What to expect in 2023: A series of blogs about the short term future of Tibet LITHIUM’S MOMENT

#4 Lithium as an industry with global reach, global conflict minerals governance

Why is 2023 for Tibetans not only Water Rabbit year, but also lithium year?

Timing is everything. Now that China has emplaced Tibet in the global economy, it is global timing that matters.

2023 is the year the lithium of Tibet -both in rock deposits and salt lake brines- goes big, even ballistic, as Chinese corporations fight to get their hands on valuable Tibetan landscapes and boast to investors of exclusive access.

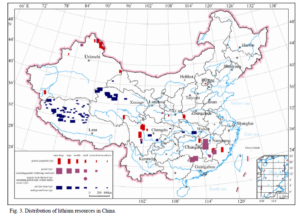

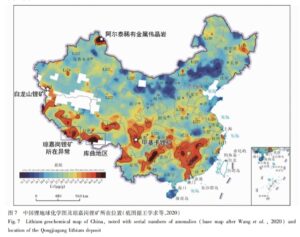

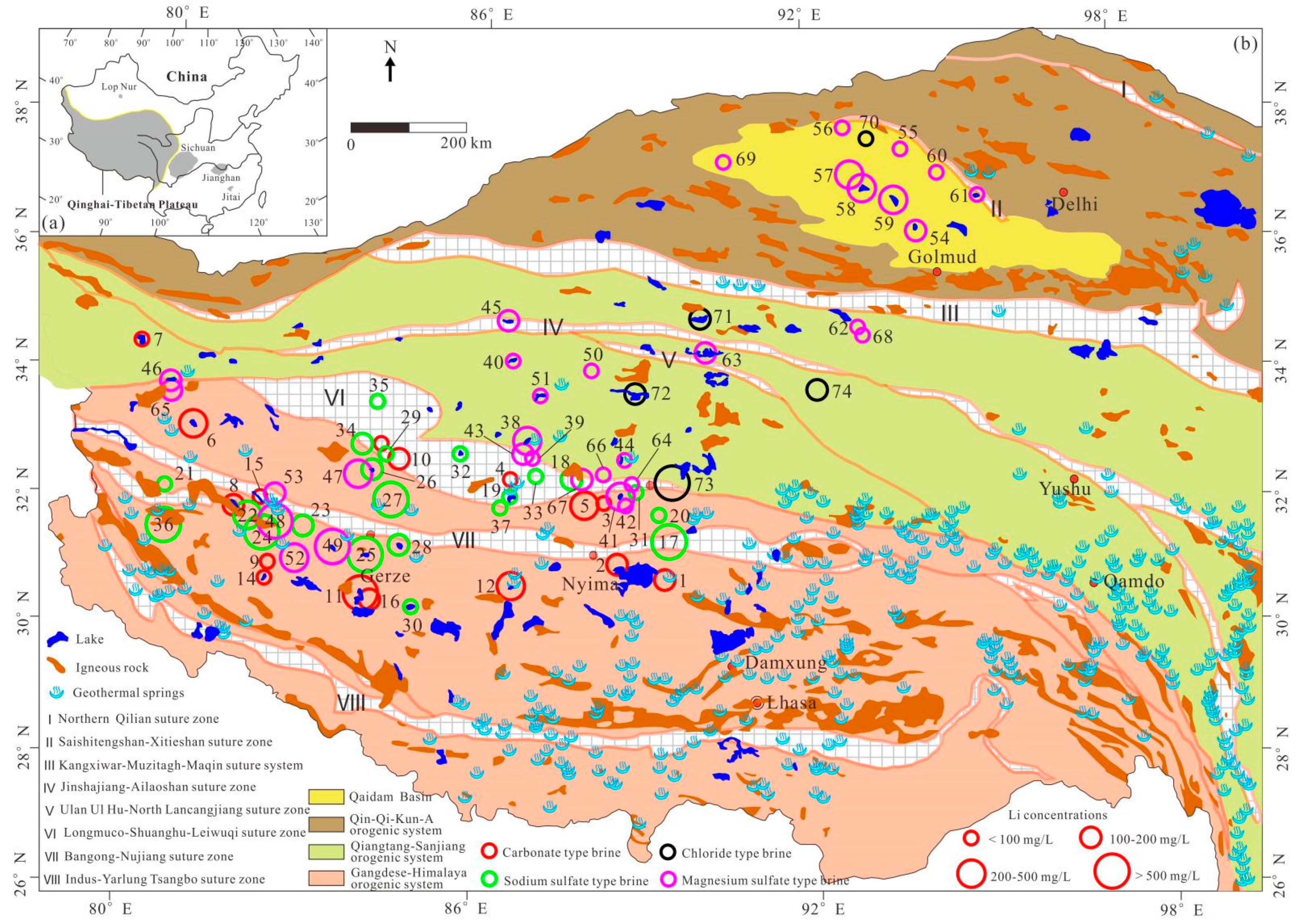

For many years, prior to mid-2022, Chinese geologists checked the chemical characteristic s of hundreds of lakes across Tibet, some freshwater, many salty, finding a few in which the salts were primarily lithium salts, easier to extract. But the main focus was on the huge salt lakes of the Amdo Tsaidam Basin, where profitable extraction focussed on potassium salts (for potash fertiliser manufacture), magnesium salts (many industrial uses) and common sodium salt (not only for food but as feedstock for many industrial processes), while lithium salts were a bit of a nuisance, hard to totally separate.

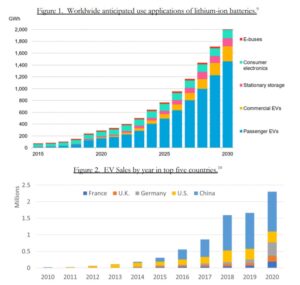

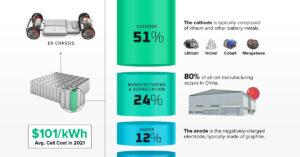

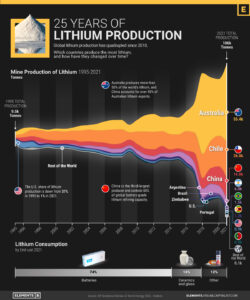

The New Electric Vehicle boom changed all that. Suddenly lithium became far more valuable than the other metal salts of the Tibetan lakes, but extracting lithium at a very high level of purity, sufficient to power lithium-ion batteries without overheating and failing, was hard to achieve. So as the lithium boom boomed, corporate China turned to the rock lithium deposits of Kham Kandze, in eastern Tibet.

