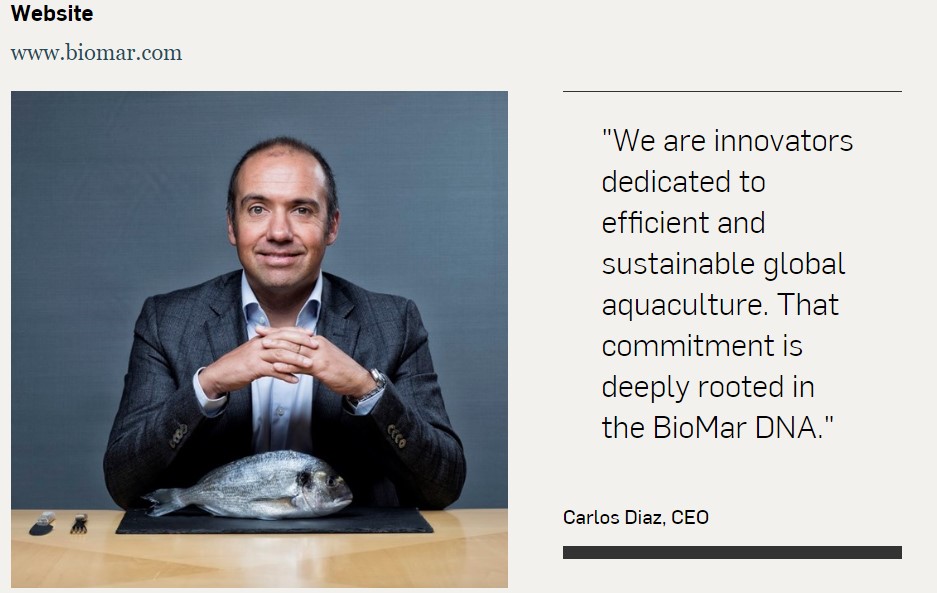

The main foreign investor in Tibetan mass production of rainbow trout is the Danish fish feed manufacturer BioMar. This may not be a well-known company, since it has few direct dealings with the consuming public, but as aquaculture grows rapidly worldwide, led by China, BioMar pitches its fish feed formulations as the most advanced and scientific, uniquely capable of enabling the trout agribusiness to intensify fast.

BioMar is so keen to get into the China aquaculture market -by far the world’s biggest- it has been buying out Chinese fish food manufacturers and building new factories, so far none close to Tibet.

In 2019 BioMar, at its head office in Denmark, signed an agreement with Qinghai officials, a clear indication that the party-state is deeply involved, especially with subsidies. This is now a three-way partnership between BioMar, the Qinghai government and the private company Qinghai Minze Longyangxia Ecological Aquaculture Co., Ltd; 是青海民泽龙羊峡生态水殖有限公司还打, which is the main player, claiming in June 2020 “an annual output value of 760 million yuan, and the products were sold to domestic and foreign markets.”[1]

Each of the three partners get what they want. The Qinghai government can and does boast of successful development and poverty alleviation, as if Tibetans benefit in any way. Official media boast: “Cold-water fish farming becomes a major industry for poverty alleviation and prosperity. In Qinghai, the dotted reservoirs provide a broad space for the development of cold-water fish farming enterprises on the plateau, and become a major industry for the local poor to get rid of poverty and become rich.”[2] Tibetans presumably should be grateful.

Qinghai gets to scale up, with the prospect of rapidly growing to a big industry feeding rich urban Han trout hard to distinguish from prestigious imported salmon. Since the Tibetan trout farming industry’s conflation of trout with salmon has scandalised Shanghai consumers, the industry is out to build its brand as clean, green, disease-free and pure because it is based in Tibet. Official media have sent investigative reporters to Amdo Chabcha (Gonghe in Chinese) to delve into how this industry operates.[3] Qinghai, hoping for greater revenues, is keen to lift the industry’s reputation. This includes the involvement of a prestigious Danish company, adept at scientific management language.

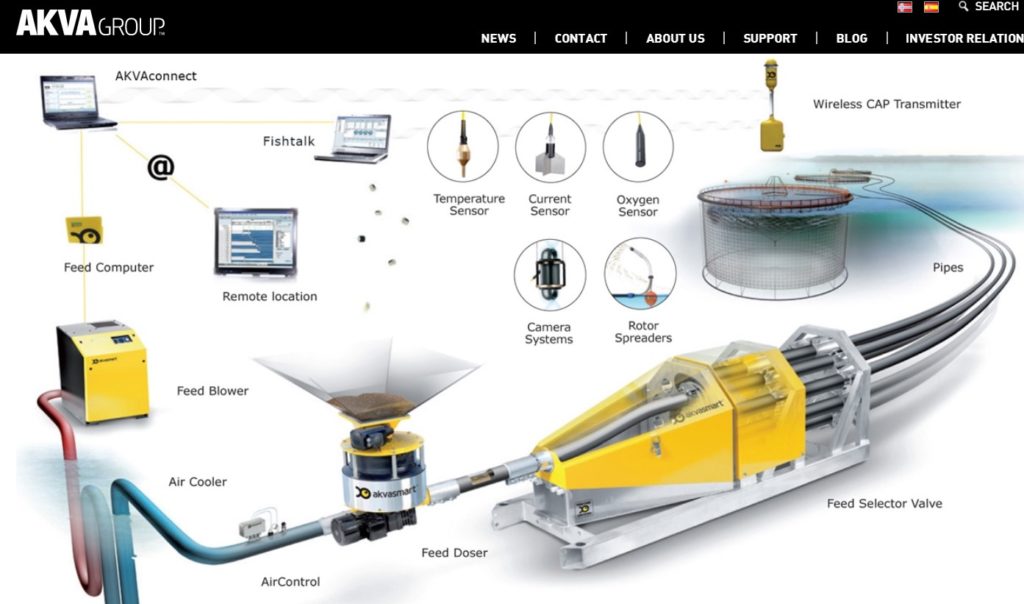

Qinghai wants every stage of production in-house in Qinghai, including the production of fertilised fish eggs, currently flown in from Denmark, Norway and the US; and the production of formulated fish feed made of “trash” fish, soybeans and agricultural wastes. This is where BioMar comes in, as the scientific experts in calculating the exact sweet spot. If the fish feed pellets spewed by Norwegian AKVA machines into the cages twice a day is not nutritious enough the fish don’t grow as fast, cutting into profits. If, however, the fish feed is too nutritious, it goes to waste, becoming nutrients for other organisms, upsetting the natural balance. BioMar says it can get this balance right.

Many questions need answers. Will the growing trout also be fed antibiotics? Will they be fed anthaxanthin, made from “trash” fish to make their flesh pink-red, to look like salmon? Will BioMar set up a fishfeed factory in Tibet, or import fish feed pellets from its factories elsewhere in China? Will fishfeed ingredients be sourced in Tibet, or rely on soybeans shipped in from Brazil or the US? Will the production line for making fertilised fish eggs be localised, or continue to rely on imports flown in from Europe?

