A blog series on China’s lust for lithium from Tibet, blog 2 of 3

BOOMING LITHIUM: FEAR OF MISSING OUT

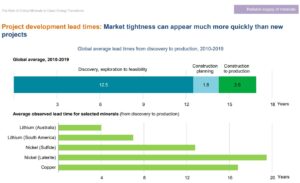

Mining has always been prone to booms and busts, since the interval between demand and supply is several years of careful investigation to find and confirm a mineral deposit, draw up a sound business case, obtain all necessary permits, arrange finance, build the mine and its infrastructure and commence extraction. Almost inevitably by the time production starts this is out of sync with the business cycle.

Lithium, the core of the electric vehicle industrial revolution meant to get the planet out of fossil fuel dependency, is no exception to this disjunct between extraction and expectation, between mining and investor mania.

CHINA’S WORLDMAKING GAZE TURNS TO TIBETAN LITHIUM

That is why Tibet has suddenly emerged as the magical solution to China’s urgent need for more lithium, as its electric cars get bigger and faster, needing heavier lithium batteries, and exports start to boom around the world as well as in China.

Many of China’s electric car makers, including Tesla, say their business success relies on vertical integration, which means they own, or have guaranteed exclusive access, to the lithium mines as well as the car factories and the gleaming showrooms where they sell direct to the public, bypassing dealers. In a world of sudden, disruptive shortages, all too frequent in the past three years, there is nothing like owning a captive lithium source to ensure there is no slippage between demand and supply.

Until recently the situation was not urgent, but now it is. This is for four reasons.

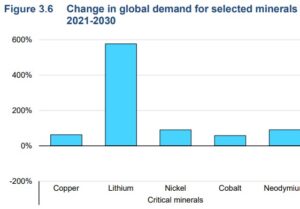

First, demand is booming.

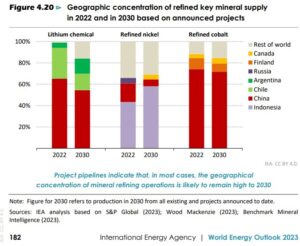

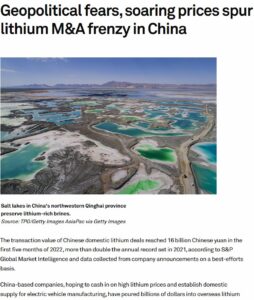

Second, China’s program of buying lithium mines worldwide is now risky, due to the rising resource nationalism of governments of the Global South who hope to do the lithium extraction, processing and battery making themselves, adding value onshore rather than shipping their raw mineral patrimony ores to China.

Third, a further pressure is the derisking strategy of the richest countries, seeking to decouple critical minerals supply from China, which may divert lithium mined in Australia, contractually destined for China, to western countries instead, bypassing the Chinese processors of lithium who currently dominate the global market. Or will Australia happily sell its many rock lithium deposits to both China and Australia’s allies?

Fourth, the many millions of tons of lithium sitting on the surface of flat salt lakes in the Tsaidam Basin of northeast Tibet are frustratingly unavailable for lithium battery making, because there is no technology capable of separating them from the admix with other metal salts to which lithium has a natural affinity. The lithium in batteries needs to be extremely highly purified; even the slightest impurities reduce battery life, making it harder to recharge; and worse, cause batteries to dangerously overheat and catch fire. This danger is so well known that when a car freighter with both electric and internal combustion cars on board recently caught fire off the Dutch coast, the immediate suspect was the batteries in the electric cars.

These are four compelling reasons why China is now urgently turning to the mountains of eastern Tibet, not for salt lake lithium but hard rock lithium. A classic rush is on. Hot money demanding big and quick returns is pouring in. Auctions of mining rights, even just exploration rights, regularly sell to the highest bidder for 1000 per cent of opening asking price.

The sure sign that a boom is beginning to peak is when the big money moves in, the major mining companies with the capital to build scaled up mines and the surrounding infrastructure. This phase, of consolidation, buying out the minnow chancers, is now well under way, in the rock lithium extraction industry in both China and Australia. When the big end of town arrives, you can be sure there are billions to be made. In Tibet, just one company, Zijin, dominates copper mining; in rock lithium it is Ganfeng, Huayu and Tianqi.