That is what makes 2023 the moment to bring Tibet back into global focus, and find new audiences for Tibetan anguish at exploitation, pollution, disempowerment and repression.

This moment may not last. By 2025, perhaps even earlier, there will be Chinese lithium battery factories all over Europe, often in partnership with European auto manufacturers who are desperately trying to get in on the NEV path to the post internal combustion engine era. For far too long the Europeans bet on diesel as the future, while China invested heavily in battery powered cars, buses and trucks. Now this Fourth Industrial Revolution is upon us all, wherever we live, and the future is battery-powered.

By 2025 the European auto industry will be locked in to Chinese battery tech, Chinese suppliers, Chinese battery megafactories, even Chinese electric car factories in Europe, all reliant, some more than others, on lithium from Tibet. American car makers won’t be far behind. So by 2025 it may be too late.

It can take as little as 18 months to build a megafactory that makes both the lithium batteries and the cars that wrap around the battery. Just ask Elon Musk, who in 2019, at the height of Donald Trump’s confrontation with China, announced he was building a megafactory on the outskirts of Shanghai. And so he did, in record time. It helps if you have the support of an authoritarian national government and a powerful municipal government who can sweep aside all community environmental objections. But European governments are also keen to attract similar factories, and doing all they can to ease the way for the Chinese manufacturers.

That is what makes 2023 a specially auspicious moment for Tibetan voices to be heard, plugging in to the present vigorous debate, backed by laws and regulations, on conflict minerals and critical minerals. Throw a mo, you’ll be glad you did.