Will the Qinghai provincial government continue its subsidies, which currently reduce the price of producing baby trout from RMB 2.5 to 1.5? “In order to make up for the shortcomings in the development of cold water fish industry, our province has arranged a certain amount of fiscal funds every year at the policy level to support and subsidize enterprises engaged in fishery breeding, processing, circulation and logistics services.”[4]

For the Qinghai Minze company with exclusive legal access to the common pool resource of Tibetan waters impounded in Chinese dams, the deal with BioMar comes at the inflection point where the industry could take off, if it can improve its reputation with the sophisticated consumers of Shanghai and Beijing.

Qinghai Minze Longyangxia Ecological Aquaculture Co. has plans to launch an IPO, selling shares on a Chinese stock exchange, which could raise a lot of investment capital, as well as making its current owners very rich.

The company has benefited from the regulatory vagueness that fails to distinguish salmon from trout, enabling it to market its fish as salmon, at much higher prices. This has greatly annoyed metropolitan thought-leader influencers who have publicly questioned whether this is a scam.

Branding is everything, and Tibet is becoming a brand in its own right, a guarantor of clean, green purity precisely at the moment of industrial intensification. Both Tibet as the locus of production and the fast-growing role of BioMar as scientific guarantor of efficient, clean industrial supply chains, testify to the rainbow trout airfreighted from Tibet to Shanghai as worth their high price.

https://medium.com/@shanghaiist/your-imported-salmon-is-probably-local-rainbow-trout-3286c4ecda5e

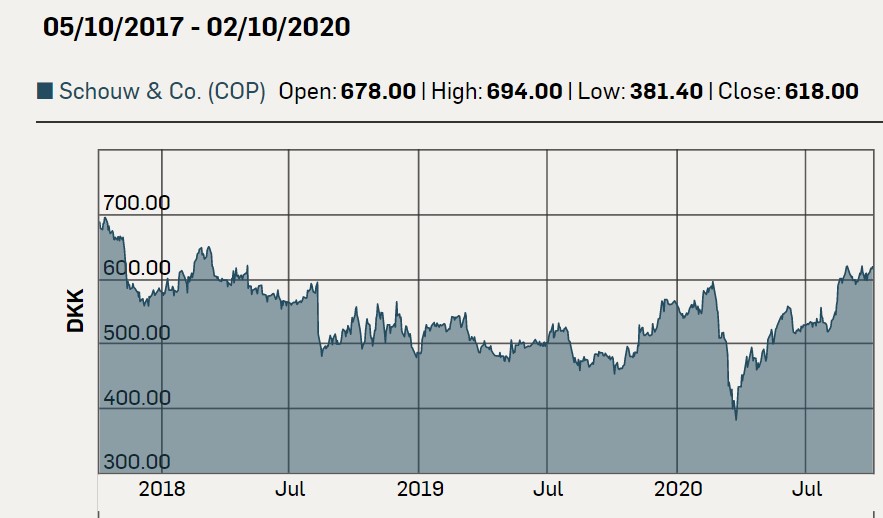

BioMar has fish feed factories in Denmark, Norway, Scotland, France, Spain, Greece, Turkey, Chile, Costa Rica. BioMar is owned by Schouw, its shares are traded on the Copenhagen Stock Exchange. Share price has been volatile, in the past three years as high as DKK 694, as low as DKK 381. This is a business that proclaims credentials as a market leader in clean, green production. It would not wish to be associated with exploitation of Tibet, offending Tibetan religious sensibilities, and mass cruelty to animals. Such association would reduce reputational equity and thus reduce share price.

WEAKNESSES

Chabcha, less than 200 kms southwest of Xining, is one of the most Chinese of rural Tibetan areas, partly due to the Longyangxia dam and the 200 trout cages sitting inside the reservoir. In the 2000 census Tibetans were only 34% of the county population. Many Tibetans were displaced by construction of the Longyangxia dam, losing access to grazing land and the freedom of being largely self-sufficient. Chabcha dzong is mostly below 3000m altitude, which attracts Han settlers. Little of the Tibetan Plateau is below 4000m. Han can often speak the Amdo dialect of Tibetan.[5]

The whole prefecture of Tsolho (Hainan in Chinese), both meaning south of the Qinghai lake, is gently rolling grassland suited to immigrating Han “reclaiming” pasture by ploughing for crops, often unaware until too late of the harsh winter winds sweeping in from the deserts of Xinjiang that can strip bare soil. Ongoing loss of pastureland is due to local government classifying pastoral landscapes as common pool resources belonging to no-one. This leads to tensions.[6]

OPPORTUNITIES

Tibetan culture in Chabcha is strong. Prior to 1958 there were 1066 monks in 16 monasteries in Chabcha; by 1999 Chabcha had recovered, to 828 monks, in 24 monasteries.[7] On official statistics, in 2017 rural residents of Tsolho/Hainan prefecture had per capita incomes of RMB 9279, not much below those on the rural margins of Xining, the provincial capital.[8] For urban households the figure was RMB 15,130. Chabcha is home to www.yongzin.com , an online database of Tibetan culture that has uploaded more than 15-thousand books, including many ancient classics.

BioMar projects itself as a world leader in clean, green, scientific fish feed production. BioMar and its partners in Qinghai are acutely aware of reputation, as a form of capital, which makes all the difference between fish consumer willingness or unwillingness to pay premium prices.

Is the wealth generated by the 200 fish farming cages in the Longyang gorge dam shared by Tibetans? Not only do Tibetans dislike factory farming for the sole purpose of slaughter, the entire industry is capital-intensive and technology intensive, employing few people, and no-one without literacy in reading operational instructions issued in Chinese.

http://finance.sina.com.cn/roll/2018-07-04/doc-ihevauxi9723662.shtml

Tibetans sometimes get temporary work as unskilled labourers on construction sites, but there is no sign of Tibetan employment or benefit in this intensive aquaculture production line. Even the small traders who venture out onto the lake after a windstorm, to catch trout that escaped the cage, are all Han Chinese, judging by the hand painted signs they scrawl on rocks along the roadside advertising their private catch. That was the finding of investigative reporters sent from Beijing to Longyangxia in 2018.

CONSTRAINTS

Timing is everything. In 2020 BioMar is entering China’s huge fishfeed market for the first time, making key strategic investments, both by buying a major Chinese fishfeed manufacturer in southern China, and by building its own fishfeed factory in eastern China, close to the coastal locations of most aquaculture.

In recognition that aquaculture is now changing fast and moving inland -to Tibet- BioMar is on the ground, possibly intending to build a production base in Tibet, which could utilise by-products of other farming operations, or use imported soy beans from Brazil, and continue to import fishmeal made from “trash” fish, even though overfishing worldwide (largely by China) has so depleted fish stocks that even “trash” fish are now scarce.

So far, there is no formal contract, only a Memorandum of Understanding between BioMar, the Qinghai provincial government and the company operating the 200 trout cages in the Longyangxia dam.

A campaign to persuade BioMar’s owner Schouw that the Tibet connection is not a good idea, can succeed before BioMar has locked itself in.

