TROUBLED TIBET: THE PREFECTURES OF KANDZE AND NGAWA

For the densely populated inland province of Sichuan, its mountainous Tibetan rump has always been an anomaly. Sichuan is a largely lowland province, stiflingly hot and humid in summer, made more fiery by a passion for the hottest of chilies in most dishes. The alpine meadows of the Tibetan uplands seem a world away, altogether another country with only tenuous connections to the basin.

On a map the Tibetan portion of Sichuan –the two prefectures of Kham Kandze and Amdo Ngawa- are huge, no less than 42 per cent of the area of Sichuan, yet less than two per cent of the provincial population. The winding roads up to the plateau have been the only connection, but they too are regularly blocked by landslides and earthquakes, and by blizzards. Economically, the mountains and high plateaus beyond have barely been connected to the lowlands, except for foothill towns such as Wenchuan, where 70,000 people died suddenly in an earthquake in 2008. Even though there is demand in Sichuanese cities such as Chengdu, and in nearby boom city Chongqing, for Tibetan products such as yoghurt, milk and cheese, Sichuanese prefer to import from afar, even from New Zealand.

The lack of economic integration also means little political integration. There are enclaves in Kandze and Ngawa of intensive mining, and tourism, but the disconnect is palpable. For central leaders in Beijing, and provincial leaders in Chengdu, the absence of economic or political integration has become more and more problematic, as Khampa Kandze has, in the most unambiguous way, asserted its unhappiness at being incorporated into Sichuan and China, by public protest suicides, which strengthen the resolve of the Tibetans to remain Tibetan, and not assimilate.

The response of provincial leaders to the willingness of Tibetans to burn the flesh, to die fearlessly as a protest against Sinicisation, has been ever tighter security controls. In the towns of Kandze, and at Tibetan festive gatherings, security personnel patrol, armed not only with combat gear, but also fire extinguishers in hand, and full body reflective fireproof clothing to attempt to douse any flaming Tibetan, immediately. While the frequency of burning the body has diminished, the sense, shared both by Tibetans and immigrant Han, that Kandze is a foreign country, not in any substantial way integrally Chinese, has not diminished.

Now China has a new strategy for Kandze prefecture, in line with China’s frequently repeated policy that security crackdowns are the short term answer to Tibetan problems, and that the long term answer is development. In the 13th Five-Year Plan period to 2020, Kandze is to be developed at extraordinary speed and vast expense, to extract water from its great rivers for diversion to water-short industries far downriver, for hydro dams and power grids, for a new railway directly connecting Chengdu to Lhasa, and new lithium mines to meet imminent demand for electric car batteries.

When China announces it will spend $30 billion over five years in a single rugged, remote, mountainous prefecture, something odd is under way. The Tibetan Prefecture of Kandze (Ganzi or Garze in Chinese) has such precipitous terrain it fits China’s perception of a waste land, fit for no modern purpose. If a small (by Chinese standards) human population makes their living growing crops on valley floors and pastoral livestock production on the uplands, that’s of little interest to lowland China, bent on realising “the China Dream”. A handful of Tibetans eking their subsistence, stubbornly staying in their valleys and high plateaus, seems to most Chinese incomprehensible, when urban comfort is now an alternative. One in nine of all Tibetans lives in Ganzi Tibetan Autonomous Prefecture, to use its official designation, an area roughly the size of New York State, but that’s still only 703,000 Tibetans (2000 Census data). In 2000 there were also 164,000 Han Chinese and a total prefectural population of 897,000.

To the north of Kandze, Amdo Ngawa (Aba in Chinese) has a similar total population -847,000 in 2000- with a greater cultural mix -455,000 Tibetans, 155,000 of the Qiang ethnicity, and 209,000 Han Chinese. About 22 per cent of all Tibetans on earth live in just these two fertile, well-watered prefectures.

But neither produces much that China needs, and have long been seen by booming Sichuan province as its remote and useless westernmost portion, a mountainous waste land.

So why, as part of the 13th Five-Year Plan for 2016 to 2020, has China announced a capital expenditure of $30 bn, or $25,000 per person if one includes not only the Tibetans but Han and other immigrants.[1] Not only does China focus our attention on that investment of $25,000 per head, but proudly announces this is ten times the revenues raised by the prefectural government. It is not uncommon for poor regions to receive subsidies to lessen inequality, alleviate poverty, create a modern economy, give remote areas access to wealthy markets. In Tibet Autonomous Region, to the west of Kandze, subsidies sent from Beijing have crept up over the years, to the point where subsidies are actually more than 100 percent of regional revenue raising.[2] The result is, as Chinese economists admit, a region utterly dependent on subsidies, with little economic take-off and a huge tertiary sector of Han immigrants securitising and administering an unhappy province, to which the sojourning immigrants come because Beijing pays such high wages, which can be saved and remitted to the folks back home in a lowland area. As the subsidies grow, the law of diminishing returns sets in, and Beijing gets little result other than deepening dependence. Yet the subsidies keep rising, the record being 107% of the province’s own revenue raising.