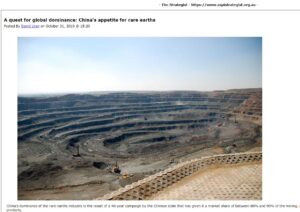

This is a race for global dominance China has announced, at the highest level, it intends to win, and Tibet is at the heart of the strategy. China’s dominance of lithium battery production has relied on importing semi-processed lithium from South America and Australia, mostly from deposits owned by Chinese lithium companies. This has never been seen as problematic, until 2023, as security risks rise higher on the agenda. Now the security state insists much more lithium is to be sourced domestically, and that means Tibet, both the rock lithium of Sichuan Kham Kandze, and the salt lake lithium of Amdo Tsaidam.

Xi Jinping commanded intensification of lithium extraction from Tibet when he gave specific instructions to senior cadres from Qinghai, according to China Chemical Reporter 中国化工报导 (CCR). China’s chemical industries are core for China’s global dominance across the board, from pharmaceuticals to new energy. CCR is issued fortnightly, in English and in Chinese. Headlining the edition of 6 August 2022: “Time for Accelerating the Utilization of Domestic Lithium Resources.”

CCR: “The influx of both private and state-owned capital will lend strong support to the development and utilization of domestic lithium resources. The cumulative mining volume of domestic lithium ore was 41 500 tons (calculated as metal volume) from 2010 to 2020, accounting for only 2.8% of the recoverable reserves of domestic lithium resources, and the average import dependence rate of lithium in the past decade reached 67%. The lithium carbonate consumption in China was 263 700 tons in 2021, of which, 190 000 tons were imported. At present, the overall cost of domestic lithium carbonate is pegged at RMB 20 000-60 000/ton, while the production cost of lithium carbonate fed by imported spodumene concentrate has been close to RMB 100 000/ton as the prices of the latter have surged. Thus, the cost advantage of domestic lithium resources is obvious.

“Xi Jinping stressed ‘accelerating the construction of a world-class salt lake industrial base’ when the Qinghai delegation deliberated on to the fourth session of the 13th National People’s Congress on March 7, 2021. During his inspection in Qinghai in June, he reiterated ‘actively cultivating emerging industries and accelerating the construction of a world-class salt lake industrial base based on the unique resource natural endowment of the plateau’. In February 2022, the Ministry of Industry and Information Technology claimed that it should improve the key resources guarantee ability, strengthen communication and coordination with Qinghai, Sichuan.

“At present, most lithium mining areas are located remotely, where infrastructures are less developed, significantly hampering the development process of lithium resources. In this regard, first, we should beef up the construction of road transportation, power, communication, network and other infrastructures in major lithium mining areas and enhance the industrial carrying capacity. Secondly, we should make full use of the abundant solar energy, thermal energy and other new energy resources in Tibet and Qinghai.

“We should thoroughly carry out the Action Plan for Domestic Mineral Exploration of Strategic Minerals (2021-2035). Restricted by many factors such as technology, climate and talents in Tibet, there are very limited salt lake lithium resources exploited. Therefore, it is necessary to increase the exploration of salt lake lithium resources in Tibet, so as to increase the identification rate of local lithium resources.”

China’s miners and battery makers responded enthusiastically, knowing this is their moment.

China is already well ahead, so much so that auto makers in Europe are starting to decide they can’t beat China -in Europe- so the only option is to join them. That is short term thinking, and European governments, more focussed on longer term risks, may intervene, in the national interest. It’s in the balance.

Some recent developments: “CATL announced on August 12 2022 that its board of directors had approved the proposal of building an industrial new energy vehicle (“NEV”) battery base in Hungary. According to CATL’s announcement, the company intends to pour no more than €7.34 billion in constructing a power battery production base in Debrecen city, Hungary. The project will be managed by Contemporary Amperex Technology Hungary, which is 100% controlled by Contemporary Amperex Technology (Hong Kong) Limited, a wholly-owned subsidiary of CATL. In 2019, CATL founded Contemporary Amperex Technology Thuringia GmbH (“CATT”) in Erfurt, Thuringia, a state in east-central Germany, marking its first global expansion in EV battery manufacturing. On April 4, 2022, CATT was granted the second partial approval for battery cell production from the government of Thuringia, obtaining an initial capacity of 8 GWh per year.”