******************************************

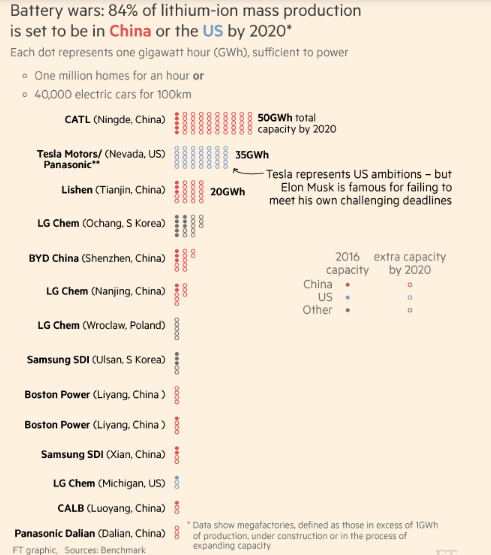

FOREIGN INVESTMENT CASE STUDY TWO: NEW ELECTRIC VEHICLES & LITHIUM BATTERIES

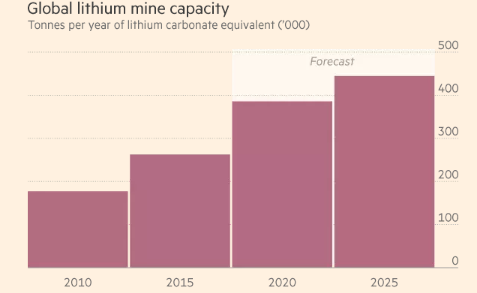

In a crowded, competitive market for battery powered cars, one company stands out because of its reliance on Tibet as the source of lithium for battery production. Most battery manufacturers, in the US (Tesla) and China (now including Tesla) rely on lithium imported from the salt lakes of the high desert of Chile. Even though the lithium in the salts of the lakes of the Amdo Tsaidam basin are plentiful, and salt extraction is on a huge scale, very little has been used so far for battery making. This is for technical reasons: to work safely in a battery the lithium has to be extremely pure, not mixed up with the magnesium, sodium and potassium salts also in the Tibetan lake beds.

If the lithium is not extremely pure, batteries overheat and catch fire, and also don’t allow much recharge, so the batteries fail. Chinese scientists have been working hard to reach a level of purity that makes Tibetan lithium suitable for battery manufacture.

Until now, despite much interest from Tibet support groups, there has been no campaign, because there was little evidence that Tibetan lithium from Gormo was being used for battery making. Now the moment has come, because a battery making plant is now in operation just outside Xining, using lithium from the Tsaidam salt lakes.

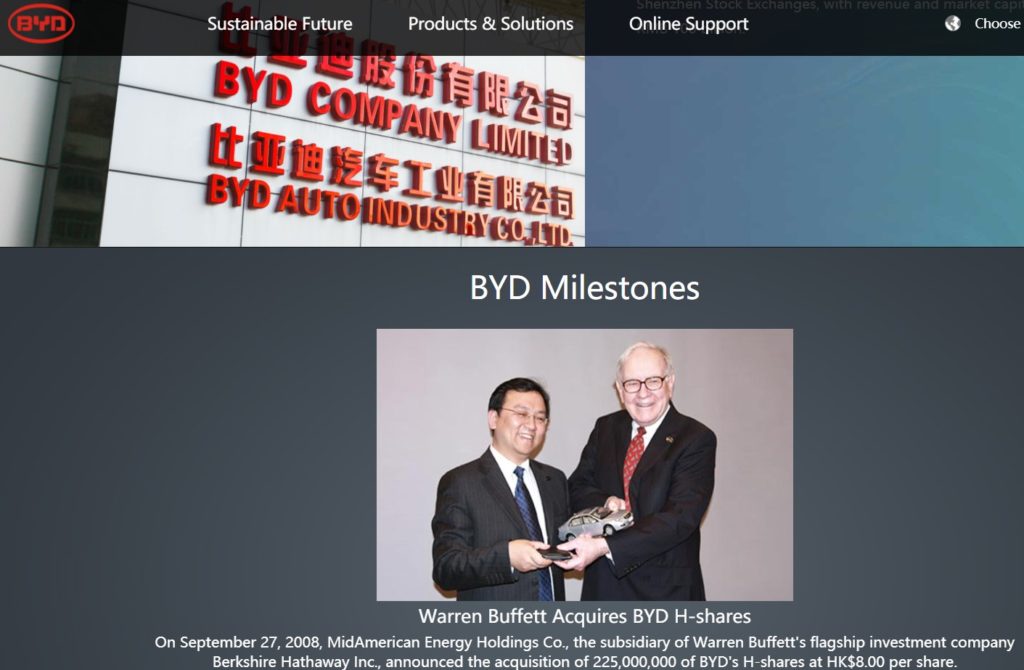

This is the work of one company, BYD, a Chinese battery maker-cum-car maker, whose biggest shareholder is a famous American investor.

A campaign on BYD and its American part-owner is an opportunity to focus on the theft of Tibetan endowment of natural resources, without any benefit to Tibetans. This opens up a new aspect of Tibetan nationalism that has seldom attracted attention.

STRENGTHS:

Campaigning on lithium extraction from Tibet opens up debate on the exploitation of Tibet, the extraction of Tibetan resources for Chinese profit, and the many environmental impacts of not only salt extraction but also the pumping of Tibetan oil and gas from the Tsaidam Basin. Combining salt and oil provides the ingredients for making petrochemicals, explosives, fertilisers and PVC plastics. That is how the Tsaidam Basin became the most heavily industrialised part of Tibet.

BYD has been the most heavily government-subsidized Chinese company in the electric vehicle industry, with more than half of its 2018 profits coming from Chinese government subsidies, according to an analysis by the U.S.-based research organization Radarlock. BYD also has large contracts with the People’s Liberation Army, and the Guangzhou Municipal People’s Government owns a significant stake in one BYD auto subsidiary. That’s led U.S lawmakers to believe BYD is controlled by the government, and the ban on using federal dollars on BYD vehicles stems from fears the company can outbid American rivals and that China uses corporate partners to spy on Americans.”

A campaign on the BYD lithium battery production in the heavily polluted industrial zone around Xining will mobilise active concern of environmentalists. Lithium production is part of the production of magnesium, potassium and sodium salts, all from the Tsaidam salt lakes, where they come mixed together. Separating them is highly polluting, and also highly reliant on using massive amounts of hydropower from China’s dams across the Ma Chu. So if environmentalists start to take interest in the problems inherent in lithium battery production, there are other related environment issues for a wider campaign.

source: Qinghai Scitech News 5 August 2020

The American investor in BYD is Warren Buffett, who now has a 25% stake in BYD, having bought in a decade ago, ahead of the curve. Buffett’s Berkshire Hathaway has a strong following, because of Buffett’s reputation as the guy who knows how to make money, but his reputation is sliding, and he has been accused of strategizing his investments to create monopolies, to avoid competition. In 2011 he and Bill Gates came out endorsing BYD as the future of the car industry, and philanthropically benefiting Tibet. Benevolent.