All that seems tame by the new standard set by the 13th Five-Year Plan for Kandze, which proudly announces not a 100% subsidy but 1000%, ten times what local authorities can raise through taxation. Far from being embarrassed at this artificial stimulus, it features proudly in China’s official story, and in how China wants journalists to report it.

So how will China manage to spend such sums? Media reporting dwells on schools, hospitals, technical colleges, tourism, even a winery. But they cannot absorb more than a small fraction of such a spend. If that $25000 over five years, or $5000 a year, were to simply be given to the local population, for them to decide what to invest in, it could work wonders, as the official data on income in minority areas of Sichuan lists RMB 24,400 as an average, and, in Kandze, it is only RMB 17,800 per person.[3] That’s US $2710. So an extra $2500 almost doubles incomes.

That’s not going to happen. China has invested very little in the Tibetan economy of livestock production and cropping, and isn’t about to start now, even though the dairy products the nomads make in abundance are in great demand in urban China, especially among the hip and health-conscious.

Overwhelmingly, this capital expenditure is for nation-state building projects that assert China’s sovereignty over its remotest landscapes and peoples. By far the biggest ticket items are railways, highways, hydro dams, power grids for long distance transmission of electricity right across China, mines and huge reservoirs to capture the rivers of Tibet, not only for hydropower but to pump it into the exhausted Yellow River, diverting several watersheds northwards.

China presents this as development, for the benefit of the Tibetans of Kandze. If, as planned, China will spend as much as $45 million per mile of road, necessary because of all the tunnels and bridges needed, no doubt many Tibetans will appreciate the opportunity to visit the thick, heavy, humid air of the Sichuan basin lowlands, a road trip cut to three hours from the present 20.

The planned expressway down also goes up, bringing the Han Chinese construction crews, the engineers and an entire economy of extraction. Water and electricity are the prime extractables. The locations best suited for cascades of dozens of hydro dams and the big reservoirs above them have long been mapped.[4] China has long expected Tibet to pay a dividend. Now, in this eastern edge of the Tibetan Plateau, immediately above inland China, that dividend is to manifest. The expenditure and the profits are in the hands of the biggest of state-owned enterprises (SOEs), pioneers in establishing China’s global presence. The grid corporation is 7th biggest company in the world, bigger than Volkswagen or Toyota. This is nation-building on a huge scale, financed by official finance at concessional rates available only to the biggest SOEs, in the expectation of profit.

China always needs more electricity, despite the enormous number of coal-fired power stations. North China also needs more water. That alone does not make an economic case for these dams, in the remotest locations, as profitable enterprises, especially since water and power are not only monopolised by SOEs, but pricing is directly in the hands of the party-state.

The torrent of capital expenditure scheduled for Kandze has been a possibility for a long time, but only now put into operation. We do need to ask if these projects are justifiable economically, or whether other agendas are driving this extraordinary program.

At first glance, it seems obvious that China’s biggest manufacturing centres such as Guangzhou and Shanghai need more electricity, while northern China, including Beijing, is desperately short of water. Yet, when one looks more closely, the picture shifts. The world’s factory is no longer on the Chinese coast; it is rapidly shifting inland, much closer to Tibet. The last time there was a major shortfall of electricity production was back in 2004. China’s economy is slowing, becoming more energy efficient (with German help), and shifting from heavy manufacturing to a consumer-driven economy of services, from entertainment to banking, which don’t need electricity the way smelters do. Recent research suggests the hydropower of Tibet may not be needed 2000 kms to the east, in Shanghai.[5]

WATER POWER

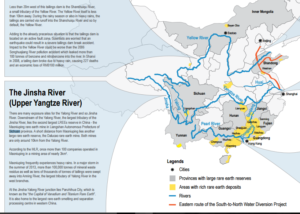

Kandze and Ngawa are central to China’s 13th Five-Year Plan to make eastern Tibet, adjacent to lowland China, China’s water tower and extraction zone for massive amounts of hydropower, to be sent, with help from Siemens, all the way across China to Shanghai and Guangzhou, the coastal cities at the heart of the world’s factory.

The scale of extraction of hydropower is staggering, especially in the remote valleys, where there has been little Chinese presence, and a traditional mode of production has remained viable. The steep terrain of these high valleys and rolling pasturelands perched above China’s lowlands remain deeply meaningful to the Khampas, as recent anthropological fieldwork has found: “pastures have specific histories and meanings that allow nomads to interact as part of a particular community and to belong to particular places; stones have gender and influence the imaginary of nomads with respect to male-female relations, place and oral history; rivers and lakes are residences of water spirits and nomads understand elements of the weather in terms of the emotional state of these spirits; some mountains are residences of territorial spirits that protect local areas, and other mountains are themselves deities that are part of a kinship system that extends across the Tibetan plateau. Nomads also attribute emotions to the nonhuman guardians of waterways and mountains, such as anger and pacification of Lu, guardian water beings, and ritual offerings to territorial deities that reside in mountains. Some mountains are deities themselves and they have kinship networks that extend across the plateau, linking places of great distances through a shared imaginary.”[6]

These remote pastoral production landscapes will be encroached by the construction crews building not only the many hydro dams but also, above each cascade of dams, a huge reservoir to hold back the seasonal flow of the wild mountain rivers, to make the electricity generating turbines turn year-round. In order to achieve this, several of the dams will be the tallest in the world, with dam walls as much as 318 meters high.

