FINANCIALISING TIBET

1 in a series on what’s likely in Tibet in 2022

Why is a massive data centre being built in Lhasa? Five further questions arise.

Why would giants of fintech, crypto currencies and automated wealth management apps choose to locate to Lhasa?

Is Lhasa is becoming a centre of data processing for corporate wealth managers pitching their products worldwide, to insurance companies, health companies, crypto miners, raw materials traders, among others? Does that globalise Tibet, in ways unimaginable before?

Or is the reality more mundane, that Lhasa is just a backoffice that does the gruntwork of seeking patterns in torrents of big data generated by those insurance, health, crypto and commodity traders based in Beijing, London, Switzerland and inevitably the Cayman Islands tax haven, who are all part of this new Ningsuan data centre’s investment portfolio?

Or is it simply that Lhasa has become a reliable source of electricity, essential to all that data crunching? Crisp Lhasa air cooling all those computers running hot?

Or is Lhasa the new frontier after the remote province of Guizhou became such a big data hub that bold fintech innovators saw in Lhasa an ever further frontier, with plentiful incentives and subsidies available from both provincial and national governments?

GREED AND SPEED: THAT’S A WIN-WIN

The answer seems to be all of the above. If you look at Ningsuan’s portfolio list, from many industries, what they all have in common is greed and speed. All have bought into the seductive promise of big data analytics, of being able to detect patterns in torrents of data, that elude the wandering human mind, enabling fast moving companies to make money work ever harder and faster to maximise profits, powered by algorithmic sorting of signal from noise. This is the fintech utopia, the promise of being smarter and faster than anyone else in spotting what is trending.

Fintech has lots of ways of making money. If the trend identifies an incipient risk, you can then, ahead of the competition, quickly raise prices on the insurance policies, healthcare or commodities you sell, or sell off shares, or deleverage, or take up a short option gamble on the price going down, as a way of making money from the losses of others not as sharp and ruthless as you. Fintech is predicated on being the fastest to discover anything and everything that affects price, meaning the price of anything at all that is traded, and can fluctuate in price.

Ningsuan provides thumbnails of its investment portfolio. Among them are:

Erwan “financial literacy” education

PRIMITIVE ACCUMULATION

All of them, without exception, are focussed on making more money for already wealthy people. However, nearly all are now targets of Xi Jinping’s “common prosperity” campaign and its crackdown on evading taxation, scrutiny and regulation by using legal loopholes. This applies to Ningsuan’s portfolio list, but also to Ningsuan too, http://www.lingfengcap.com/index which manages to manage US dollar denominated funds by the now supposedly illegal route of being registered in the Cayman Islands.

Xi Jinping promised to bring down not only the flies of corruption but also the tigers, and Lingfengcap, trading as Ningsuan, presents itself as a tiger, an exclusive and expensive wealth creator for the sophisticated super-wealthy whose only purpose in life is to get ever richer.

So why build its big data analytics hub in Lhasa? Why route torrents of data generated in London, Switzerland and Beijing to Lhasa for pattern detection?

The most obvious answer is right there in the headline of an admiring 2020 article posted by TencentQQ: “The world’s highest cloud computing data center is about to be completed, built in Tibet, remotely controlled by Beijing”. The control room is in Beijing; Lhasa is the slave.

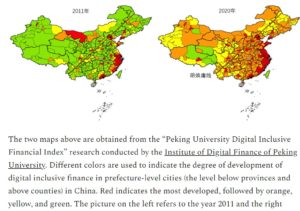

Further reasons come from a look at the infrastructure enabling Lhasa as a reliable base for global fintech. That means a reliable and plentiful supply of electricity, plenty of bandwidth to carry torrents of data to and fro, plenty of subsidies to build an industrial park campus in a remote area, plenty of grid management surveillance to ensure the locals don’t protest.

All of these preconditions now obtain. Quite recently central Tibet (TAR) was an importer of electricity, both from Qinghai and Sichuan, on long distance ultra-high voltage power grids reaching to Lhasa from afar. Now TAR boasts of being an electricity exporter.

Private equity funds in China may have other reasons for removing to Lhasa, not only the incentives on offer, but also the disincentives of a highly interventionist party-state with a history of predatory rent-seeking, of periods of let-it-rip latitude followed by sharp bursts of regulatory rectifications. The further you are from Beijing the better.

THE 2021 CRACKDOWN ON ILLEGAL MONEY LAUNDERING WEALTH MANAGEMENT FUNDS

Right now the party-state is in full dirigiste mode. “Internet financial services were expanding rapidly into financial gray areas with only the flimsiest of regulatory covers”, economist Barry Naughton tells us. Rectification is under way, registering your corporate domicile as Cayman Islands is no longer an option. Ningsuan would seem to be near the top of the list of secretive, exclusive, intensely private wealth management operations now targeted by the current crackdown.