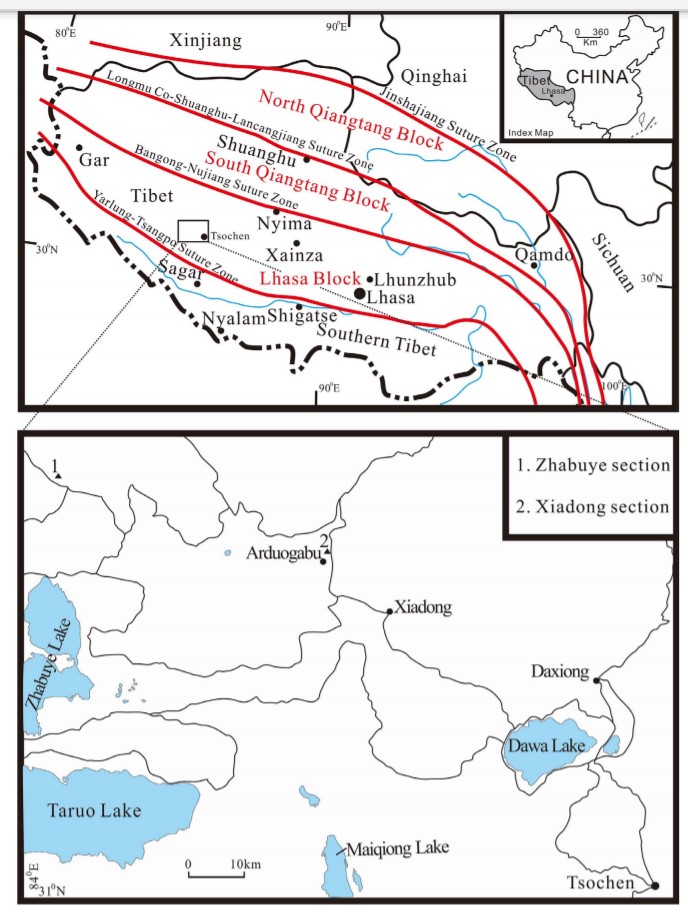

BYD boasts of having exclusive access to a lake in far western upper Tibet, in Ngari, the Zhabuye Tsaka, which has an especially high concentration of lithium, giving it a market advantage over competitors. Scooping the lithium salts from the dry lakebed is the easy part, they then have to be trucked right across the Tibetan Plateau, around 1200 miles, to where they can be processed near Xining. Zhabuye Tsaka is a most unusual lake, rich also in uranium.[9]

BYD has benefited greatly from Chinese government subsidies, including subsidies to buyers of BYD cars and buses.

source: Journal of Asian Earth Sciences 2019

WEAKNESSES

- Warren Buffett is an American icon. Millions revere “the sage of Omaha” as a magical rainmaker with a unique ability to pick stocks that make you rich.

- The BYD lithium Buffett story is complex, hard to reduce to a simple meme.

- Folks want to believe lithium batteries will solve all our fossil fuel carbon emissions problems, and don’t want to hear about the downsides of “green, renewable” energy such as lithium batteries or hydro dams.

- Tesla is a major competitor to BYD, but Tesla just built a huge factory in Shanghai and won’t want to rock the boat.

- So far electric vehicle sales have never really taken off, possibly they won’t catch on, despite all the hype.

- During the corona virus crisis BYD manufactured lots of face masks and got lots of free publicity.

OPPORTUNITIES

The Dalai Lama has often said environment issues in Tibet should be top priority. If Tibetans can tell the BYD battery story, how it robs Tibet of its resource heritage and causes pollution, while relying on the damming of Tibetan rivers for its massive electricity consumption, they build new alliances. Allies amplify the Tibet story, put it on their agenda, include it in their campaigns, make Tibet part of the global debate on mining impacts.

This is a human rights campaign focussed on the economic and social rights of the Tibetans, as a people, their collective right to development, to benefit from resource extraction, and to consent to extraction only on the basis of prior, free, informed consent.

This in opportunity to shine the spotlight on Gormo, the most industrialised city of the Tibetan Plateau, where very few Tibetans live, except for displaced nomads under intensive surveillance on Gormo’s outer fringe, along the highway. They are now the target of China’s “vocational education” mass indoctrination campaign.

Even though BYD cars are unlikely to be cruising the streets of your town, probably BYD buses are, especially if you live in an airport city. BYD has sold lots of lithium battery buses (and trucks), which return to depot for recharge. Until there are recharging stations all over town, car sales won’t accelerate. Airports are keen to display “green” credentials since everyone knows air travel is a big cause of climate heating emissions, so there may well be BYD buses nearby.

CONSTRAINTS

Publicising the downsides of exploiting Tibetan lithium will take time, requiring commitment to go talk to local environment groups rather than the global big names in conservation, who have offices in Beijing, work with the Chinese government, and don’t want to take sides. They back renewable energy as far better for the planet than coal and oil. They will say it’s regrettable that lithium has problems but on balance it’s good.

*************************************************

FOREIGN INVESTMENT CASE STUDY THREE: LUXURY HOTELS

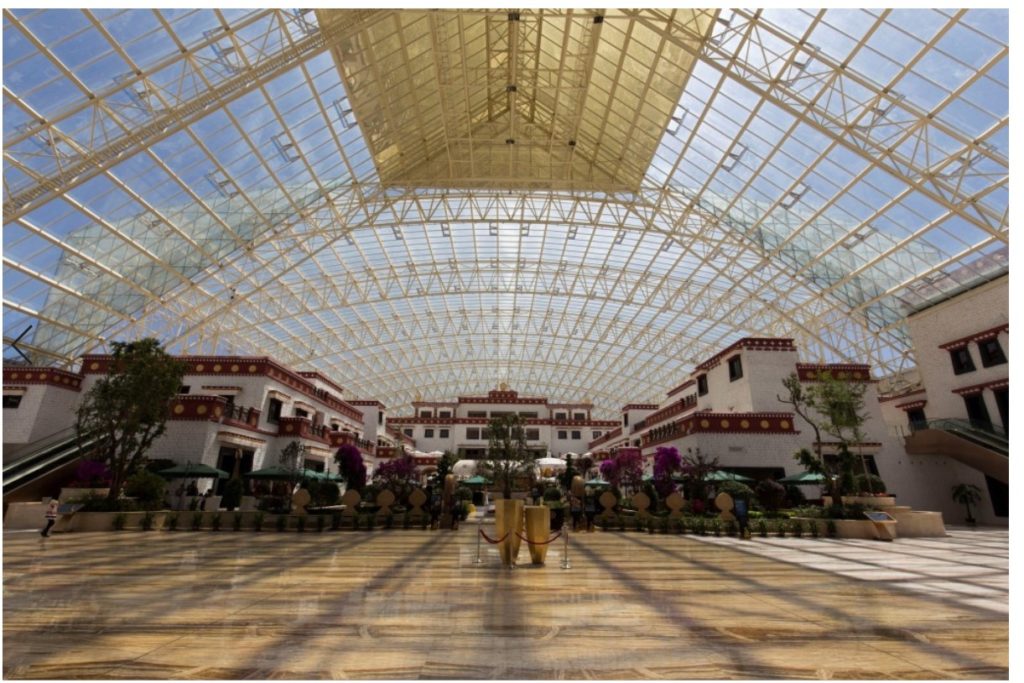

Two global hotel chains, Intercontinental and Hilton, run luxury hotels in the Tibetan cities of Lhasa and Nyingtri. There is also the StRegis Luxury resort in Lhasa, owned by Starwood; and in Gormo the Hilton Double Tree.