TIBET ROCKS

This boom is remarkable for a few reasons. Rock lithium is the mineral spodumene/pegmatite. Although such deposits have been known for decades, there was little reason to invest in actual extraction when there were dry salt lake beds across the world where extraction is so much easier, especially in the “lithium triangle” of the high deserts of Chile, Argentina and Bolivia. By comparison, rock lithium deposits are hard to find in sufficiently big tonnages, often requiring tunnelling deep underground. The actual lithium content of the extracted rock is seldom more than 1.5 per cent, much lower than the lithium in the salt lakes of Tibet Amdo.

That means a concentrate must be produced at the mine site, to make it worthwhile to ship out to a processor capable of achieving the purity of battery grade. That concentrate made at the mine site is actually only 6 per cent lithium, which means 94 per cent of what is transported great distances will end up as waste. Further the processing, whether at mine site or far below Tibet, often requires roasting the rock at very high temperatures to change the chemistry of the lithium, a very energy intensive process is remote locations.

Taken together, these are strong reasons why no-one until recently took rock lithium seriously. It just didn’t stack up competitively with salt beds requiring nothing more than a bulldozer and a dump truck to get the multi-metal salts into a processing plant.

When the electric car boom arrived, rock lithium – Plan B- arrived with only sketchy understanding of how the deposits were formed, how to find the elusive lenses of crystallised lithium deep underground as well as in surface outcrops. Much uncertainty remains as Plan B now rapidly takes shape, driven by investors piling in. The last thing on anyone’s minds is what Tibetans think of this rush.

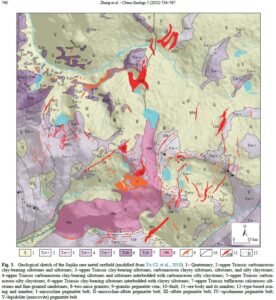

The seven major outcroppings of rock lithium in Ke’eryin district, all assigned fanciful Chinese names, spread across a 30 km district, close enough to constitute a single extraction enclave, yet far enough apart to sell as separate mine assets to eager investors. Ore Geology Reviews, 2022, a freely downloadable source: https://www.sciencedirect.com/science/article/pii/S0169136822004723

Location: east of Serthar and Dzamthang, NW of Barkham, close to villages Zamthang Barma, Zamthag Todma, Zongbur, Khangser, Tsodun.

Eastern Tibet is to Tibetans the major province of Kham, today fragmented by Chinese boundaries into prefectures of Sichuan, Qinghai, Yunnan and Tibet provinces. Kham has long been identified by biodiversity scientists as one of the planet’s biodiversity hotspots. Compared to the rest of Tibet it is wetter, warmer, capturing the monsoon winds that rise up through deep Himalayan valleys. These are medicine mountains, the basis of a pharmacopeia which combines herbs and minerals into hundreds of healing formulations, part of global intangible cultural heritage. Yet China’s new national parks are only tangentially in Kham; most are in the pastoral landscapes to the north, much less rich in biodiversity.

A rush is a rush. When Chinese goldminers swarmed to California in the 1840s and Australia in the 1850s, their tech was shovels and sieves. Today rock lithium extraction requires drilling as much as two kilometres below the surface, then roasting the rock. The tech has changed, but the hyped logic of a rush persists. Get in and get out before the bubble bursts, shorting the stock on your way out the door.

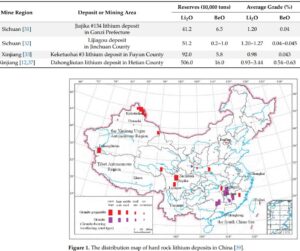

Now that spodumene/pegmatite rock lithium is deemed economic, Chinese geoscientists are rapidly finding it all over Tibet.

Newly defined pegmatite lithium deposits identified in northern Tibet. Source: https://www.sciencedirect.com/science/article/pii/S0169136822002384?via%3Dihub Ore Geology Reviews Jin-Heng Liu et al., Geochronology of the Chakabeishan Li–(Be) rare-element pegmatite, Zongwulong orogenic belt, northwest China: Constraints from columbite–tantalite U–Pb and muscovite–lepidolite 40Ar/39Ar dating, Ore Geology Reviews, Volume 146, July 2022, 104930

CLEAN AND GREEN?