Xi Jinping now calls for “increasing the income of low-income groups, reasonably adjusting high-income, and eliminating illegal income.” Ningsuan should be afraid. Within a few weeks, share prices of targeted companies fell by $1.5 TRILLION dollars. Lots of investors, in China and worldwide, lost a lot, quickly.

Minxin Pei tells us: “As for ‘elimination of illegal income,’ Xi refers to a crackdown on corruption, insider trading, manipulation of the stock market, falsification of financial statements, and tax evasion. Regarding the growth of private capital, Xi reiterates what is now a well-known government policy of ‘firmly opposing the disorderly expansion of capital, drawing up a negative list for sensitive sectors, and intensifying anti-monopoly enforcement.’”

Does this mean Ningsuan’s Lhasa data crunching factory is doomed, even before it starts? Not at all.

Ningsuan/Lingfengcap has powerful friends. One of the corporations in its investment portfolio is the cloud computing arm of the e-commerce giant jd.com, which tells us “According to Gartner data on IaaS (infrastructure as a service) market, JD.com’s cloud business is ranked fifth in China and is among the top 10 cloud providers globally. Based on the data, the global IaaS market grew 40.7% YOY in 2020 to US$ 64.86 billion. JDC has a 6.4% market share in China. JDC is quickly becoming a popular choice among government and enterprise customers in China. On Apr. 25, JDC was shortlisted on the 2020 cloud computing service procurement catalogue of the organs of the central government. JD Cloud has provided digital solutions to more than 1.2 million small and medium-sized enterprises as well as complex solutions for major industrial customers such as Dada Group, a long-time partner and now part of JD.com. In the finance industry, JD Cloud has provided digitalization solutions for over 780 financial institutions, including banks, insurance companies and securities companies.”

Are JD Cloud and its financier Ningsuan/Lingfengcap already too big to fail, too important to the party-state? Ningsuan has inked deals with Alibaba, and brashly presents itself as establishing, in Lhasa, China’s data gateway to South Asia, a win-win for all. The propaganda spin inevitably presents this as a great thing for Tibet and its development, and a contribution to the Belt and Road. Tibet is presented as a natural location, since computers get hot and Lhasa is cool, and Tibet is close to the sky you can touch the clouds, as Han Chinese often say, and this is a cloud computing hub, actually a “campus” designed to expand to 645,000 sq m of floor space. All good.

AN OVER-PROMISING WIN-WIN?

Ningsuan claims to spot trends that impact -positively or negatively- on corporate valuations faster than any human mind could discern. Market intelligence is delivered in milliseconds. Not only is that a service Ningsuan’s clients in Switzerland and UK are willing to pay for, the party-state too can cash in and out. Ningsuan, boasting of its dual currencies, USD and RMB, is ideally placed, as its clients and official regulators know, to launder capital, however it is acquired, and shift it abroad.

Officially, the party-state condemns “disorderly expansion of capital”, yet individual party leaders, especially their sons and daughters, have every reason to park capital beyond China, beyond the reach of the predatory state they publicly declaim loyalty to. Now the casinos in Macau, Sydney and Melbourne that were conduits for capital flight and laundering are under attack, new channels are needed.

If Ningsuan is nimble in reading the new wind, it will make handsome donations to officially approved charities, and get back to its core business. It may have to register an address in China, and drop Cayman Islands, but as a private equity fund, not listed on any stock exchange, it will not be subjected to close scrutiny. Lhasa will be its massive back office, Beijing in command, a launch pad for China’s financialisation to go global.

That is what matters much more than regulatory rectitude to a regime that aspires to nurturing a global wealth management industry based in China. On paper, the reverse was meant to happen, with the global giants of financialisation able to access China’s capital markets, but it hasn’t happened. “JPMorgan, Morgan Stanley, Credit Suisse and HSBC are all in the red” in their China operations, and “global banks have far to go to capture a significant slice of the enormous domestic deals market.”

Instead China’s private equity advisers and investors such as Ningsuan have plunged into the global sea, plugged into global hot money forever seeking to drive its financialised capital further and faster. The party-state could crack down on this as disorderly and actually illegally breaking rules about Chinese companies domiciling within China, under official scrutiny. The party-state may go the other way, overlook such indiscretions, because Ningsuan is a pioneer of globalising China’s financialisation, joining the big league of sophisticated gamblers who know how to stay ahead of the curve, making their private money work harder.