Their clients are wealthy Chinese tourists who, to avoid crowds and virus transmission risks, hire cars and drive to Nyingtri and Lhasa, to escape the summer heat and humidity down the Yangtze below Tibet, in Wuhan, Chongqing and Chengdu. Both Lhasa and Nyingtri have become fashionable destinations for the newly rich leisure class in China, especially at a time when international travel, because of the virus, is restricted and risky.

The Nyingtri Hilton and Intercontinental Lhasa Paradise make Tibet consumable. Lhasa, officially a city of 690,000 people, receives more than 25 million tourists a year, mo stly in the warmer months, overwhelmingly from lowland China, not many international. Although Tibetans experience many restrictions on free movement, Han Tibetans move freely, with no need to prove they are virus free.

The Intercontinental Lhasa Paradise is next door to Gutsa prison, where many Tibetans have been tortured.

Nyingtri is merging with nearby Bayi, a new Chinese town close by, marketed as the warmest climate in Tibet, famous for its peach blossom season, the ideal time to stage an upmarket wedding, or stage a meeting to impress your business clients and seal a deal, with Tibet the picturesque backdrop. If you decide you like it, you can build your own luxury villa.

For the rich, first stop is these luxury hotels, which boast Tibetan styled interiors, yet employ Tibetan staff only in menial low paid jobs as housemaids and cleaners, with no career path to become front of house. The more secure and well-paid jobs are for those who speak Chinese and English, which excludes most Tibetans.

These luxe hotels strongly feature how Tibetan they are, how you can experience all Tibet has to offer under their one roof.

SUGGESTED CAMPAIGN GOALS

Could be modest, such as guaranteed employment for Tibetans who speak English, including those who learned during a sojourn in India.

Could be a training school for Tibetans to get real front of house jobs, not just silent cleaners, room maids and bellboys. Intercontinental says: “The IHG Academy provides local people with opportunities to develop skills and improve their employment prospects in one of the world’s largest hotel companies. Within a consistent framework, each IHG Academy is tailored to meet the needs of local communities as well as hotels around the world.”

Could be hotel chains financing training for Tibetans in defending their land rights, especially in Nyingtri, where many Tibetans are losing their land (and food security) for luxury villas built by rich Chinese.

Could be gender equality and reduction of inequality, through training to improve human capital formation.

Could be training and accrediting more Tibetans as tour guides, culture interpreters, custodians of scenic spots, ensuring visitors and Tibetans have better opportunities for real connection.

STRENGTHS

These hotels succeed because of the brand names of Intercontinental and Hilton. China is the world’s biggest luxury market, and the sacred pilgrimage route around the Potala -the Barkor- has been rebuilt as upmarket boutiques with outwardly Tibetan characteristics, selling premium products.

There is probably an Intercontinental or Hilton in your city, since Intercontinental also owns Holiday Inn and many other brands. Local action for global effect. Intercontinental (IHG) operates 5,900 hotels in roughly 100 countries, is listed on the London Stock Exchange. Its shareholders are acutely aware of reputational risk, which can dampen bookings, and reduce share price and profits. Hilton is second to IHG in size. Both have experienced dramatic drops in bookings in 2020 because of virus fears and travel restrictions; both are vulnerable to reputational loss. IHG has sublet some hotels to governments as virus quarantine isolation locations. Biggest IHG shareholder is Cedar Rock Capital.

Wealthy Chinese are also acutely conscious of corporate reputations, as in this 2018 secretly filmed video which caused a crisis for Hilton and others.

All hotel chains are attuned to reputational risk and publish plenty on their websites about corporate social responsibility, and the need to train local staff to qualify for better jobs.

There are many critics of luxury tourism, its carbon costs, cultural impacts, exploitation of indigenous peoples, who will be interested to hear from Tibetans.

China is regularly criticised for theft of intellectual property. If you look at these hotels you see theft and appropriation of Tibetan intellectual property.

WEAKNESSES

Big corporations can ignore protests, brush them aside, unless the protest gathers momentum, mobilising a lot of voices online. Tibet supporters need to prepare for a long campaign.

As of summer 2020, luxury hotel bookings are from wealthy Han Chinese, not international travellers, so no point in targeting Western tourists. However, that will change once virus panic is past, and the hotel chains seek to recover lost traffic and revenues, and may well offer special deals, possibly marketing Tibet as a pristine, clean destination.

OPPORTUNITIES

This campaign can show that Tibetans are now precarious gig workers in their own land. The campaign can deliver practical solidarity with Tibetan hotel staff, and push for big chains to live up to their published corporate social responsibility promises, which include training minority staff for bigger responsibilities.

Private equity dealmaker Blackstone bought Hilton in 2007 at the height of a boom, then saw it crash when the world economy went into crisis in 2008. So it took Blackstone a decade to make Hilton sufficiently profitable to make it worth selling, initially to a bold Chinese investor, HNA, which took a 25% stake. As of 2018 both HNA and Blackstone had sold their holdings, so Hilton is back on the NY Stock Exchange. Biggest shareholder is T. Rowe Price Associates, holding 12.8%.

The biggest shareholders in both Intercontinental and Hilton are professional wealth managers who invest other people’s money. They are sensitive to risk, any risk that might affect share price, and quick to sell if they see difficulties ahead.

CONSTRAINTS

While the Intercontinental Lhasa Paradise was under construction, Tibet supporters tried to oppose it, making a maximum demand, by letter, that construction stop. The campaigners were not ready for a long-haul campaign with mass mobilisation, IHG ignored the request, the campaign ceased.