Until now, China has emphasised that the dams it has built in Tibet are run-of-the-river, a term suggesting water is impounded only as long as needed to turn the turbines, with the water then immediately released back into the rivers. Now, the plan is to deliberately disrupt the natural environmental flows of the rivers of Ngawa and Kandze prefectures, as much as possible, as the rainfall is overwhelmingly in the months of the Indian and East Asian monsoons reaching far inland, from June to October, and China wants to extract electricity year-round. This is why China has announced its’ intention, in the current Five-Year Plan, to build “big reservoirs” in Tibet.[7] The purpose of capturing water on such a scale is to disrupt natural flow to the maximum extent technically feasible.

Since electricity cannot be stored, it must be consumed and produced at almost the same moment, even if production and consumption are 2000 kms apart, connected by intrusive power cables, each carrying as much as one million volts. This means the natural river flow will be disrupted not only seasonally but daily as well, with maximum water release timed to coincide with maximum urban demand peak hours each day. The inevitable result is a river that rises and falls sharply and unpredictably, a danger to all life downstream, human or animal.

The announcement of “big reservoirs” may also signal the go-ahead for the long-planned diversion of water -20 billion cubic metres a year- from the Tibetan tributaries of the upper Yangtze, across to the Yellow River. This too is a massive project, requiring not only very high dams and canals but also long tunnels through seismically active mountains prone to earthquakes.

Why does China need the water? Is it for irrigation, or thirsty cities? According to Chinese scientists who argue for this project to go ahead, the main customer will be the coal industry, which urgently need clean water they can dirty by using water liberally in all stages of production, from dust suppression in mines, spontaneous combustion prevention in open air heaped coal, in coal-fired power plant cooling towers, and in the latest industry favoured by central leaders, the conversion of coal to oil and to chemicals. Maybe, if China gets serious about reducing coal use and greenhouse gas emissions, it could decide it no longer needs the electricity and the water taken from Tibet.

LITHIUM: THE HOT METAL

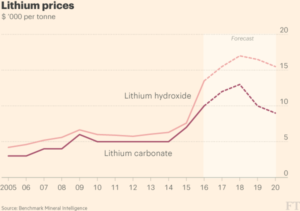

A major driver of investment in Kandze and Ngawa is the fast rising price of lithium.

The major lithium deposits of Nyagchu, or Yajiang as it is known in Chinese, half way between Litang and Dartsedo (Kangding in Chinese) on the 318 Highway from Chengdu to Lhasa. These deposits were discovered in 1960 by geological prospecting teams, and even during the Cultural Revolution, were extensively investigated to prove their viability for mining.[8] From a geologist’s viewpoint, the rock lithium deposit was a great find, but demand was limited, distances great, and the salt lakes of the Tsaidam Basin in arid western Amdo hold more accessible sources of lithium.

The major lithium deposits of Nyagchu, or Yajiang as it is known in Chinese, half way between Litang and Dartsedo (Kangding in Chinese) on the 318 Highway from Chengdu to Lhasa. These deposits were discovered in 1960 by geological prospecting teams, and even during the Cultural Revolution, were extensively investigated to prove their viability for mining.[8] From a geologist’s viewpoint, the rock lithium deposit was a great find, but demand was limited, distances great, and the salt lakes of the Tsaidam Basin in arid western Amdo hold more accessible sources of lithium.

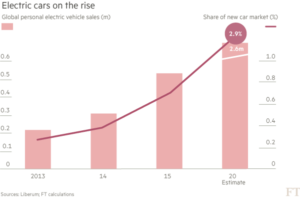

In the 1960s, even in the early years of this century nobody foresaw the lithium boom, the prospect that lithium could actually replace coal and oil as primary sources of energy to drive modernity. When that promise of a tech revolution did emerge, it was, as usual, oversold as a tech utopia in which the world would painlessly transition from fossil fuels to a low energy future, save the climate, and all would be well. The future, we were told, would be electric cars, but in reality, on the streets, very few wanted to pay a premium price for a silent electric car that also needed a petrol engine as well, or needed a lengthy recharge after travelling as little as 50 kms. Electric car sales never took off.

The dream of a tech solution never went away. Different business models were tried, including getting people used to frequent recharges by having recharge stations all over our cities or, better still, fast swapping of depleted batteries by recharged ones, to get us back on the road fast. None is this appealed much.

Now, after so many false starts, the electric car age is about to dawn. The reason we can be so definite has nothing to do with unpredictable consumer demand (or indifference), and everything to do with statist intervention that decrees demand and underwrites the costs of ensuring the new technology succeeds. The state manipulating the market, engineering demand is of course China, which sees not only a lithium battery technology it can dominate globally, but also the applause of the world for reducing auto emissions, especially from Germany after the German auto industry bet everything on diesel rather than electric, as the low-carbon future.