January 25 2023: “A potential deal in the works could reset competition in Europe’s automotive supply chains. Ford is in talks with Chinese electric-vehicle maker BYD about the sale of the U.S. company’s manufacturing plant in Germany. The Wall Street Journal’s William Boston reports that Ford is targeting the sale of its factory in Saarlouis, where production of the Focus compact model is slated to end in 2025. Selling the plant would mark another step in Ford’s efforts to overhaul its European operations and shift completely to electric vehicles. It would also be a major step for China’s electric-car industry, which has started expanding into European markets. A deal would mark a major milestone for fast-growing BYD, which last year sold 1.86 million electric and plug-in hybrid vehicles, three times as many as the year before. Tesla has also jumped into the market with production starting last year at a plant near Berlin.”

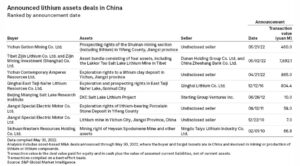

CATL and BYD rely increasingly on lithium extracted from the rock deposits of Kham Kandze, or Jiajika in Chinese.

The new normal is that, in the name of security, sovereign states now recognise they need to juggle short term corporate deals against longer term security concerns, which means state intervention to review corporate dealmaking and halt deals assessed as dangerously close to handing over the keys to China. States these days step in, even after the deal is sealed, to undo deals inimical to national security. One example is Canada stepping in to order Gormo-based lithium and potash miner Zangge to sell three Canadian lithium deposits it had already bought.

What this adds up to is three overlapping audiences waiting to hear from Tibetans: the security agencies and think tanks of the richer countries; environmentalists who understand the downsides of “green” energy; and human rights advocates focussed on keeping conflict minerals out of the supply chain. That’s a big and powerful new audience for the Tibetan case. That makes the Water Rabbit year auspicious.

HOT ROCK

How did we get to this moment? Extracting lithium, whether from rock deposits or scooped up from salt lake beds, requires complex, expensive and polluting processing in order to make lithium pure enough to work in batteries. This is an industry China is well on the way to dominating globally, much as it already dominates the manufacture of solar panels, wind turbines and ultra-high voltage power grids.

Where and how the lithium extracted from hills and lakes of Tibet is processed is a story worth exploring. What we discover is that it is not only European companies and governments keen to attract lithium factories, it is happening in Tibet too.

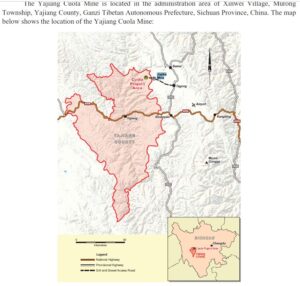

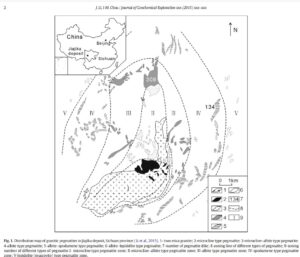

Our focus is on what China calls the Jiajika rock lithium deposit, which sprawls, in twisting veins, over 64 square kilometres, big enough to allow several Chinese mining companies rights to mine there. Many players. To Tibetans this is Kandze Lhagang.

Tianqi next door at the same rock deposit may have few plans to exploit Jiajika for anything beyond brand enhancement. However the Jiajika rock lithium deposit is huge, biggest in China, and has been parcelled out to more than one mining company. While Tianqi dithers, others have full scale plans for extraction, notably a close associate of BYD, a company in the news a decade ago for all the wrong reasons, Ganzizhou Rongda, which poisoned fish and livestock of local communities, resulting in Tibetan protests, ruthlessly crushed.

Ganzizhou Rongda is now back in operation, since 2019, in fact rapidly gearing up for full scale extraction of lithium rock, plus a processing plant in nearby Dartsedo [Kangding in Chinese]. The infamous Ganzizhou Rongda name is now seldom heard, instead the parent company Youngy is more often named as the driver of this huge open pit, steeply sloped mine in a district of Kham prone to earthquakes.

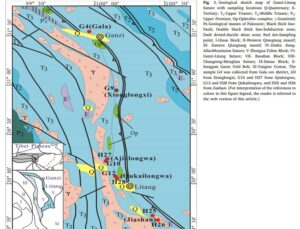

The Jiajika lithium-bearing pegmatite rock formation is mapped by Chinese geologists as at least 12 kms long and up to three kms wide, room enough for several operators. The more it is drilled, the bigger the mapped deposit gets. While the fate of the salt lakes remains uncertain, it is this pegmatite rock deposit that has everyone excited, including the Kangding local government cadres, the BYD car maker, and lots of investors in Youngy expecting to make spectacular profits. Judging by Youngy’s most recent results, they have reason to rejoice.