*************************************************

FOREIGN INVESTMENT CASE STUDY FOUR: MINING

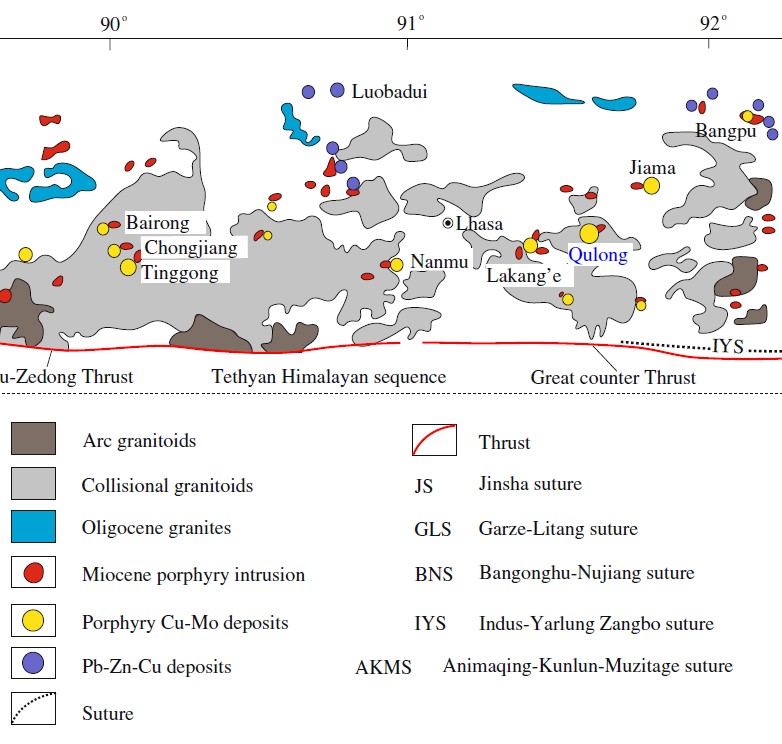

Tibet is rich in minerals China needs, not only lithium, oil and gas from Amdo, but also copper, gold, silver and molybdenum in many deposits mapped by Chinese geologists, in a long line close to the Yarlung Tsangpo, and further east in Kham. Usually these metals occur together, and need to be concentrated and smelted into separate, pure metals on site, at the mine, because of the vast amounts of waste produced, which stays forever at the mine, held from leaking into nearby rivers by tailings dams.

International miners have been involved in mine development stages, to map deposits, plan an extraction and processing strategy. At that point the international partner is usually bought out, and the actual mining is done by Chinese companies. In Tibet that increasingly means just two companies: Zijin and Western Mining.

Digging up the ore, crushing, processing and smelting rock into pure metals all takes a lot of electricity, so high voltage electricity supply is just one of the many subsidies provided by the Chinese government, along with the construction of highways and railroads. This intensifies the pressure to build more hydro dams in central Tibet.

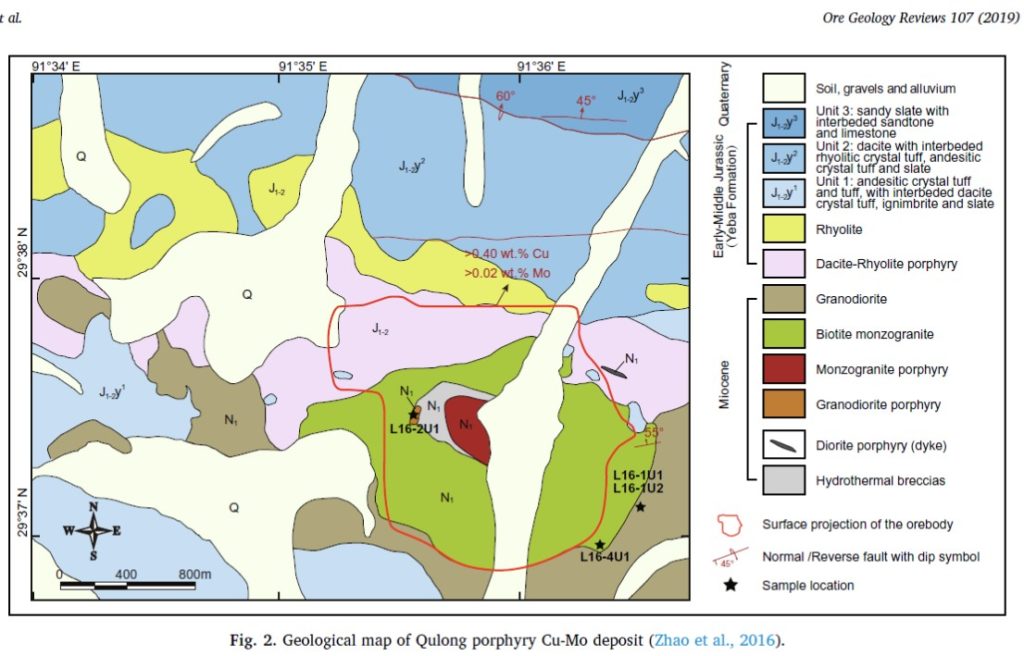

One company now dominates: Zijin, which in June 2020 bought out smaller miners owning the Chulong copper mine in Meldro Gongkar, upriver from Lhasa, already a huge open pit mine, with plans to make it much bigger. This is where Songtsen Gampo was born. Zijin’s three Tibet mines together have 7.9576 million tons of copper metal and 370,600 tons of associated molybdenum. For power, 110 kV high-voltage transmission lines have been connected to the mining area, providing security of electricity supply for mining development. Chulong has a permit to extract 30 million tons of ore per year from 2016 to 2037. After 2037 Zjin will depart, having exhausted the deposit, but the mine wastes -at least 97% of all the rock dug and crushed- must remain forever secure in tailings dams to prevent pollution of the Kyichu, Lhasa’s river. Those wastes have highly toxic metals in them that normally are well underground. Arsenic, lead and mercury naturally occur in the soil at Chulong; it will be hard to prevent them from leaking into the rivers.[10]

This is the first world-scale mine in Tibet, dwarfing Shetongmon, near Shigatse. Over the mine life three BILLION tons of rock will be blown up, hauled out, crushed, cooked to concentrate, then smelted. That is 300,000 tons a day, when the mine reaches full speed towards the end of this decade as planned. Massive. If this mine intensifies extraction as planned, many more mines will follow. This one mine, when in full production, will boost China’s copper output by 15%.

The location of the deposit is high in the mountains above the Kyichu, at 5200 m altitude, so high the soil is frozen permafrost, and the plan is to blast the soil with explosives and then remove it to get at the ore.[11]

Zijin is fast becoming a leader in China’s global reach, and has privileged access to loan capital at cheap rates. Its shares are listed on the Shanghai Stock Exchange. It is also traded on the Berlin Stock Exchange, and Frankfurt Stock Exchange.

SUGGESTED CAMPAIGN GOALS

- Tibet Autonomous Region to show some autonomy by legislating for Zijin to set up a long term mine remediation fund to care for despoiled landscape after Zijin departs. Zijin to pay royalties to local communities in Meldro Gongkar county. In Papua New Guinea a provincial government stood up to Zijin and cancelled its licence.

- Zijin chairman Chen Jinghe to be put on list of individuals banned entry to US.

- Independent environmental impact assessment required. Toxic metal concentrations in Kyichu and Yarlung Tsangpo to be monitored monthly, with public disclosure of results.

- Press US government to restore Dodd-Frank Act monitoring of conflict minerals trade, and broaden definition of conflict minerals to include Tibet, lithium, copper and molybdenum.

STRENGTHS

Zijin mines copper, not only in Tibet but in Congo, Serbia, Guyana, Colombia and Papua New Guinea. These mines are controversial, attracting activist critiques by well-established NGOs opposed to exploitation, pollution, conflict minerals, climate change, corruption and slavery. China also mines copper in Zambia, which is also controversial. Campaign allies are readily available. https://www.sourcingnetwork.org/ https://www.globalwitness.org/en/campaigns/conflict-minerals/ https://sdg.iisd.org/news/global-outlook-highlights-resource-extraction-as-main-cause-of-climate-change-biodiversity-loss/

The many campaigns against conflict minerals have broadened to name climate change as a result of not only fossil fuel extraction but also the world’s insatiable demand for minerals, especially by China. Climate activists will readily come on board.