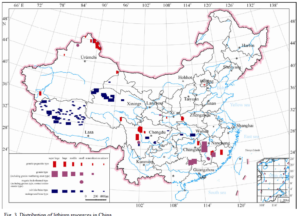

China is doing all it can to ensure that electric cars become popular, which means lithium demand will soar. The early investors in lithium, such as Warren Buffett, will make spectacular profits. And the lithium deposits of Tibet will be in demand as never before. Nearly all of China’s lithium comes from Tibet, from two widely differing areas, hosting quite different resources: the dry salt lake beds of the Tsaidam basin in Amdo, and the spodumene pegmatite rock deposits of Kandze. Which of these will soon be extracted more int ensively, to drive the electric car boom, is a technical question we will return to.

ensively, to drive the electric car boom, is a technical question we will return to.

China’s party-state believes in not only picking winners, but in making winners, selecting both the technologies and the corporations that will dominate the post-oil age world. China’s strategy is to build up national champions, usually state-owned corporate giants made all the bigger through acquiring their rivals, by the command of a party-state that retains more than a passing resemblance to what, in East Germany, has been understood as the cause of its failure. China is serious about staying ahead, dominating key industries globally, as it transitions to a consumer-driven economy with wages that are no longer the lowest in the world. Instead of relying on cheap labour to remain the world’s factory, China now aims to be the technology leader in key industries, which happen to compete strongly with Germany. These include photovoltaic solar power, wind power and electric cars powered by lithium batteries.

China’s strategy is to have access to raw materials, the technologies and the corporations with global reach, mass manufacturing capabilities and mass market consumer pricing, all in place ahead of anyone else. This is a strategy of global proportions, embracing a global supply chain for raw materials, and global reach for selling consumer products worldwide. Very few corporations could achieve that alone. It takes the full commitment of the party-state to orchestrate this risky bet on how the world will be, and maximise the chances of success. The vehicle for co-ordinating this master strategy is the Five-Year Plan, which also is the prioritised list of massive state investments in Kandze and Ngawa, to extract water, build hydro dams and export electricity across China from Tibet to the coast.

The Five-Year Plan can be read as just a wish list, and for many who still like to believe that a richer China inevitably means a private enterprise China that may yet become democratic; the targets of the latest Five-Year Plan are read as an anachronistic echo of the bad old days of command and control. But the Five-Year Plan commands enormous resources, is a directive to the big banks (all state-owned) as to who gets priority in loans and access to capital. The power of the state to allocate to its favourites remains strong, and there is no sign of the state withering away, except when it comes to adequate spending on education and health care.

China is not the first to try, as the Financial Times reported: “the Obama administration pumped billions of dollars of stimulus money into trying to create an advanced battery industry in the US. The resulting companies were more like chemistry experiments. They might have come up with demonstrations in the lab but could not scale up in production. That has left slower- advancing lithium-ion as the default technology, particularly where lightweight batteries are needed in things like consumer electronics and transport.”[9]

But China has a coordinated strategy that only the world’s leading developmentalist state, with all its allocative powers intact, could hope to implement. In 2014 China’s State Council announced “extended subsidies for drivers who purchase electric vehicles, set a 30 per cent electric vehicle quota for government car fleets and ordered an end to discrimination by regional governments, many of which have extended policy support only to alternative energy vehicles produced by local companies.”

”China will extend subsidies for new energy “green” vehicles to 2020, according to draft rules published on Tuesday, extending the current incentive scheme which expires at the end of 2015. The policy represents China’s latest effort to fight severe pollution and snarling traffic and is a boon to firms such as Warren Buffett-backed BYD Co Ltd, the country’s biggest maker of electric vehicles. Subsidies will be granted to buyers of pure electric, highly electrified plug-in hybrid and fuel-cell vehicles, with the amount of subsidies gradually scaled down during the period from 2016 to 2020, according to the draft rules posted on the Ministry of Finance’s website. Buyers of pure-electric cars will initially be able to receive subsidies of up to 55,000 yuan ($8,834) under the draft rules, while buyers of pure-electric busses will be eligible for up to 500,000 yuan.”

“Premier Li Keqiang vowed to “step up support” for the electric vehicle industry at a meeting of the State Council on Wednesday by shifting funds from supporting EV production to rewarding companies that produce new technologies and hit sales targets, according to the government website. China is keen to create home-grown champions that can compete in this crucial area. Currently most major EV producers in China are joint ventures with foreign carmakers.