Roasting spodumene to extract lithium requires temperatures above 800 degrees C, which in turn requires a high voltage electricity supply, which in turn, in Tibet, means a hydro dam athwart one of the many mountain rivers incising these rugged landscapes. This is substantial industrialisation; an extractive colonisation at high altitude, that may convert Tibet from a cost centre for China to a profit centre. Then the concentrate is trucked to a lower altitude, to a second industrial plant, closer to the edge of the Tibetan plateau, closer to industrial users, the makers of batteries. In the announced corporate plans of the rock lithium boom, these secondary processors are hundreds of kilometres from the mine, which incentivises a state keen to promote China’s global electric vehicles, to invest heavily in upgrading the highways, as well as financing the hydro dams and power grids. All of this heavy industrialisation is done in the name of clean, green renewable energy saving the planet.

There is a cheaper and quicker way to get rock lithium out of the earth and into a truck, for the roasting to be done somewhere more convenient, without requiring the expensive phase change roast˚ at 800˚C, then sulphuric acid, to achieve a concentrate that is economically worth transporting. The shortcut is grandly called Dense Media Separation, DMS, which at best takes ore of 1.3% lithium and produces a “concentrate” of 5 % or even 6%. Since lithium is the lightest of metals, all it takes to do DMS is to pulverise the extracted rock, add water and a thickener, and shake it all about. That suffices to sufficiently separate the lithium from all the rest to enable this ‘concentrate” to be taken out of the frontier and into a processing plant at a much lower altitude, which has access to power, labour, transport logistics and the lithium battery makers.

One day, if rock lithium does boom as investors expect, there may be investment in roasters and sulphuric acid cookers, as well as hydro dams to power them, but not yet. These are early days in the rock lithium boom, and everyone is in a hurry to get their hands on supply, heedless of the fossil fuel burning needed to get “concentrates” that are 94% waste, into a factory.

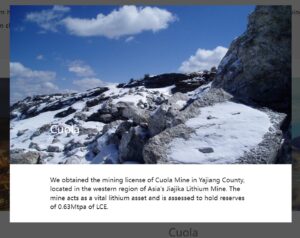

In 2023 only the oldest of the rock lithium mines in Tibet, Jiajika, can boast of actual tonnages extracted and then DMS concentrated. The 2023 Annual Report of Rongjie to its shareholders and Shenzhen Stock Exchange boasts that it is the second biggest rock lithium miner in the world and first in Asia. Yet its actual production stats suggest a rudimentary extractivism still rules, with minimal DMS concentration, that fails to achieve even the contracted 6% lithium content scheduled for sale to another Rongjie subsidiary. Actual ore extraction over the year was 319,400 tons, which was then concentrated down to 65,000 tons, then trucked out and sold as adding up to only 55,000 tons because DMS failed to achieve 6% as per contract. This means what was trucked to Rongjie’s “beneficiation” plant in Dartsedo [Kangding in Chinese] never achieved a concentration level better than 5%. So 65,000 tons of pulverised rock ends up producing 3250 tons of actual lithium, at the second biggest rock lithium mine in the world.

None of this seems to worry investors, who keep piling in. It does worry environmentalists. Transporting crushed rock long distances burns a lot of fossil fuels, to create a fossil-fuel free future for the planet. DMS requires water. Satellite camera remote sensing reveals rock lithium mines athwart rivers that feed into the Dri Chu/ Yangtze, a great river China proudly proclaims as fully protected by recent legislation covering the entire watershed. Once DMS has done its work, the water is returned to the river.

China’s geologists draw increasing attention to the presence of rare earths in many of the rock lithium deposits, seldom in concentrations sufficient to make extraction profitable, but interest in these rarest of critical minerals is growing. As long as DMS is the only ore treatment at the mine site, the rare earths are washed into the river, along with other toxic wastes.

In these early days of rock lithium boom, there is as yet not much to see at mine sites, even in a large area of many deposits such as Ke’eryin. The necessity of a river close by does show clearly in the satellite camera shots.

However the boom is arriving, all the faster if rare earths are extractable too. It was China’s refusal to sell rare earths to Japan, back in 2011, that triggered the deglobalising slide into the securitisation of critical mineral chains we now see unfolding, much to the alarm of globalists in the International Monetary Fund, who say de-risked parallel universes of critical minerals supply, East and West, will make lithium 30% more expensive. For us all.

Rare earths are a unique asset class, not because they are all that rare but because it is the military that has pioneered their uses, and found plenty.