Suppliers of surveillance cameras in Xinjiang have been named, shamed and sanctioned. Retailers of consumer products made in Xinjiang have been named and shamed in several campaigns. US Congress, under both Republican and Democrat regimes, is increasingly willing to take legislative action.

Where Zijin operates outside China it is under intense scrutiny, with a lot of reporting on its performance. Contrasting Zijin’s global corporate accountability, and unaccountability in Tibet can be easily done.

While there are no international investors with a stake in Zijin, there are plenty of foreign key equipment suppliers, specifically Cummins diesel powering the heavy haul trucks, Thyssenkrupp providing the conveyors taking ore to crushers, and powdered rock from crushers to smelters, Siemens providing power.

Further up the Kyichu valley is the Gyama copper mine, also open pit, which disastrously collapsed, killing 83 immigrant Han mine workers in 2013.

WEAKNESSES

There are no international mining companies invested in Tibet.

Equipment suppliers may duck responsibility, even if their equipment is crucial.

Metso, a mining logistics company from Finland has helped prepare the Chulong mine for this scaling up, but their effort seems to be largely over. However the massive machines that grind rock to powder, essential to extracting the metals, are yet to be installed by Metso.

OPPORTUNITIES

Tibetans in Tibet are disempowered. If they protest, they are criminalised and jailed. This is a solidarity opportunity to stand with local communities of a deeply historic district, to prevent the despoliation of Tibet, theft of patrimony.

Mining is controversial worldwide, many campaigns willing to add Tibet to the list of conflict minerals zones.

Both the US and EU have legislated to keep conflict minerals out of their supply chain and have imposed reporting requirements on manufacturers of consumer products to prove their metals do not come from conflict zones. The US Dodd-Frank Act, EU and OECD rules are a bit narrow, some are focussed only on Africa, others only on specific minerals such as cobalt, which are not mined in Tibet, but a regulatory regime is already in place, due to intensive lobbying by NGOs agonised by Congo. Further lobbying could expand the laws to cover Tibet. A Biden presidency will be an opportunity to reverse Trump’s abandonment of Dodd-Frank conflict minerals governance. A campaign to restore conflict minerals vigilance will unite Tibetans and campaigners focused on Africa.

One major ally could be the campaign group Global Witness, which worked hard to stop trafficking of conflict minerals from Congo, but embarrassed itself by certifying the compliance of Chinese miners. Global Witness works with Chinese mining companies in their operations outside China, while saying nothing about the same companies operations in Tibet.

CONSTRAINTS

Conflict minerals are not as hot a topic as a few years ago. But as post-virus demand picks up and US rejoins the world, concerns about conflict minerals will return.

********************************************

FOREIGN INVESTMENT CASE STUDY FIVE: POWER GRIDS

Hydro dams in Tibet are a concern to environmentalists in China and worldwide. The great rivers of Asia, all originating in Tibet, are well known. The increasing number of hydro dams -some of them with the tallest concrete walls in the world- only work when connected to power grids, transmitting the electricity generated to far distant consumers.

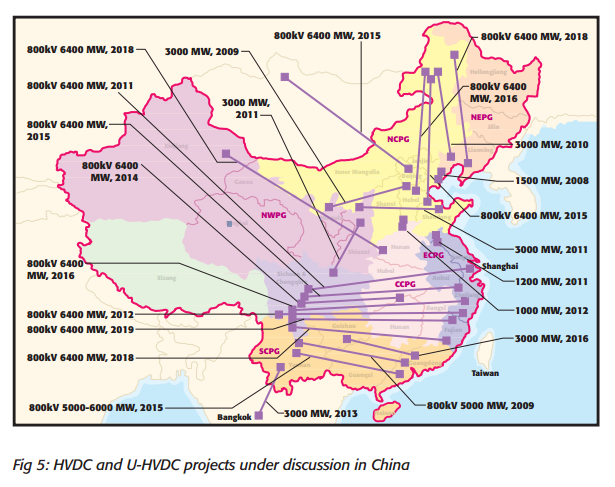

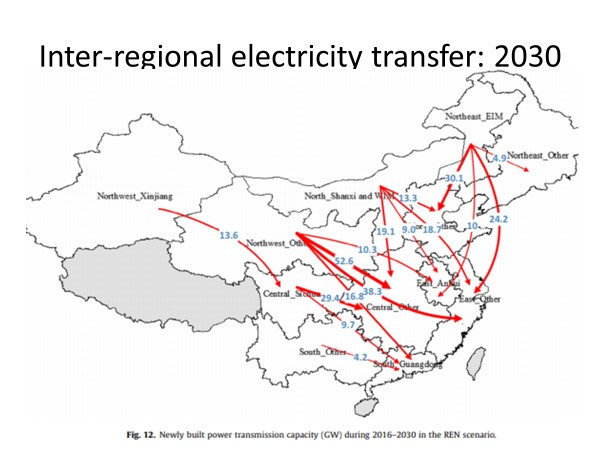

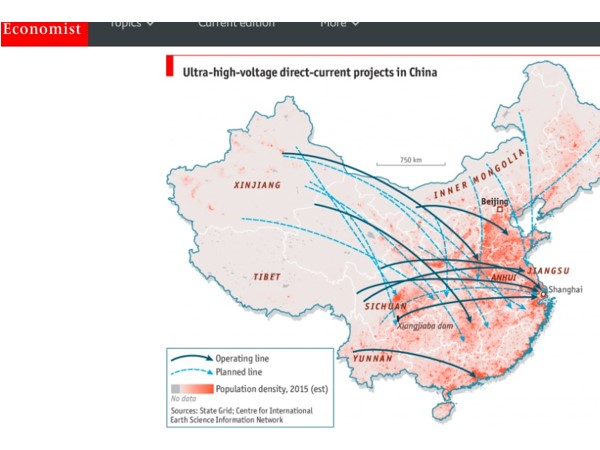

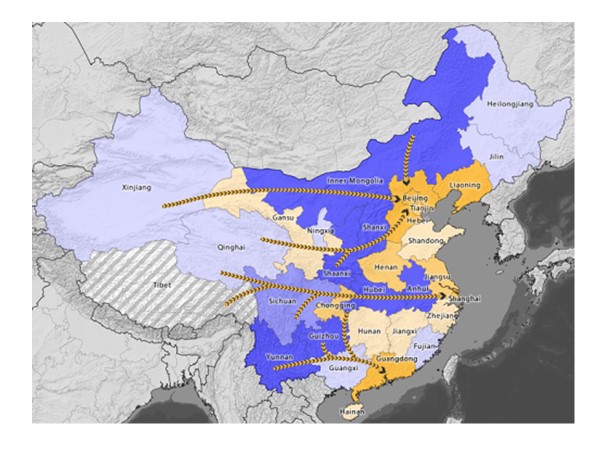

China’s grand plan is for the colonisation of Tibet to at last make profit, by transmitting electricity right across China from west to east, from Tibet to the power-hungry industrial cities of the east coast. China’s longer-term plan is that Tibet will generate so much electricity, not only from hydropower but also wind and solar power, that China will be able to export electricity across Asia, even as far as Europe.