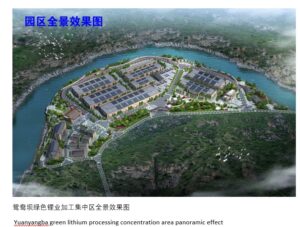

The new processing plant of the notoriously polluting Ganzizhou Rongda/Youngy/Luxiang extraction enclave plans to do all the steps of lithium processing in Tibet, both at the mine site, and in Dartsedo, 600 kms away.

Why split the processing? This is a puzzle, since the output of the dual processing plants will still be low in lithium content, and in much need of further industrial processing. The Dartsedo/Kangding industrial “park” begun ceremonially in 2020, on the banks of the Dadu River, will then do the final stage, of feeding soda ash (calcium carbonate) into this toxic slurry, to change it chemically from lithium sulphate to lithium carbonate, while recovering the sulphuric acid for reuse. The slurry is dried through evaporation, so it is ready to go to market. That is why the Kangding “ore processing facility” is a series of evaporation ponds, over 50 of them to allow time for evaporation to happen. While the ceremonial start of industrial park construction was highly publicised, its purpose, officially called beneficiation, is to take the final step of turning lithium sulphate into lithium carbonate, while recovering the sulphuric acid for further use.

ENVIRONMENTAL RISKS

Constructing this lithium “beneficiation” plant right on the banks of the Dadu tributary of the upper Yangtze is dangerous. Massive landslides occur unpredictably. In 2023 Chinese scientists concluded that “This region is one of the world’s most active landslide-prone mountain belts and has great potential for damage to surrounding residents and industrial buildings.” [1]

“Chinese historic documents recorded that on June 1, 1786, a strong M=7.75 earthquake occurred in the Kangding-Luding area, Sichuan, southwestern China, resulting in a large landslide that fell into the Dadu River. As a result, a landslide dam blocked the river. Ten days later, the sudden breaching of the dam resulted in catastrophic downstream flooding. Historic records document over 100,000 deaths by the flood. This may be the most disastrous event ever caused by landslide dam failures in the world.”[2]

The most recent earthquake close to Kangding was in September 2022, killing 90 people, injuring 400.[3]

After digging into the rock lithium veins and applying sulphuric acid, everything else happens 600 kms away at the mine site, the same location where repeated fish kills a decade ago anguished local Tibetan communities. It all starts with extracting the pegmatite rock from the three veins discovered so far. Although these veins dip 400 meters below the surface, this is an open cut mine, with steep walls, vulnerable to landslides, perhaps triggered by earthquakes, which are not uncommon. Yet back in 2010 specialists from Sichuan Metallurgical Design and Research Institute, and Shenyang Ecological Environment Monitoring Centre, assessed the open cut plan and declared its’ steep, open cut walls “reasonable”.[4]

Metallurgical Design and Research Institute, and Shenyang Ecological Environment Monitoring Centre, assessed the open cut plan and declared its’ steep, open cut walls “reasonable”.[4]

That is what investors like to hear, likewise the Kangding/Dartsedo municipal government, keen to get a slice of the action.

The company boasts its mining licence is until 2041, so it has two decades of intensive extraction and on-site sulphuric acid processing ahead of it. By then, the mining licence will for sure be renewed, as the extraction plan is designed to take 29 years to exhaust the Tibetan endowment. That takes us to 2052, if production starts in 2023.

Even if the company this time manages to contain the sulphuric acid, without leaks, the impact will be great, in the middle of a biodiversity hotspot of much greater biodiversity than the national parks China has redlined in Amdo/Qinghai. Kham is where, on a single slope, you can climb from the subtropics to the alpine, hence the enormous diversity of life.

RARE EARTHS MIXED WITH THE LITHIUM

The company involved is now in a hurry to scale up, as the lithium boom is upon us. Youngy has designed the mine on a scale intended to satisfy booming demand: “The company’s lithium mine has 28.995 million tons of ore reserves with an average grade of lithium oxide of over 1.42% and is accompanied by rare metals such as tantalum, niobium and beryllium. The company’s lithium mine has excellent resource endowment, concentrated veins and superior mining conditions, which is suitable for full open pit mining.”