Now rare earths occur in or near rock lithium deposits in Tibet.[1]

Nonetheless the race is on, capital is flooding in, one of the most troubled parts of Tibet is for sale to the highest bidder, nothing must get in the way of a reliable and sufficient commodity flow of lithium, the archetypal producer good on which China’s global rise and rise now depends.

Corporations based all over China are rushing to Tibet, including many with little or no past experience in lithium, batteries or even mining. Do they care that the extraction zone is in Tibet, in areas contested for many decades? Let the police take care of that.

Judging by corporate landing pages, stock exchange filings and wealth management PR announcements, Tibet is just a geography, the location of the deposits is incidental, all that matters it to get it out of the ground, trucked to a distant “beneficiator” and into the production line. What matters is cars in showrooms, leave the rest to the tech guys. Will the spodumene ore be roasted or microwaved? Only tech heads would care, and only a logistics manager needs to factor in the location, in Tibet.

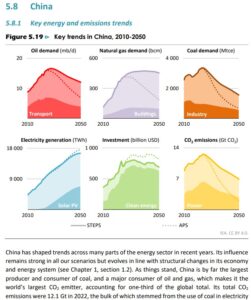

China faces the world, proclaiming itself a global leader of clean and green. In a world of petrostates running climate COPs, backsliding rich countries slow to match ringing rhetoric with actual decarbonisation, people worldwide look hopefully to China for real climate action. Yet China, despite its predation on Tibet in the name of a clean, green future, is also committed, openly and publicly, to increasing its carbon emissions each year to 2030, and is actively building many new coal-fired power stations. China’s top climate negotiator says “that a global fossil fuel phase-out is unrealistic, dampening hopes that such an aim could be agreed at the Cop28 climate talks.”

PRECARITY: THE RISKS OF DE-RISKING THE SUPPLY OF LITHIUM

As with any bubble, there are so many ways it could burst. Chinese scientists hunt the grail of salt lake extraction, which everyone calls DLE, direct lithium extraction. The goal is clear, but no solution yet exists.[2] If DLE eventuates, the rock lithium industry would struggle to compete, an entire industry could collapse, all the hydro dams, power grids, mines, ore roasters and long-haul highways would become stranded assets. The smart money with insider intel would have baled early, leaving local communities around the mines to cope with the toxic waste aftermath.

Unless investors get a high rate of return, and quickly, they may just move on. Much of the money pouring into lithium extraction in China was in bitcoin. What will be the next Big Thing? It is in the nature of mining bubbles that prices rise far higher than actual production, or projected production, can justify. Having peaked, expectations rise, FOMO kicks in, everyone piles in and the smart money picks the moment to bail out by shorting the stock, thus making a handsome speculative profit as the price crashes. Tibet is in the hands of gamblers.

One way the bubble might burst is US-led effort to decouple dependence on China for the supply of critical minerals may fizzle out, achieving little. By now it is simply too late to reverse a trend that has been gathering momentum for decades. It is too late to reopen all the metals smelters that closed around the world because Chinese smelters (often in Xinjiang) were bigger, newer, more efficient, cheaper to operate per ton of output, cheaper to buy from. It is too late to re-industrialise the formerly industrial manufacturing cities of the West, those rustbelts are beyond revival.

Dependence on China has become the new normal. Importing anything and everything manufactured from China has become the new normal. Economists have done the numbers on this. Over the 11 years between 2010 and 2021 most Indo-Pacific countries shifted away from Japan as the source of manufactured imports, and towards China. Indonesia shifted the most, its diversification of imports reduced by 83%. India and Vietnam reduced import diversification by more than 70%; Malaysia by more than 50%, Philippines and Australia by 40% or more.

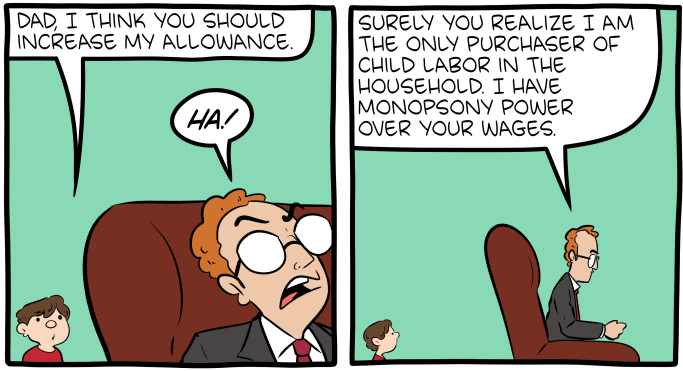

Those countries also export to China, but largely it’s raw materials, unprocessed or semi-processed; and China is often the sole buyer, able to dictate prices, what economists call a monopsony. If the US does spend billions, as planned and budgeted, on making America a great industrial giant again, and succeeds, then critical minerals suppliers will face an oligopsony, in which there are just a few big buyers, able to set prices. Just ask the world’s cocoa farmers: that it what they face.