Mr Li’s statements also included a push to use public transport and institutions as a conduit for boosting EV sales, with the mandated percentage of new energy vehicles purchased by public institutions rising to 50 per cent from a previous 30 per cent. The prospect of updated public transport fleets being encouraged to use only electric vehicles also raises the possibility of an uneven playing field developing, with local manufacturers given priority in bidding for deals.” 25 Feb 2016

The amount of lithium in the salt lakes of Amdo Qinghai is enormous, officially 16.1 bn tonnes of lithium chloride, or lithium salt. The problem of its extraction is that almost always the lithium salts are mixed with ordinary salt, magnesium and potassium salts, and separating them to the high level of purity required by battery manufacturers is very difficult. Even though there are, officially, 850 people employed in extracting salt bed lithium in Qinghai, resulting in 2013 in 5.7m tonnes extracted, the sales value was only RMB 195 per tonne, with the enterprises doing the extraction recording a loss of RMB 147 m in 2013.[10]

Chengdu-based, Tianqi Lithium http://www.tianqigroup.cn/cn/ 天齐, its shares listed on Shenzhen Stock Exchange, boasts it is the world’s biggest producer of lithium from spodumene rock deposits, and that its main resources are a spodumene  mine in West Australia and a deposit in Ganzi (Kandze) in Tibet, featured on its Chinese language version website, naming it as the Cuola Lithium deposit, 100 per cent owned by Tianqi, containing 300,000 tonnes of lithium dioxide, with an expected mine life of 40 years. It has a production base at Ya’an, a Sichuan city right at the foot of the Tibetan Plateau, directly on the route of the Chengdu to Lhasa rail route planned for the 13th Five-Year Plan construction.

mine in West Australia and a deposit in Ganzi (Kandze) in Tibet, featured on its Chinese language version website, naming it as the Cuola Lithium deposit, 100 per cent owned by Tianqi, containing 300,000 tonnes of lithium dioxide, with an expected mine life of 40 years. It has a production base at Ya’an, a Sichuan city right at the foot of the Tibetan Plateau, directly on the route of the Chengdu to Lhasa rail route planned for the 13th Five-Year Plan construction.

Tianqi, despite its claims, is not a big company, and most of the lithium it extracts comes from its mine in Australia. Tianqi’s website has pictures of its portion of the Tibetan rock lithium deposit, but it shows only snowy hills with little sign of mining activity. This is what is about to change, as electric car production at last grows fast, as it has promised for more than a decade. As electric car production scales up, there is even a race between the two Tibetan sources of lithium –the salt lake beds of Qinghai Tsaidam versus the rock lithium of Sichuan Kandze. From a Chinese perspective, this is inter-provincial competition, with each province championing its local heroes. For Qinghai, the challenge is to get its lithium salts sufficiently pure to be usable in batteries.

If the supply of battery-grade lithium does scale up to meet demand, the race is on to see which company makes the lithium powered cars and buses that will win. Globally, the headlines focus on Tesla, which is investing heavily in mass manufacturing in the US. Its main rival, backed by China Warren Buffett and Bill Gates, is BYD, a battery maker that realised it could make its fortune if it made cars as well. BYD is in partnership with Daimler, to speed its transition to becoming a carmaker. The BYD-Daimler partnership launched its first vehicle in 2014, an awkward hybrid that still needed a petrol engine as well as battery powered electricity.[11] Now known as the Denza, a name coincidentally akin to how Chinese pronounce Benz, it has enticing advertising and sells well.[12] Since Daimler also plans to have lithium battery powered versions of its own Grade S, E and C Mercedes-Benz available, this raises questions as to whether the batteries will be made in Germany, USA or China.[13]

BYD, with its backing from China’s central leaders, aims to not only enter the auto manufacturing market but to change it dramatically, ending the dominance of engine manufacturers for a new age in which high tech companies will dominate. While the high priced BYD Denza is not BYD’s most popular model, BYD is surging ahead, as the Financial Times[14] puts it: “BYD is the world’s largest producer of hybrid and battery powered vehicles by volume. Its sales of “new energy vehicles” tripled in 2015, beating even Tesla in terms of units sold. Sales of its NEVs have continued to soar in 2016, with BYD’s Tang sport utility vehicle, launched last year, China’s most popular NEV by new sales to June.”

The BYD-Daimler enterprise is matched at government level by a project created by Germany’s Federal Ministry for Economic Affairs and Energy (BMWi) and carried out by China’s Ministry of Industry and Information Technology of the People’s Republic of China (MIIT), with help from GiZ.[15]

BYD, having boosted its stock price by boasting of its exclusive rights to Drangyer tsaka salt lake (Zhabuye in Chinese) in far western Tibet, has now moved to boost its lithium supply by turning to the abundant lithium of the Qinghai Tsaidam basin salt lakes. BYD is taking a gamble that lithium from the salt lakes can be purified sufficiently to fully eliminate the other salts sodium, magnesium and potassium- that are mingled, in the lake bed deposits. “BYD is looking to get ahead of rivals in battery technologies and production, inking a deal in June to start mining lithium carbonate, used to make lithium batteries, in the western China province of Qinghai.”[16]

Qinghai competes with Sichuan to supply the lithium market, even if both sources are actually Tibetan. Qinghai’s advantage is not only a much bigger quantity of lithium, but also a substantial industrial infrastructure capable of producing a wide range of lithium products. Qinghai also boasts official German technical assistance.