These are magic words to investors: not only lithium but also rare earths. After four decades of geological investigations, and as markets changed, it emerged that the Minyak Lhagang deposit also contains small amounts of very valuable rare elements: tantalum, niobium and beryllium. Like lithium, these are critical minerals in demand worldwide for many high tech uses, and, like lithium, China is close to realising its plans to dominate global processing of rare earths.

The presence of rare elements has excited investors and geologists alike. A 2021 geological report summarises what is now known: “The Jiajika rare-metal deposit is located in the west of Sichuan Province, situated on the south-eastern side of the main body of the Songpan-Ganzê orogenic belt (SGOB) lying on the east margin of the Tibetan Plateau. It is a super-large rare-metal reserve that includes an estimated 1,887,700 t of Li2O with associated economically variable components of BeO [beryllium], Nb2O5 [niobium], Ta2O5[tantalum] and Cs2O [caesium]. The area of the Jiajika rare-metal deposit covers approximately 62 km²” [5]

IN SUM

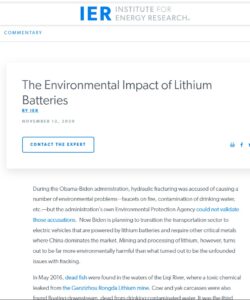

In all, the production of pure, industrially useful lithium carbonate from pegmatite (or spodumene) rock is violent, energy-intensive, extreme; not at all the clean green renewable energy promised by lithium enthusiasts, and the mining company that owns this deposit.

Why violent? Lithium is highly inert, whether mingled with other salts of metals in brine lakes, or in rock. Extracting lithium from rock or from salt lakes is difficult and dangerous, not what a world hungering for a magical alternative to fossil fuel combustion wants to hear. The first step requires roasting the extracted rock at 1100 degrees C, in concentrated sulphuric acid, which means emitting 15 tons of carbon dioxide into the atmosphere for one ton of lithium.[6] In Tibet, the energy may come from building more hydro dams, farther and farther up the rivers of Tibet, to provide sufficient energy to roast rock lithium

Youngy boasts that it will extract one million tons of lithium ore from its Jiajika deposit, each year, for the 29 years it will take to exhaust it. To investors, one million tons a year sounds impressive, big-time, worth investing in. Youngy further boasts that its “ore beneficiation” plant 600 kms from the mine will process around 475,000 tons a year, again an impressive amount. Yet if, as Youngy says, the actual lithium content of the rock it is blasting out of the Tibetan earth is just 1.2 per cent, then the final amount of pure lithium resulting from all that blasting, melt temperature heating, colling, acid bathing, chemical conversion and evaporation adds up to annual output of 12,000 tons of actual lithium. Is it worth despoiling Tibet for that?

As is usual in the convoluted Chinese corporate world, companies and beneficial owners are entangled, and manifest under several names. The bottom line is that Ganzizhou Rongda/ Youngy and BYD are partners. BYD relies on lithium from Tibet. BYD is expanding rapidly worldwide. Your next trip to or from your flight, on an airport bus, is probably on a BYD lithium-powered bus.

WHAT ABOUT THE SALT LAKE LITHIUM OF AMDO, NORTHERN TIBET?

This strategy of focussing on Tibet’s rock lithium attracts investors, attracted by prospective profits. In Tibet the pivot towards lithium as the premium priced output of lake bed extraction is not so easy. This is because the salts in those salt lakes have been extracted for decades, not so much because they contain lithium, which was almost a by-product, but for the other metals, which were in demand.

Common table salt, sodium chloride, is widely used in the manufacturing of plastic, paper, rubber, glass, chlorine, polyester, household bleach, soaps, detergents and dyes; and the availability close to the Tsaidam Basin salt lakes of gas fields meant the raw materials for chemical fertilisers -urea- were handily adjacent.