CRITICAL CONFLICT MINERALS

Yet this bubble may have a long way before bursting. China is now the sole buyer of rock lithium mined in Western Australia and the Northern Territory of tropical Australia. Tesla threatens to sue to ensure it is head of the queue. Chinese miners are ramping up rock lithium extraction from Mali. Spodumene mining is ramping up in Brazil, Portugal and many other geographies. Lithium is one of the most plentiful of elements, not at all rare; it is only concentrations of lithium that are rare.

The International Energy Agency is sticking with its forecast of an almighty lithium boom. IEA also insists China’s dominance of global processing of raw critical minerals into industrially usable form is not likely to end soon: “Capacity to process these minerals into usable materials must also expand considerably. Currently anticipated projects point to large supply gaps for some critical materials unless new plans are announced soon, regardless of whether mining capacity is sufficient. The current announcements imply shortfalls of 60% for nickel sulphate and 35% for lithium, relative to what is needed in the NZE Scenario by 2030. Geographic diversification could reduce the risk of supply disruptions, but current expansion plans point to continued dominance by China.”[3]

Nor are the initial stages of rock lithium extraction difficult. What attracts the miners is outcroppings of lithium at the surface, perhaps followed by deeper open-pit extraction, no need for expensive tunnelling. Only then does it become apparent that the veins and lenses of crystallised lithium deep underground are elusively hard to locate, and much more expensive to extract.[4]

Nor are the initial stages of rock lithium extraction difficult. What attracts the miners is outcroppings of lithium at the surface, perhaps followed by deeper open-pit extraction, no need for expensive tunnelling. Only then does it become apparent that the veins and lenses of crystallised lithium deep underground are elusively hard to locate, and much more expensive to extract.[4]

At Australia’s newest rock lithium mine, near the town of Darwin in the tropical north, the extracted rock, all contractually bound for China, is naturally only 1.3% lithium. Much the same in Tibet. Shipping that thousands of kilometers to China would be crazy. So at the Finniss mine the ore is concentrated first. But how concentrated is a concentrate? The rock is pulverised, water is added, the slurry is stirred, and the lithium, lightest of the metals, separates somewhat from the powdered silica in which the lithium was embedded. This ‘concentrate’, now ready for shipping. According to the mining company it is now 5.4% lithium, hardly what anyone would rightly call a concentrate. But that is what is shipped off to China, burning fossil fuel all the way, to deliver tonnages of powdered rock that are 94% waste. Green energy ain’t so green.[5]

The transition from a fossil fuel carbon emitting world to clean and green in practice requires burning a lot of fossil fuels. Same goes for BYD’s extraction of lithium from the far west of upper Tibet, also thousands of kilometers from lithium battery factories, but overland, starting with 1000 kms by truck, then rail freight. The world pays a price for Chinas global dominance.

In Australia this extractivism is contested by environmentalists, and by First Nations indigenous landscape owners. In Tibet no such advocacy is possible. The securitisation that intensifies extraction from Tibet is the same securitisation that classifies any Tibetan voices of protest to be criminal. As in neighbouring Xinjiang, there is a strong case for recognising the extraction regime of critical minerals as conflict minerals, doubly debarred from G7 supply chains.

CCP RIDES THE BOOM

It takes years to build a mine, only seconds to bet on a stock price going up or down. For the traders, arbitrageurs, speculators, smart money folks, these different attention spans could result in supply outstripping demand, prices crash, the bubble bursts. This is the classic cycle of mining.

Is that really true within China? Will China, under tight control by the Communist Party, allow buccaneer capitalism free rein?

The CCP does worry about booms and crashes, and the instability they cause. It does denounce speculators. Yet China, at the highest level, plans to lead what it calls the Fourth Industrial Revolution, leading a decarbonising world that reinvents energy and the automobile. China also wants the landscapes of Tibet to become Chinese, to be stamped with Chinese characteristics, to no longer be beyond the frontier.