Qinghai competes with Sichuan to supply the lithium market, even if both sources are actually Tibetan. Qinghai’s advantage is not only a much bigger quantity of lithium, but also a substantial industrial infrastructure capable of producing a wide range of lithium products. Qinghai also boasts official German technical assistance.

Official Tibetan media report: “On 20th June 2016, Qinghai Provincial government organized International Forum on Lithium Industry and New Ecology” in Xining City. Hao Peng, the governor of Qinghai Province[17] chaired the forum and hundreds of people also participated. Hao Peng said “Qinghai Province has tremendous and abundant solar energy, wind energy and Lithium resources which accounted for more than 80% of Lithium reserves in the country and 1/3 of the world reserves. Qinghai Province is hosting sure treasure mineral resources geographically as well as very unique climate which is providing such natural facilitation to the development of the lithium industry. In recent years, we rely on our unique resources advantage, efforts to enhance the level of lithium from salt water, vigorously cultivate leading enterprises to accelerate the development. The initial formation of the Lithium from salty lake, Lithium carbonates, positive and negative electrode material, Lithium battery manufacturing and other integration of the industrial chain upstream and downstream. Lithium industry to accelerate the development of cluster, scale development; it is becoming a new economic growth point”. The forum was attended by Sandra Retzer[18], Director of GiZ Gesellschaft für Internationale Zusammenarbeit Transport and Energy Department, and also other Experts and Entrepreneurs. ”[19]

Germany defines its purpose as “improving the security of energy supply in both countries and helping to mitigate the effects of climate change internationally. German enterprises can access the Chinese market more easily.”[20]

Lithium, the lightest of all metals, is plentiful. Its extraction has been limited by limited demand until now. Now demand is rising fast. Investment advisers are forecasting there are fortunes to be made by the wealthy putting their money into lithium extraction. The rock lithium of Kham may soon be mined.

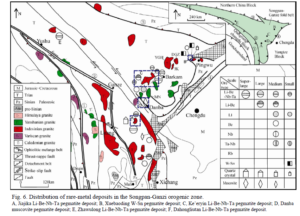

In the 1980s, while Tenzin Delek Rinpoche made skilful use of a liberal period in China’s governance of Tibet to spend six years at Drepung monastery in south India, Chinese geologists were busy in Tenzin Delek Rinpoche’s home area of Nyagchu, assessing a major find of lithium and rare earths, which China knows as the Jiajika deposit.

By 1990 the Jiajika lithium, niobium, tantalum and beryllium deposit was listed as China’s largest “super deposit”[1] but mining did not begin. This was for three reasons. First, new technologies made it easier to extract lithium from Tibetan salt lakes, even though the lithium salts were mixed with magnesium salts and toxic solvents were needed to separate them. Scooping brine from salt lake beds is much easier than drilling and blasting the hard rock of Nyagchu, or Yajiang as it is known in Chinese, half way between Litang and Dartsedo (Kangding in Chinese) on the 318 Highway from Chengdu to Lhasa. Second, demand for lithium was modest, prior to the lithium-ion battery that powers our tablets and smartphones. Third, China, the world’s factory, was concentrated on the east coast, conveniently able to import lithium from the salt lakes of the Atacama Desert of Chile and Bolivia. Today, these three constraints are fast disappearing.

In the 1990s, Tenzin Delek Rinpoche “undertakes projects in the Nyagchu area, renovating and reconstructing monasteries, setting up a boarding school for orphans and nomads’ children, establishing a home for the elderly poor, and promoting forest conservation.”[2]

What were the forests Tenzin Delek Rinpoche was trying to protect? Nyagchu is named for its river, a long and wild mountain river, known to China as the Yalong, carving its way through precipitous Kham, eventually joining the Yangtze. The 1990s was the final decade of indiscriminate logging of the great forests of Kham, made easier on steep roadless slopes by simply chain sawing the trees to fall into the river, for later retrieval in downriver Sichuan. It was also in these forests that the geologists clambered to locate the outcrops of lithium and rare earths. Yajiang Jiajika may be classified as a superdeposit, but the richest ores are scattered. As the geologists of the Key Laboratory of Metallogeny and Mineral Resource Assessment, Institute of Mineral Resources, of the Chinese Academy of Geological Sciences in Beijing point out: “In the Jiajika pegmatite field, pegmatite dikes surround the granite body in both horizontal and vertical directions. The total area of the metamorphic zones is about 500 km2. In the Jiajika deposit, a total of 498 pegmatite dikes with a size of more than 20 m2 are distributed in an area of about 80 km2. The deposits are shallowly-buried, can be easily mined, and have a low detached ratio, resulting in low extraction costs.”[3]

It is the scatter of lithium ore outcrops over hundreds of square kilometres that made the encroaching geologists so visible, and upset the Tibetans of Nyagchu, who turned to their Rinpoche for protection. Even after Tenzin Delek Rinpoche was accused of terrorist bombing and gaoled, only to die in prison in 2015, the people of Nyagchu continued to fear intensive mining.