Technically this was not possible, until recently, because the usual alternating current (AC) electricity dissipates into the air as it traverses long distances, a waste of energy. China has now mastered the technologies of direct current (DC) which can be despatched over thousands of miles with little loss, on power lines of alarmingly high voltage, at present 1.1 million volts. That is how China plans to electrify the world, with Global Energy Interconnections, a project technically feasible enough for the European Commission to have already checked, finding it is technically possible to transmit electricity from Tibet to Europe.

This means massive power grids originating in Tibet. China’s program for grid construction consciously announces itself as a strategy for knitting China together as one nation-state, with one identity, one language, and one market. In practice, it means power grids marching across Tibetan landscapes, including national parks and UNESCO World Heritage areas.

Many of the grids are already built, and many of the hydro dams, with many more scheduled for construction. They advertise to the world, especially to developing countries, that China can (and does) build similar infrastructure worldwide.

This plan crucially depends on key technologies supplied by Western countries. At both ends of any ultra-high voltage DC grid there must be massive transformers. At the upload end, they convert AC coming from hydro dam turbines, wind farms and coal fired power stations, to DC. At the download end, close to industrial and urban consumers, these transformers convert DC back to AC, ready to use in factory and home.

These transformers are manufactured by one Swedish/Swiss company, and one German company.

Share in ABB are traded daily on the Swiss Stock Exchange. Siemens shares are traded on many stock exchanges in Europe, US and India.

STRENGTHS

- Opportunity for local campaigns by local groups pressing global infrastructure companies Siemens and ABB to do the right thing and sell no more AC/DC transformers to State Grid.

- This campaign has the lot. It raises the profile of so many issues affecting Tibetans:

- Power grids lock Tibet into China as never before, making Tibet a profit centre for China, a return on investment; gives coastal cities a stake on ongoing exploitation of Tibet

- The construction of high wall hydro dams in remote areas where the population till now is almost wholly Tibetan

- The disempowering of poor Tibetan villages, where ultra-high voltage lines are overhead but inaccessible because DC above isn’t transformed into usable AC below

- Employment on dam and grid construction restricted to immigrant workers fluent in written and spoken Chinese

- No economic benefit to Tibetan communities, no royalties or compensation for land loss, yet electricity by decree sells at low price, so as to subsidise industrial users, while much never gets into the grid at all, and is wasted

- Incentivises further scaling up, with massive wind and solar farms close to power grids and hydro dams, enabling export of electricity across south and central Asia, even to Europe

- Turns Tibet into a showroom for developing country delegations to admire, and do deals with State Grid, one of the world’s biggest companies, to do the same in their country

- Loss of land tenure and Tibetan food security as nomads are removed from pastures above dam and grid locations in the name of watershed protection

- Loss of medicinal herbs essential to sowa rigpa traditional Tibetan healing, as steep Kham valleys are walled in concrete

WEAKNESSES

Both Siemens and ABB are big corporations, with long histories of partnering with Chinese companies. They have experience handling protest, and strong connections to governments in many countries.

Hydro and wind power are promoted as green energy, better than coal. For many folks that is enough: they support hydro and ignore the downsides.

Construction of dams and power grids takes years, a slow process, an effective campaign might need patience and resilience over a long period.

Tibetans in Tibet frequently protest and are ruthlessly crushed; no opportunity to form their own NGO citizen initiatives; journalists seldom have access

Chinese environmentalists organised effective and successful campaigns against hydro dams in Tibetan areas but are now silenced by the current repressiveness.

China learned from the West how to build ultrahigh voltage power grids, made the technology its own, and now dominates power grid construction worldwide. China may also learn how to make the essential AC/DC transformers too.

ABB is an unwieldy corporate conglomerate, criticised by investors for failing to make enough profit, which may sell low profit operations including power grid technologies to its growing partnership with Hitachi.

OPPORTUNITIES

Environmentalists worldwide, climate campaigners, biodiversity campaigners and heritage protectors already know much of this story and will readily sympathise. The task is to mobilise that latent support.

Siemens recently had to defend its investment in tech help for a controversial Adani coal mine in Australia, as a result of social media campaigning. Activists against the coal mine persuaded huge investors such as BlackRock to protest to Siemens. “One thing is clear: the Adani case was a communications disaster,” said Vera Diehl, a portfolio manager at Union, which represents German co-operative banks.”

Disinvestment campaigns work. Investment analysts, wealth management consultants and antitrust regulators accuse Siemens of being too big, a dinosaur conglomerate that needs to break apart. Its division selling equipment for gas and electricity generation is the likeliest to be sold off. This guarantees keen interest in the AC/DC transformers story.

CONSTRAINTS

China’s grand dream of connecting all of Eurasia to electricity from Tibet might seem so improbable, and so distant, that more immediate issues take priority

It’s a complex story, in places a bit technical, not so easy to summarise into a campaign slogan.

[1] The self-report of Qinghai cold-water fish “rising to the plateau”, Qinghai Scitech Weekly 3 June 2020

http://115.236.76.50/qhkjb/html/2020-06/03/content_3_1.htm

[2] Cold-water fish breeding enterprises bred in the upper reaches of the Yellow River, 2020-June -02 Workers Daily http://www.xinhuanet.com/food/2020-06/02/c_1126062840.htm

[3] What kind of fish is freshwater salmon? Field visit to Longyangxia Reservoir in Qinghai Province, July 4, 2018 http://finance.sina.com.cn/roll/2018-07-04/doc-ihevauxi9723662.shtm l

[4] The cool waters of the sky are good for fish farming-the rapid development of Qinghai cold water fish industry creates a brand, Qinghai Ribao, 23 September 2019, http://www.chinafarmernet.com/a/7/52/2019/0923/29449.html

[5] Duojie Zhaxi (Dorje Tashi), Tibetan Farmers in Transition: Urbanization, Development, and Labour Migration in Amdo, PhD thesis University of Colorado 2020, 159

[6] ‘‘Tibetan Villagers Evicted to Make Room for New Airport,’’ Radio Free Asia, May 16, 2019.

[7] Kolas, Ashild, and Monika P. Thowsen. On the Margins of Tibet: Cultural Survival on the Sino-Tibetan Frontier, University of Washington Press, 2011, 206

[8] Qinghai Statistical Yearbook 2018, table 11-9, Per capita consumption expenditure of rural households by region

[9] Uranium Geology Journal vol 30, 4, July 2014 铀 矿 地 质

[10] Shaoping Yang, Study on surficial soil geochemistry in the high-elevation and -frigid mountainous region: A case of Qulong porphyry copper deposit in Tibet, Journal of Geochemical Exploration 139 (2014) 144–151

[11] Zhai Xiangchao; Tao Tisheng; Li Honghao; Gong Shanlin. Research on Blasting and Stripping Technology of Frozen Soil Layer in Qulong Copper Polymetallic Mine Project, Sichuan Water Power, 2019, 4: 13-15