If it takes a sometimes wild ride in Tibet, to quell dissent, extract the raw materials of the Fourth Industrial Revolution, turn Tibet into an exporter of energy and the lithium that stores it, China is up for it. The stakes are high. Already China leads globally in making and selling the tech of solar and wind power, and is about to claim mastery of lithium power and the fast accelerating cars powered by it. Made in China 2025. These are big goals, nurtured over past decades by a developmentalist state willing to pour subsidies, big spends on supportive infrastructure, making it easier for electric car makers to succeed.[6] There are risks, but there is also a massive police, paramilitary and military presence throughout Tibet if protests occur.

China’s history of deploying its market dominance to punish and “rectify” trading partners that step out of line, brought this on. Too often, in too many market economies trading with China, China has withheld supply of critical minerals. That is what provoked the reaction, especially among the G7 (plus Korea and Australia) to pay a lot to derisk the supply chain from dependence on China, spending huge amounts in coming years to re-industrialise.

Newton’s Third Law posits as basic physics that there must be an “equal and opposite reaction” to force pushing in one direction. Could this be the reason China, in response to Western onshoring of critical mineral supply, is now hastily boosting its own domestic sourcing of lithium, from Tibet? That G7 reaction in turn has now triggered China’s reaction to the West’s reaction? China too is onshoring and de-risking its commodity chains, hence Tibet as the reliable, controllable domestic source of lithium, and much else, notably copper and electricity.

REACTIVE, REACTIONARY?

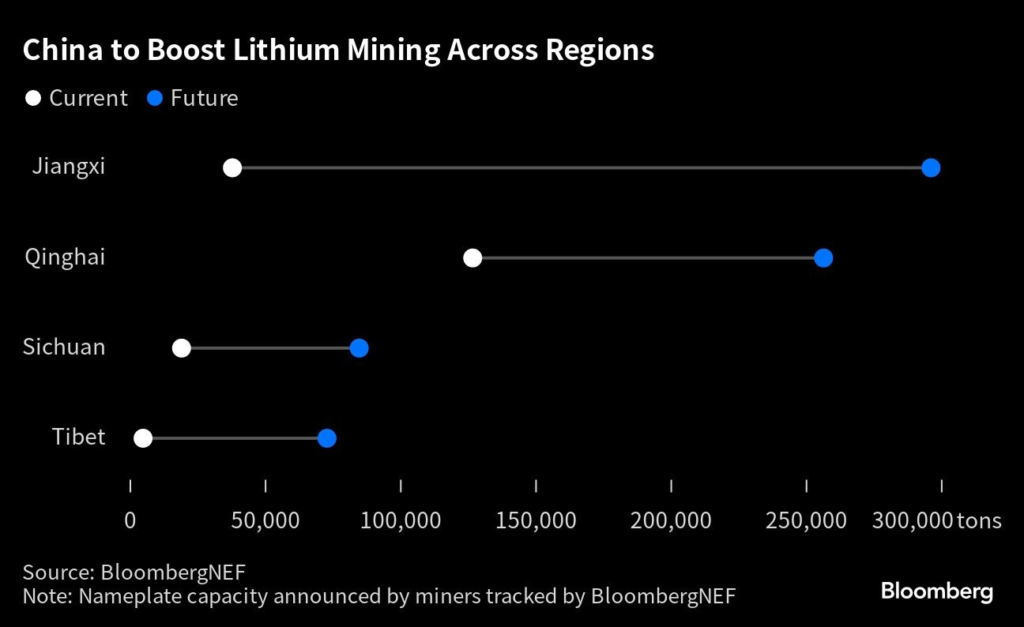

As the world’s biggest maker of electric cars and their lithium batteries, China dominates the processing of lithium to a level of purity that can be used in batteries that don’t dangerously overheat, due to even the smallest impurities. Not only does China dominate the processing of lithium, it has been energetically buying lithium deposits worldwide, or contracting to buy the semi-processed ores of those mines, to be shipped great distances to China. Yet China is also accelerating its extraction from Tibet, as never before.

Although China depicts itself as exemplary in following all the laws of physics, history, development, growth and more, China’s reaction to Western critical minerals de-risking may have nothing to do with Newton’s laws of physics, and more to do with Polanyi’s double movement law.