RARE EARTHS AND COBALT

Lithium is not the only metal essential to China realising its official dream of becoming the globally dominant player in the manufacture and sale of lithium batteries, electric cars and other hi-tech products. High technology makes much use of elements whose use has been only recently defined.

Rare earths, a collective term for a range of elements needed, usually in small amounts, in advanced technology are mined almost entirely in China, not because rare earths are not found elsewhere, but because the huge deposit in Inner Mongolia, plus China’s low labour costs and inattention to environmental regulatory compliance add up to a cost of production no competitor can match.

If electric cars and other hi-tech take off as predicted, China will need other sources of rare earths. The other big deposits are at the extreme edge of the Tibetan Plateau, in areas populated by the Yi ethnic minority, and Tibetans, as well as Han immigrants.[21] These deposits, already mined on a modest scale, may now scale up. The closest to Tibet is the Muluozhai ore district, which contains as much as 450,000 tons of rare earths, but which will require removal and crushing of 12 million tons of rock in order to extract the rare earths.[22] This area is immediately adjacent to Gyezil Tibetan Autonomous County of Kham, very close to the Yalong River, a major Tibetan tributary of the Yangtze.

CONFLICT MINERALS AND YOUR SMARTPHONE

Cobalt is another metal much needed if China is to fulfil the goals it has set, but China lacks cobalt deposits. Most of global supply comes from the Congo, at enormous human cost, as militias and warlords battle for supremacy in a conflict zone where millions of people have died in recent years. In May 2016, according to the Financial Times: “As China Molybdenum announced it was buying one of Africa’s largest copper mines earlier this month one thing was soon clear: the acquisition was about far more than the red metal. The $2.65bn deal, the biggest private investment in the Democratic Republic of Congo’s history, is instead designed to secure China’s supplies of cobalt, a once niche raw material that is crucial to developing batteries for electric cars. The purchase of the Tenke mine, which contains one of the world’s largest known deposits of copper and cobalt, shows how Chinese companies are now moving to take a dominant position in battery materials as the country prepares to shift its economy from heavily polluting industries. Companies that make batteries for carmakers, from Tesla Motors to General Motors, will be increasingly reliant on Chinese-controlled supply chains as they scale up production of the electric cars western policymakers hope will help cut emissions and reliance on imported oil. ‘The majority of the cobalt is heading straight to China,’ said Edward Spencer, an analyst at metals consultancy CRU. ‘Their global hold is huge.’ If the Tenke mine deal goes through, Chinese companies will be responsible for around 62 per cent of global refined cobalt production next year, according to CRU estimates. Demand for the material is expected to soar by more than two-thirds over the next decade.”[23]

China’s mining companies are well aware that the Congo has been such a deadly conflict zone for so long that in Europe many campaigners and consumers are determined to keep these metals, obtained at such cost in human lives, out of the supply chains that produce the handyphone in your pocket. China’s miners have acted collectively and proactively to show they do not source minerals form conflict zones, by announcing they will comply with regulatory standards and codes of conduct intended to keep “blood metals” out of products sold in Europe.

Yet the very same mining companies, many state owned, that now pledge in their Memorandum of Understanding with the European Union to abstain from using conflict minerals sourced from Congo, face no such restraint, or even due diligence monitoring requirements, when it comes to their extraction of lithium, water, electricity and perhaps rare earths from Tibet. Since it is the same Chinese companies, which choose to mine in Congo or Tibet, how it is possible their Congo operations are scrutinised, reported and certified, with no scrutiny of their operations in Tibet?

The strategy is simple. Europe’s rapidly emerging regulatory regime is based on the OECD Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas; and it is with the OECD that China’s miners have signed a Memorandum pledging co-operation.[24] However, the Chinese partner is Chinese miners solely in their role as importers and exporters, into and out of China, not their roles as domestic miners. The Partnering organisation is the state-led China Chamber of Commerce for Mining, Minerals and Metals Importers and Exporters (CCCMC). Through this manoeuvre, Chinese companies exploiting Tibet escape scrutiny. At the end of 2015 CCCMC launched its own guidelines.[25]

However, the EU regulatory regime, still not quite finalised after years of debate, does not restrict itself geographically, and applies worldwide.[26] Tibetans and their supporters could apply for the inclusion of Tibet as a conflict zone, meriting the same level of scrutiny, reporting and compliance as central Africa. At present the EU regulations cover only a limited range of metals, including gold, a major component of all the big new mines in Tibet, but not yet lithium.

AS TIBET GOES…………..

The impending lithium extraction boom in Tibet will be not only in Kandze, as Tulku Tenzin Delek predicted, but also in Amdo Tsaidam’s salt lakes, as demand soars. China’s investment boom is not only overwhelming Kandze but also central Tibet, or Tibet Autonomous Region (TAR). China continues to pump money into its’ TAR projects: railways, urban enclaves, mines, hydro dams, ultra-high voltage power lines etc.