In the five years 2015 2020 Qinghai province produced a steady output of chemical fertilisers, varying between 4.62 million tons and 5.6 million tons, in demand by farmers right across China for their over-exploited soils. The three components of chemical fertilisers for depleted agricultural soils are nitrogen, potassium and phosphorous, and the Tsaidam Basin provides the first two. The potassium is one of the salts of the salt lakes, and the resulting potash fertiliser industry based in the Tsaidam Basin is huge. So intensively have the Tibetan salt lakes been exploited for potassium, production is starting to decline. Peak year was 2016, with output of 8.88 million tons, by 2020 this had dropped to 7.42 million tons.[7]

Then there is the magnesium salt in the lake brine as well, a metal in increasing demand. As well as long standing uses in manufacture of high-temperature refractory bricks, electrical and thermal insulators, cements, fertilizer, rubber, and plastics, magnesium is increasingly used in reducing the weight of car seats, luggage, laptops, cameras and power tools. China’s official data for magnesium production aggregates the data of ten nonferrous metals, so there is little indication how much of the annual Qinghai output averaging 2.5 million tons is magnesium, as magnesium is bundled statistically with copper, aluminium, zinc, lead, nickel, tin, antimony, mercury, tin and titanium.

However, the Qinghai Statistical Yearbook does list lithium-ion battery production as a separate key metric of provincial output, with production as high as 11.28 million units in 2019, with a low of 5.62 million batteries the previous year. Those numbers are expected to ramp up quickly, as Tibet becomes both a raw materials source, and battery maker.

Pivoting from potassium, sodium and magnesium salts to prioritising lithium extraction is technically difficult, given their chemical affinity for each other, and reluctance to separate. If the required purification level is high, it’s all the harder. The shortcut is to find, among the myriad lakes of the Tibetan Plateau, the few lakes where just one of these mingling metals -lithium- is found is high concentration. Such lakes may be rare and remote, close to upper Tibet’s disputed border with India’s Ladakh Changtang, but there are a few. Zabuye and Mami tso.

ROCK, SCISSORS, BRINE

Whether China’s lithium supply comes from brine lakes or rock lithium depends on the technicalities of producing lithium that meet the specifications for battery manufacture. Those standards are high -much higher than for older uses of lithium such as industrial grease and glass making. Any impurities cause batteries to overheat, sometime dangerously, and reduce battery rechargeability.

Lithium is common, found in many places , less common in commercial concentrations. The lithium problem is not finding it, but in making it into lithium hydroxide suited to batteries that use nickel as well, rather than lithium carbonate. Lithium doesn’t react much to chemical manipulation. It is one of the most inert of elements, resistant to human interventions to shape it to human will. This is a major reason why lithium from Tibetan salt lakes has limited use in battery manufacture -so far.

[1] Fan Xie, Eric Larose, Qingyu Wang, Yuxiang Zhang, In-situ monitoring of rock slope destabilization with ambient seismic noise interferometry in southwest China, Engineering Geology, 312 (2023) 106922

[2] F.C. Dai, C.F. Lee, J.H. Deng , L.G. Tham, The 1786 earthquake-triggered landslide dam and subsequent dam-break flood on the Dadu River, southwestern China, Geomorphology, 65 (2005) 205 – 221

[3] 9 September 2022, NoticiasFinancieras

[4] DUAN Junfeng; LIU Na, Study on Stability of Open-pit Slope of Jiajika Spodumene Mine, Modern Mining. 2020(10), 164-169, 172

[5] Zhen Wang, Jiankang Li, Evolution and Li Mineralization of the No. 134 Pegmatite in the Jiajika Rare-Metal Deposit, Western Sichuan, China: Constrains from Critical Minerals, Minerals Journal, 2022, 12, 45. https://doi.org/10.3390/min12010045

Also: Hao, X.F.; Fu, X.F.; Liang, B.; Yuan, L.P.; Pan, M.; Tang, Y. Formation ages of granite and X03 pegmatite vein in Jiajika, western Sichuan, and their geological significance. Mineralium Deposita 2015, 34, 1199–1208.

[6] Salakjani, N.K.; Singh, P.; Nikoloski, A.N. Production of Lithium–A Literature Review Part 1: Pretreatment of Spodumene. Mineral Processing and Extractive Metallurgy Review, 2020, 41, 335–348

[7] Qinghai Statistical Yearbook 2021, table 13-18: Output of Major Industrial Products