This double movement insists minerals belong to the local community, in contradiction to the legislative voice of the modern nation-state, which insists minerals belong to the state, and may be awarded to entrepreneurs, to extract. The contradiction between fungible, commodified deposits and social ownership is an ongoing dialectic, seldom fully resolved. The double movement continues to push, and push back. Tibetans who would push back have no way to do so. The riot squad is primed to quell dissent as soon as it manifests.

What Polanyi saw 70 years ago, as a repeating pattern in the history of capitalist markets, is that when a patrimonial endowment of a community is commodified, such as granting mining rights to a mining company, the initial accumulation of profit is followed by the double movement of community pushback, in an attempt to restore the embeddedness of the mineral endowment in society.

China is familiar with dialectics; its ruling party thrives on resolving them. But on the ground, around the world, China’s access to the lithium it wants, to maintain its near-monopoly in lithium battery manufacturing, and electric car making, is confronted by much double movement pushback.[7]

In Peru, China’s miners are thwarted by local indigenous communities insisting mineral deposits belong to the people. In Chile and Indonesia, China’s extraction of battery minerals is complicated by governments keen to do more of the processing and battery manufacture onshore. Even in Congo, despite venal leaders, the state wants to onshore the processing of lithium. As the world reverts to blocs, resource nationalism is on the rise, and China is no exception. In response to all these problems of a globalised commodity chain centred on China, the world’s factory is now, as never before, reaching to grasp the minerals of its backyard, in Tibet.

[1] Qinggao Yan et al., Source of the Zhawulong granitic pegmatite-type lithium deposit in the Songpan-Ganzê orogenic belt,Western Sichuan, China: Constrants from Sr-Nd-Hf isotopes and petrochemistry, Lithos 378–379 (2020) 105828

Fei, Guangchun et al., Petrogenesis of aplites in the Ke’eryin rare metal orefield in the Songpan-Garze Fold Belt, Eastern Tibet: Evidence from mineralogy, geochemistry, geochronology and Hf-Nd isotopes, LITHOS, Volume 438, article id. 107017. February 2023

Li, Xin et al., Geochronological and geochemical constraints on magmatic evolution and mineralization of the northeast Ke’eryin pluton and the newly discovered Jiada pegmatite-type lithium deposit, Western China, Ore Geology Reviews, Volume 150,2022, article id. 105164.

Wei Zhang; et al., The C-H-O Isotopic Composition and Significance of Spodumene for Redamen Pegmatite Type Rare Metal Deposit in Western Sichuan, Kuangchan zonghe liyong,[Multipurpose utilisation of Mineral Resources journal] 2023, Vol 44, Iss 1, Pp 45-54

LI Xingjie et al., Geochemical Features of Muscovite Granite in the Zhawulong Granitic Pegmatite Type Rare Metal Deposit,Western Sichuan, Geological Review. 2018(04) Page:1005-1016

Zhou Zheng,et al., Experimental Study on the Recovery of Rare Earth from a Low Grade Rare Earth Tailings in Sichuan, Multipurpose Utilisation of Mineral Resources journal, 2023, #8

[2] María L. Vera, Walter R. Torres, Claudia I. Galli, Alexandre Chagnes & Victoria Flexer, Environmental impact of direct lithium extraction from brines, Nature Reviews Earth & Environment | Volume 4 | March 2023 | 149–165

[3] International Energy Agency, Energy Technology Perspective 2023

[4] Tao Huang, et al., The genesis of giant lithium pegmatite veins in Jiajika, Sichuan, China: Insights from geophysical, geochemical as well as structural geology approach, Ore Geology Reviews, 124 (2020) 103557, an open access journal.

[5] https://www.youtube.com/watch?v=ZXA2ae46nWY&t=66s Finniss River 31’ – 37’, Four Corners May 2022

[6] Notice on Adjustment and Improvement of Fiscal Subsidy Policies for Promotion and Application of New Energy Vehicles, 2018.Ministry of Finance of China. https://www.miit.gov.cn/zwgk/zcwj/wjfb/zbgy/art/2020/art_2d4ca29e16bc4fe08c5637641948cc38.html

[7] Oliver Hailes, Lithium in International Law: Trade, Investment, and the Pursuit of Supply Chain Justice, Journal of International Economic Law, 2022, 25, 148–170