As in Kandze, at first glance this can look like development, yet there has been no economic take-off in TAR, only deepening dependence and disempowerment, as more Tibetans subsist on official rations. Yet on paper all that capital expenditure can be made to look like success, even benevolence. If one divides the influx of subsidies by the TAR population, one can say GDP is growing at an impressive rate: so why aren’t the Tibetans grateful? GDP is meaningless as a measure of human well-being, when it is merely capex divided by population.

As China finds its way to a “new normal” of much lower growth rates over the foreseeable longer term, TAR stands out as continuing to grow extraordinarily fast, and China’s propaganda machine makes a virtue of this.[27] The headline in official media: China’s Tibet comes on top of regional GDP growth.

How can TAR really be growing faster than anywhere in China, when it manufactures almost nothing, its rural sector is shrinking, and almost nothing leaves TAR as exports? TAR has now had decades of “leap over” infrastructure-led “development” financed by central leaders (using borrowed money). Now the same logic is about to be applied to Kandze and Ngawa.

[1] http://www.nbcnews.com/news/china/china-pouring-billions-majority-tibetan-ganzi-prefecture-n579176

[2] Andrew Martin Fischer, The Political Economy of Boomerang Aid in China’s Tibet, China Perspectives, 2009 #3

[3] Sichuan Statistical Yearbook 2014

[4] Jianting Cao , Yuanyuan Li , Fuxin Shen , Yiwei Chen & Jun Xia (2012)

Drawing down our resources: estimating the total appropriation of water in China, Water

International, 37:5, 512-522

[5] TOWARDS A WATER & ENERGY SECURE CHINA: Tough choices ahead in power expansion with limited water resources, China Water Risk report, Woodrow Wilson Center China Environment Forum, 2015

[6] Tan, Gillian G. 2012, Re‐examining human‐nonhuman relations among nomads of Eastern Tibet,

Deakin University : Alfred Deakin Research Institute

[7] China’s major projects to be implemented in coming five years, Xinhua’s China Economic Information Service, 7 March 2016

[8] The Discovery History of Mineral Deposits of China, 1996, Vol 23 :Sichuan, p.132 Zhongguo kuang chuang fa xian shi 中國礦床發現史

[9] https://next.ft.com/content/cd55278c-3de0-11e6-9f2c-36b487ebd80a

[10] Qinghai Statistical Yearbook 2014, table 3-20, Utilization Situation of Mineral Resources

[11] http://www.carnewschina.com/2014/04/23/byd-m3-dm-mini-mpv-concept-debuts-on-the-beijing-auto-show/

http://www.caranddriver.com/news/denza-ev-photos-and-info-daimler-and-byds-electric-love-child-news

[12] http://www.denza.com/?r=tdrive

[13] China Li-ion Battery E-News VOL.1 Issue 12, December 29, 2014

[14] Samsung Electronics in talks to take stake in BYD: Korean group pursues Chinese electric automaker as cars go high-tech, JULY 15, 2016 FT

[15] https://www.giz.de/en/worldwide/29032.html

[16] Financial Times July 15 2016

[17] https://en.wikipedia.org/wiki/Hao_Peng_(PRC)

[18] https://www.linkedin.com/in/sandraretzer

[19] http://epaper.tibet3.com/qhrb/html/2016-06/22/content_339942.htm

[20] https://www.giz.de/en/worldwide/32698.html

[21] Xie Yuling, Hou Zengqian, Xu Jiuhua, Yuan Zhongxin, Bai Ge, and Li Xiaoyu (2006): Discovery of Cu-Zn, Cu-Sn intermetallic minerals and its significance for genesis of the Mianning-Dechang REE Metallogenic Belt, Sichuan Province, China. Science in China, Series D (Earth Sciences), 49(6), 597-603.

Huang, Z.L., Yan, Z.F., Xu, C., Zhang, Z.L., and Liu, C.Q. (2006): Mineralization by mantle fluids in the Miaoniuping REE deposit, Sichuan Province, China. Journal of Geochemical Exploration 89(1-3), 165-169.

[22] Zengqian Hou, Shihong Tian, Yuling Xie, Zhusen Yang, Zhongxin Yuan, Shuping Yin, Longsheng Yi, Hongcai Fei, Tianren Zou, Ge Bai, and Xiaoyu Li (2009): The Himalayan Mianning-Dechang REE belt associated with carbonatite-alkaline complexes, eastern Indo-Asian collision zone, SW China. Ore Geology Reviews 36, 90-105.

[23] Henry Sanderson, China plays long game on cobalt and electric batteries: Chinese company’s acquisition of Congo cobalt mine has repercussions for car industry, MAY 23, 2016 Financial Times

[24] https://mneguidelines.oecd.org/chinese-due-diligence-guidelines-for-responsible-mineral-supply-chains.htm

[25] https://mneguidelines.oecd.org/Agenda_OECD-CCCMC_Responsible-Mineral-Supply-Chains.pdf

[26] http://www.natlawreview.com/article/agreement-principle-announced-eu-regime-conflict-minerals?utm

[27] http://news.xinhuanet.com/english/2016-07/25/c_135539301.htm?utm