PREDICTING WHAT’S NEXT

Either way, it says a lot that Lhasa is, in 2022, about to become a vast back office, doing the data crunching and algorithming that enables the smartest financialisers in the room to stay smart. It’s all about anticipation, prediction, foreseeing around corners, placing your bets and getting the payoff.

This is about as far removed for the core values of Tibetan culture as can be imagined. It really is a polar opposite. The Tibetans thrived for thousands of years as gatherers of nature’s seasonal cycle, as the yaks, sheep and goats gave birth, and fattened on autumn pastures. Tibetan lamas teach again and again that to forever obsessively evaluate, assess, judge, categorise, critique, anticipate, plan is to live an inauthentic, ungrounded life of anxiety and confusion. Chogyam Trungpa: “Humans are the only animals that try to dwell in the future. You don’t have to purely live in the present situation without a plan, but the future plans you make can only be based on the aspects of the future that manifest within the present situation.”

A man walks into a bar. What does that mean? These days cameras see when he walks in, and out. Security agencies and corporate tracker s on his phone know what he buys at the bar. Data points accumulate rapidly. The faster data proliferates, the greater the attraction of the massive computing power required to find something useful to market intelligence, or security intelligence, amid all that chatter. That is the fundamental delusion hardwired into the Lhasa data factory, which will seem to work well for its smart money men, until the moment it doesn’t.

Can algorithms accurately predict whether the party-state will crack down on Ningsuan as capitalism out of control and beyond the reach of the state? Or will Ningsuan be rewarded for bringing prosperity and development to backward Tibet, and financialisation with Chinese characteristics to the world? Can algorithms do that?

What ultimately will save Ningsuan/Lingfeng from being taken down, as a bad example of over-promising fintech, illegally registered in Cayman islands, is its biggest customer, which is not Tibetan pastoralists, or that gateway to South Asia, or the companies Ningsuan has invested in.

The most important customer is the party-state itself, which securitises all aspects of Tibetan life, surveils Tibetans intensively, locks Lhasa down into grid management cells, and routinely generates vast trawls of data on the identities, movements, phone use and even gait of all Tibetans, especially in Lhasa.

The more overwhelmingly torrential the data, the greater the need to make sense of it, and that is where the Ningsuan “campus” shines: “to bring cloud services to industries in the Tibetan region that span electricity supply, finance, national security, government affairs, public security and cyberspace.”

If Ningsuan is so valuable to the surveillance state in Tibet, it will survive the current crackdown on unruly, hyper-greedy capitalist expansion. That should be the end of the story, but it’s not. The very capabilities that make the Lhasa data hub useful to the party-state are what triggers US sanctions, already in place, to act against similar cloud computing hubs in neighbouring Xinjiang. Tibetans could readily make the case for Ningsuan/Lingfeng to be similarly sanctioned.

“US investors are banned from investing in any of the five dozen Chinese groups that are now on the Treasury blacklist. The targets include Megvii and CloudWalk Technology, two facial recognition software companies, and Dawning Information Industry, a supercomputer manufacturer that operates cloud computing services in Xinjiang. The others are Xiamen Meiya Pico, a cyber security group that works with law enforcement, Yitu Technology, an AI company, Leon Technology, a cloud computing company, and NetPosa Technologies, a producer of cloud-based surveillance systems. “Today’s action highlights how private firms in China’s defence and surveillance technology sectors are actively co-operating with the government’s efforts to repress members of ethnic and religious minority groups,” said Brian Nelson, a top Treasury official. The moves follow the blacklisting last week of SenseTime, a cutting-edge AI company that focuses on facial recognition software. DJI’s investors include Accel and Kleiner Perkins, two big US venture capital firms.”

If Ningsuan/Lingfeng endless enthusiasm for cyber controlling everything is curbed, not by China’s crackdown but a US crackdown, it will, for Tibetans, close the circle.

The Ningsuan mega data hub is in Lhasa, just across the Kyichu river from the Potala, the empty home of the Dalai Lamas. When the CCP regime forced the Dalai Lama to flee for his life, and become a world citizen, he invented the idea of emotional intelligence. The Dalai Lama’s idea, launched in 2004 in the Harvard Business Review, was that leaders who succeed are good at something nobody had ever named: emotional intelligence. They are attuned, empathic, compassionate, decisive, insightful, flexible, grounded, in touch with both themselves as embodied emotional animals, and everyone around them.

One of Ningsuan’s investments is in Emotibot which now claims to have automated emotional intelligence, with algorithms that detect emotion. Entire systems of predictive policing, surveillance, securitisation, detention and incarceration can be built on that.

It may yet take the US Seventh Cavalry, just like in the old Westerns, to rescue our all-too-human emotions from China’s bots.